This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

UniCredit and Lloyds to Repay AT1 Bonds

May 2, 2023

UniCredit and Lloyds Group said that they will repay their AT1 notes that are callable in June. UniCredit said that it would redeem its €1.25bn 6.625% Perp in June after receiving supervisory approval, adding that it would not need to issue similar debt for refinancing. In March, UniCredit had applied to the ECB to be able to repay the note at its first call date on June 3. UniCredit is among the better capitalized banks with a CET1 ratio of 15.03% as of end-2023. Its 6.625% Perp is trading at 100.2, yielding 3.9% to call.

Lloyds Group will also call back its GBP 7.625% Perp that has an amount outstanding of only £135mn from its original £1.5bn issuance size. The bonds are callable on June 27 and the announcement followed UniCredit’s decision to call back its AT1. Its GBP 7.625% Perp is trading at 99.96, yielding 7.93% to call.

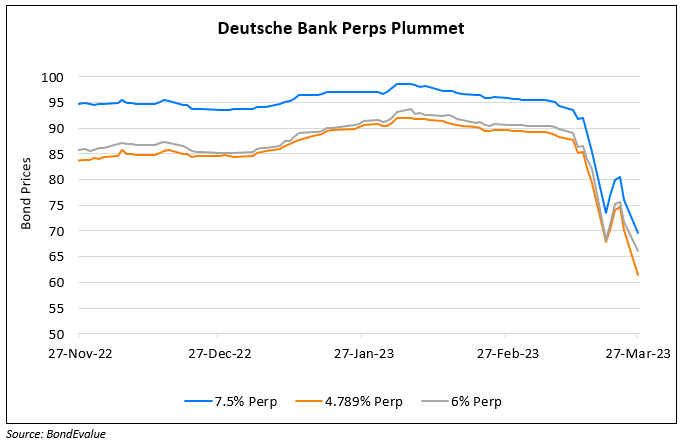

The above news from both banks come in the wake of the events at Credit Suisse in March, helping reinstill confidence in AT1 bonds. Joost Beaumont, head of bank research at ABN AMRO says the news is “definitely a positive, showing that the damage to the AT1 market can remain limited”.

Go back to Latest bond Market News

Related Posts: