This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

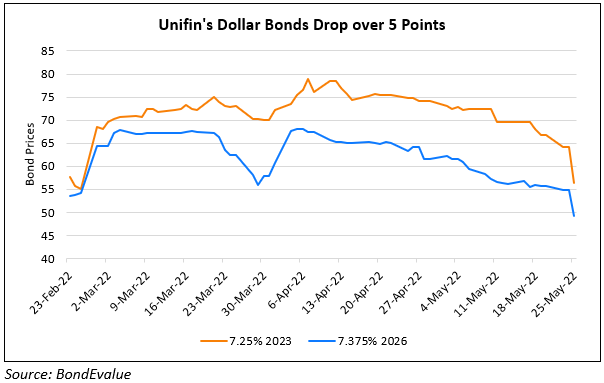

Unifin’s Dollar Bonds Drop 5-8 Points on Liquidity Concerns

May 25, 2022

Dollar bonds of Unifin Financiera fell 5-8 points on reports that the company is yet to follow up on plans to boost its liquidity. Investment bank Stifel’s analyst, Alexis Panton noted that “the clock is ticking” for Unifin to deliver good news, adding that the “excitement over the prospect for several positive announcements seemingly fading fast”. Panton said that Unifin has not yet confirmed the extension of its bond maturing in 2022 to 2024. Neither has it provided details on a local debt issue which would be partially backed by the Mexican government nor has it followed-up on talks to sell an oil rig. He further said that the time constraint comes close on the heels of rating agencies S&P and Fitch readying to resolve negative credit watches over the coming weeks.

Go back to Latest bond Market News

Related Posts: