This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Turkey’s FX Reserves Increase; Current Account Deficit Widens

August 12, 2022

Turkey’s FX reserves rose by $7.4bn in the week ended 5 August, the highest jump YTD, to $109bn following money transfers from Russia for the construction of a nuclear power plant. Russia’s Rosatom Corp was in the process of transferring $15bn to its Turkish subsidiary for building the $20bn Akkuyu nuclear plant on the Mediterranean coast, making it the likely source of the FX surge. The Turkish central bank is also trying to shore up reserves as the foreign-trade deficit widens on the rising cost of energy imports. The central bank needs to keep supporting the lira amid inflation reaching 80%.

Turkey’s current account deficit expanded to 191% in June on higher energy imports, which is a result of the the Russia-Ukraine war. The deficit was $3.46bn, in-line with estimates of $3.4bn. Turkish President Recep Tayyip Erdogan expects energy imports to touch $100bn by the end of 2022, around four times higher than in 2021. The trade deficit of goods rose to $6.43bn from $1.63bn last year.

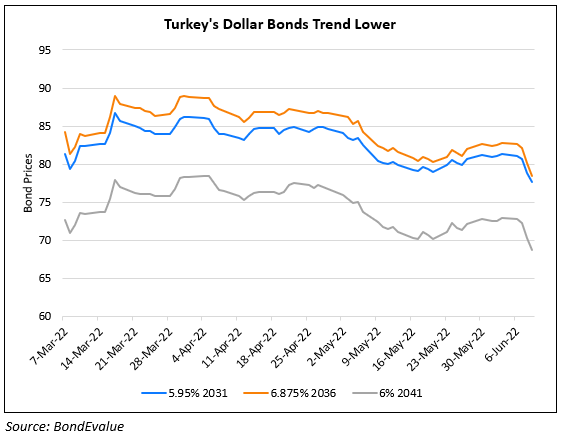

Turkey’s 3.25% 2023 traded higher 0.13 points to 99.18to yield 4.65%.

Go back to Latest bond Market News

Related Posts: