This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

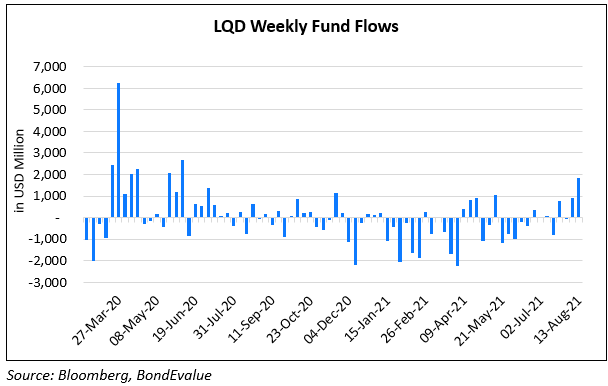

US IG ETF posts Biggest Weekly Inflow Since June 2020 as Earnings Strengthen

August 17, 2021

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) received over $1.8bn in inflows last week, adding to the $43bn AUM of LQD, the biggest IG bond ETF. This marks the largest weekly inflow since 2Q2020, and comes after ~85% of S&P 500 companies beat earnings expectations and Treasury yields reported a fall. Academy Securities Inc.’s Peter Tchir said that LQD is also expected to benefit from the slowing investment-grade issuance over the next four weeks. The start of the previous week saw around 38 high-grade deals priced in about 72 hours, however, the flood of supply has slowed significantly since then.

LQD remains down 2% YTD after rising 8% in 2020. The ETF gained 0.3% last week and was up 0.4% on Monday. Treasury yields fell below 1.2% earlier this month on concerns over the delta variant and a sharp fall in the consumer sentiment indicator. Richard Bernstein Advisors’ Dan Suzuki said, “Corporations are sitting on loads of cash, profits are surging and access to additional liquidity is wide open…Investors should keep in mind that buying broad IG credit right now is 80-90% a rate story, and only 10-20% a credit story. As a result, that positive credit story is likely to be overwhelmed by what happens with rates.”

For the full story, click here

Go back to Latest bond Market News

Related Posts:

StanChart’s Profits Up 2x to $1bn

April 30, 2021