This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Turkey Cuts Interest Rates by 100bp to 13% Despite 80% Inflation

August 19, 2022

Turkey cut its benchmark interest rate by 100bp to 13% yesterday, despite annual inflation at levels of near 80%. Most analysts expected a status-quo at the rate-setting meeting and thus were taken by surprise. The Turkish central bank said that it expects the “disinflation process to start” and that there were signals of a “loss of momentum in economic activity.” While yesterday’s move was unexpected, it is broadly in line with Turkish President Erdogan’s preference for lower rates and thus underscores his clout on the central bank. Erdogan has been adopting this unorthodox strategy for a while now, commenting a few months ago, “Those who try to impose on us a link between the benchmark rate and inflation are either illiterates or traitors”.

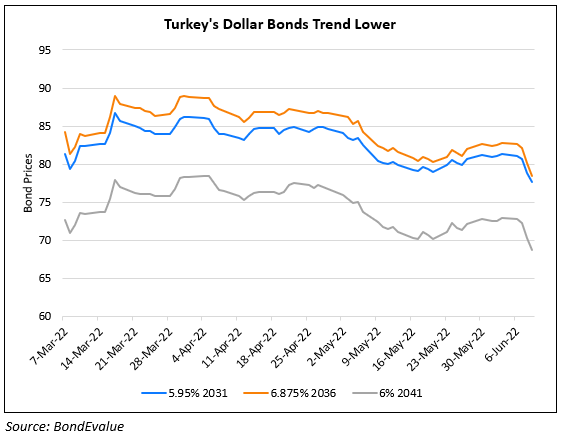

Turkey’s dollar bonds were trading weaker – its 7.25% 2038s were down 1.7 points to 80.32, yielding 9.73%.

Go back to Latest bond Market News

Related Posts: