This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Tus-Holdings Scraps Consent Solicitation for Dollar Bonds

September 14, 2022

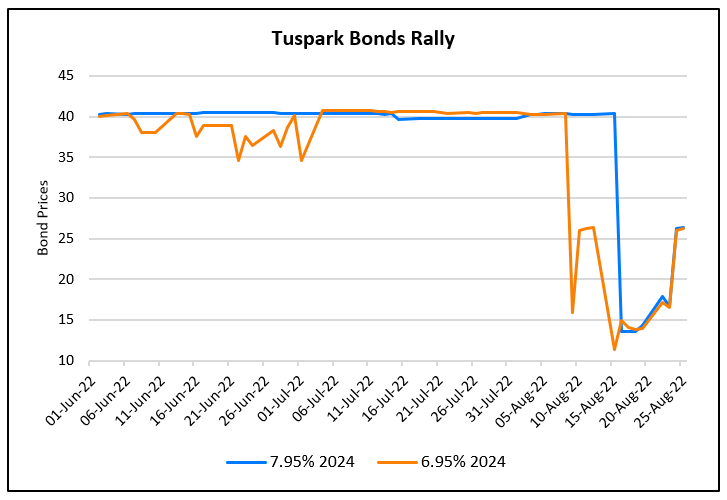

Tus Holdings has scrapped the consent solicitation (Term of the Day, explained below) that it launched in August for two of its dollar bonds on which it missed payments. The two bonds in question are its $308mn 7.95% 2024s and $522.5mn 6.95% 2024s guaranteed by Tus-Holdings. The company said that there were misunderstandings and misinterpretations in the market due to which it had to scrap the consent solicitation. It further added that the consent solicitation was finalized at the very last moment before being announced on August 24.

The consent solicitation had proposed to extend the bonds’ mandatory redemption dates by 10 months and the maturity date by 13 months. The company was initially required to redeem at least 35% of the principal amount on 13 August 2022 and another 30% on 13 August 2023, with the maturity date on 13 May 2024. Tuspark was seeking to postpone the redemption dates to 13 June 2023, and 13 June 2024, and to extend the maturity date to 13 June 2025. The proposal had already received some opposition by bondholders in late August who deemed it unacceptable and hired Withers as their legal adviser.

Tus’ 7.95% 2024s and 6.95% 2024s were trading at 22.6 and 19.23 cents on the dollar respectively. The bonds have dropped 26-27 levels seen immediately after launching its consent solicitation.

Go back to Latest bond Market News

Related Posts:

Tus-Holdings’ Bondholders Approve Debt Extension Plan

August 17, 2021

Tuspark Bondholder Group to Reject Bond Extension Proposal

August 26, 2022