This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was (April 4 – 10, 2022)

US primary market issuances fell to $17.7bn vs. $25bn in the week prior. Investment grade (IG) corporates took the chunk of issuances, with $13.6bn of deals while high yield (HY) issuance stood at $3.9bn. The largest IG deals were led by Take Two’s $2.7bn four-trancher and GM’s $2.5bn three-trancher. In the HY space, Hillcorp’s Energy $1.5bn three-trancher and Earthsone’s $550mn deals. In North America, there were a total of 30 upgrades and 12 downgrades combined across the three major rating agencies last week. LatAm saw $1.1bn in issuances last week with Fondo Mivivienda and Consorcio Transmantaro’s $600mn and $500mn deals, as compared to $1bn in the prior week. In South America, there was 2 upgrades and 3 downgrades across the major rating agencies. EU Corporate G3 issuances stood at $16.3bn vs. $31.4bn in the week prior, led by Credit Suisse’s $2.5bn dual-trancher and Diageo Capital’s €1.55bn two-trancher. Across the European region, there were 9 upgrades and 26 downgrades across the three major rating agencies. The GCC G3 region saw nil issuance vs. $1.3bn in issuances in the week before. Across the Middle East/Africa region, there were 2 upgrades and 9 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances stood at $7.5bn vs. $7.9bn in the week before. This was led by Freeport Indonesia’s $3bn three-trancher and Fortescue Metals Group’s $1.5bn two-part issuance. In the APAC region, there was 1 upgrades and 7 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

The Week That Was (Oct 4th – 11th)

October 11, 2021

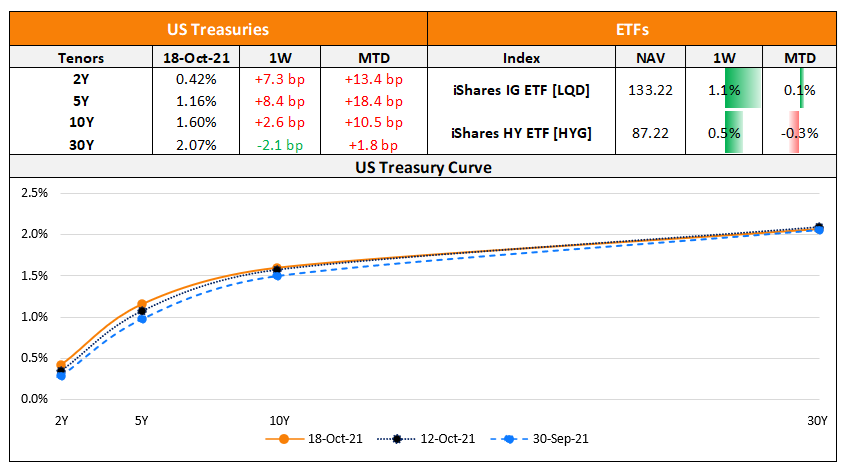

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

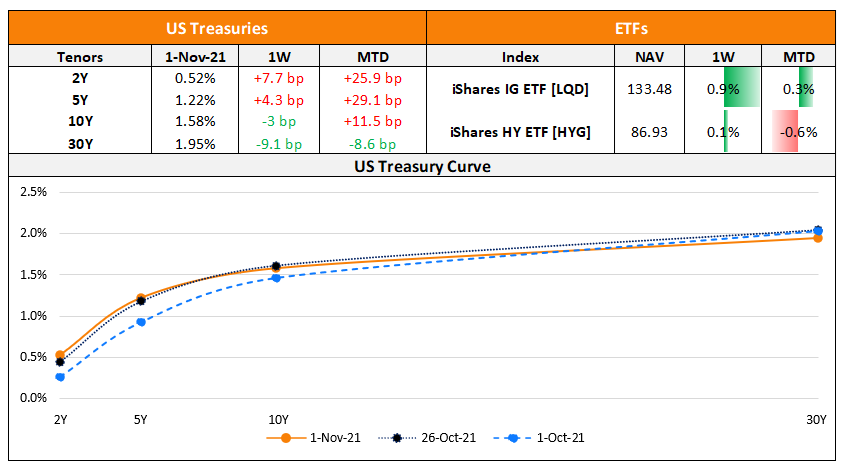

The Week That Was (25 – 31 Oct)

November 1, 2021