This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was (18 – 24 October)

October 25, 2021

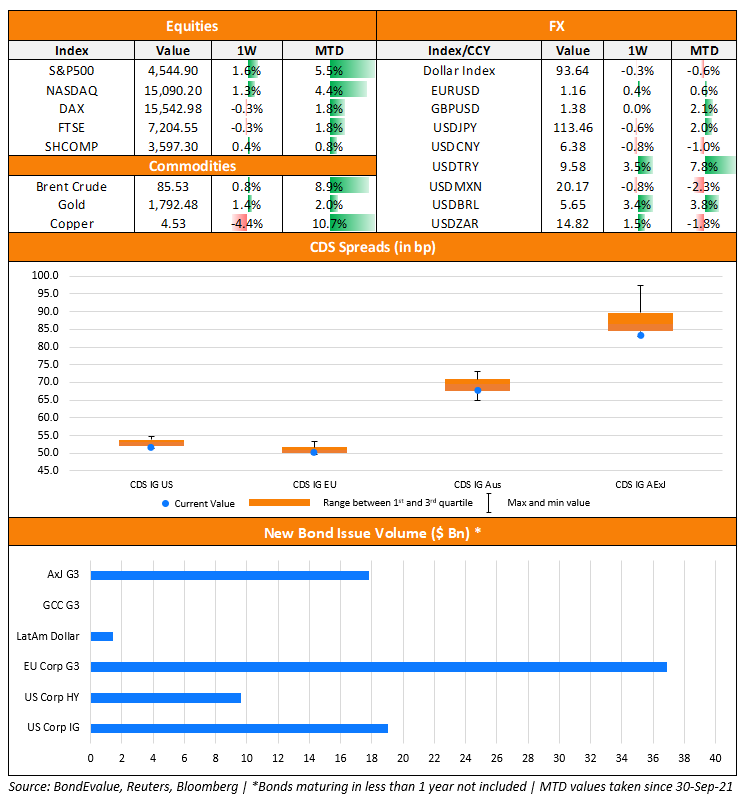

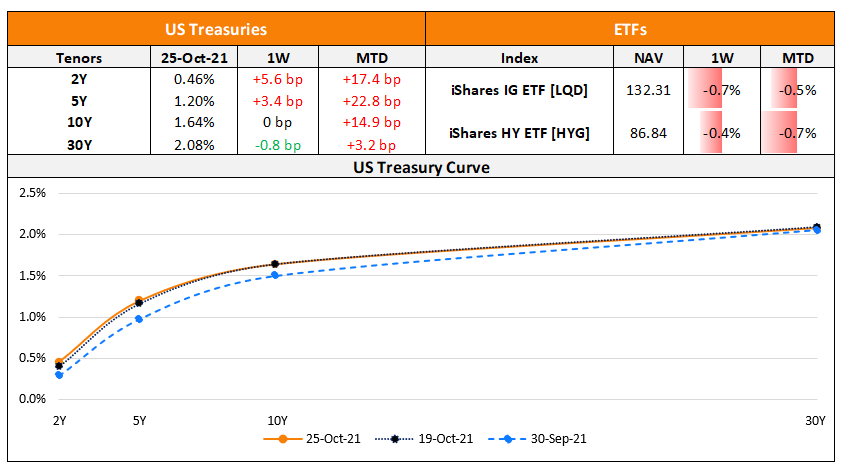

The US 2s10s yield curve flattened ~6bp last week with the rising inflation theme picking up as the short-end of the curve saw yields pick-up. US primary markets saw an decrease in issuances to $28.2bn vs. $18.3bn in the prior week. IG issuances rose almost 2x to $20bn vs. $10.9bn in the prior week while HY issuances rose marginally to $7.7bn vs. $7bn in the prior week. The largest deals in IG space were led by big banks with Goldman Sachs’ $9bn five-trancher, US Bancorp’s $1.5bn deal and BofA and Morgan Stanley’s $1.3bn deals. In the HY space, Carnival Corp raised $2bn followed by Lamb Weston Holdings’ $1.67bn dual-trancher leading the table. In North America, there were a total of 23 upgrades and 5 downgrades combined across the three major rating agencies last week. LatAm saw $1.4bn in issuances vs. $3.5bn in the week prior with Corp Nacionale del Cobre de Chile raising $780mn and Banco Santander Chile raising $500mn respectively. In South America, there were 3 upgrades and 8 downgrades each combined across the major rating agencies. EU Corporate G3 issuances saw a sharp rise to $36.9bn vs. $25.2bn in the week prior with AerCap alone issuing $21bn of bonds via a nine-part deal to help fund its acquisition of GE Capital Aviation Services. AerCap’s issuance was the second biggest issue of the year, after Verizon’s $25bn offering in March. Across the European region, there were 17 upgrades and 5 downgrades across the three major rating agencies. The GCC G3 saw no issuances for a second consecutive week. Across the Middle East/Africa region, there were no upgrades and 5 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances saw a sharp increase to $19bn vs. $6.2bn in the week before. The largest deals were led by TSMC’s $4.5bn and Chinese Sovereign’s $4bn four-tranchers respectively, followed by ICBC’s $3.23 multi-currency carbon neutrality themed bond deal and Korea Development Bank’s $1.2b dual-trancher. In the Asia ex-Japan region, there were 5 upgrades and 11 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

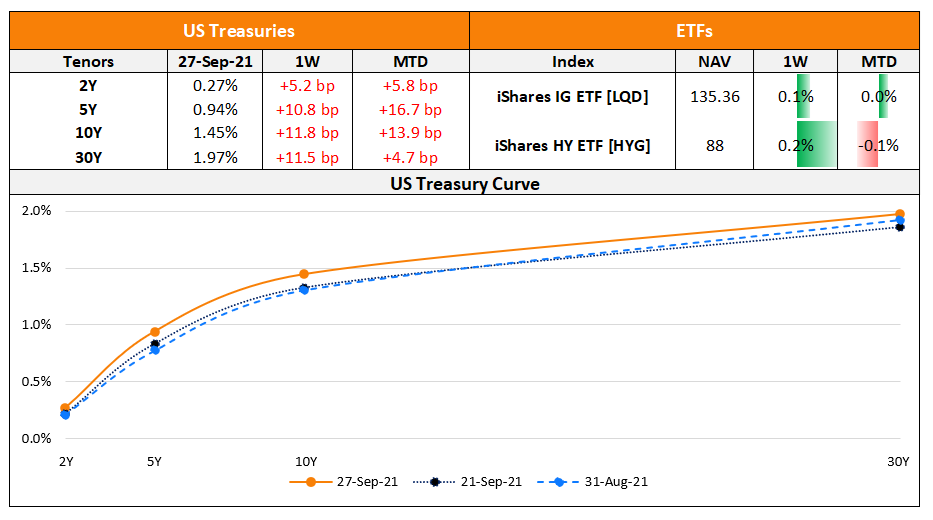

The Week That Was (20th – 26th Sep 2021)

September 27, 2021

The Week That Was (Oct 4th – 11th)

October 11, 2021