This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

US Treasuries Sell off Post NFP Data; Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

April 10, 2023

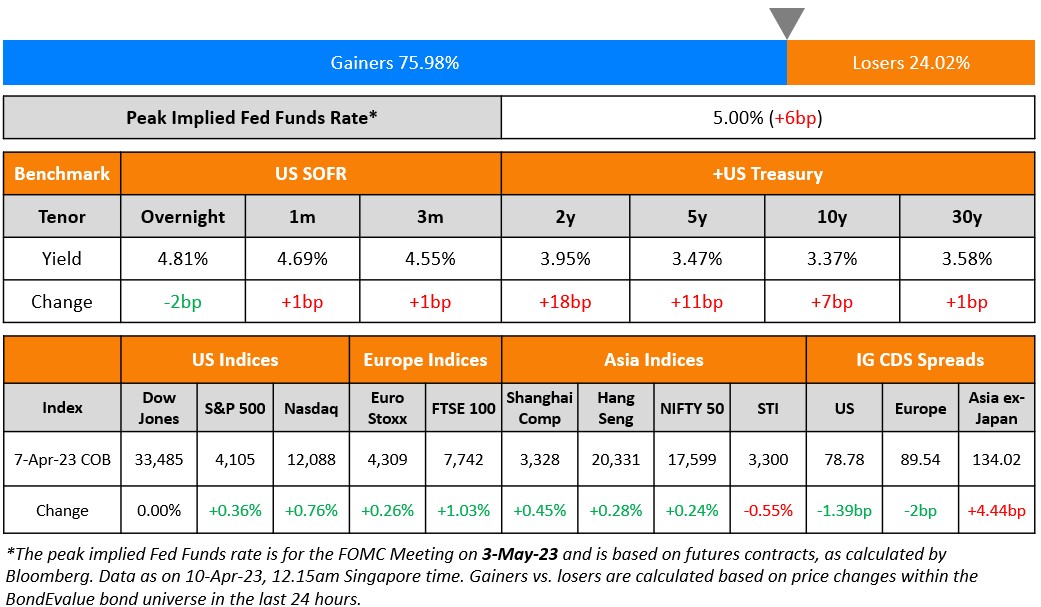

US Treasuries saw a sharp sell-off after the solid jobs report on Friday with front-end yields leading the move. The 2Y US Treasury yield surged 18bp higher while the 10Y benchmark climbed 7bp. US Non-Farm Payrolls came at 236k for March, higher than the surveyed 230k and lower than last month’s revised 326k print. Unemployment was at 3.5%, lower than the surveyed 3.6%. Average Hourly Earnings YoY was at 4.2%, lower than the surveyed 4.7% and last month’s 4.6% print, and the slowest since June 2021. CME maximum probabilities now show a 68% chance of a 25bp rate hike at the May 2023 FOMC meeting as compared to a 53% chance prior to the NFP print. The Peak Fed Funds Rate (Term of the Day, explained below) thus jumped 6bp higher to 5% for the May meeting. US IG and HY CDS spreads widened 2.1bp and 9.6bp respectively. US equity indices inched higher as the S&P and Nasdaq were up 0.4% and 0.8% respectively.

European equity markets ended broadly higher. European main CDS spreads widened by 2.7bp and Crossover spreads were 13bp wider. Asia ex-Japan CDS spreads widened by 0.5bp. Asian equity markets have opened slightly higher this morning.

New Bond Issues

Bahrain raised $2bn via a two-trancher deal. It raised $1bn via a Long 7Y bond at a yield of 6.25%, a massive 62.5bp inside initial guidance of 6.875% area. It also raised $1bn via a 12Y bond at a yield of 7.75%, 25bp inside initial guidance of 8% area. The bonds are rated of B+/B+.

New Bonds Pipeline

- Kookmin Bank hires for $ 3Y and/or 5Y bond

Rating Changes

- Moody’s upgrades T-Mobile’s sr. unsecured ratings to Baa2; outlook stable

- Kohl’s Corp. Downgraded To ‘BB’ From ‘BB+’ On Weak Fourth Quarter And Execution Risks; Outlook Negative

- Fitch Revises Ooredo’s Outlook to Positive; Affirms at ‘A-‘

Term of the Day

Peak Fed Funds Rate

Peak Fed Funds Rate refers to the highest Fed Funds rate as seen across all the upcoming Federal Reserve’s FOMC meeting dates. This rate is a calculation that is based on the Fed Funds futures contracts. The peak rate helps market participants calculate how many rate hikes are being priced-in by the markets as compared to the effective fed funds rate (EFFR). The EFFR is published daily by the NY Federal Reserve and gives an idea of the cost of borrowing federal funds by banks on an overnight basis. This rate is effectively within the Fed Funds target range, which the FOMC sets on every meeting date.

Talking Heads

“We’ve got a long ways to go and I think inflation is going to be sticky going forward, it’s going to be difficult to get inflation back down to the 2% target … so we are going to have to stay at it in order to apply pressure to make sure inflation gets back down… It just seems like a very tight labor market … and I think even if someone gets disrupted or there was somebody who was laying off workers or whatever, it seems like they can go get another job relatively easily in this environment.”

On Bond Market Overplaying the Risk of a Deep Recession

Bob Elliott, CIO of Unlimited Funds

“Each day that there isn’t a banking crisis is another day indicating that the current pricing doesn’t make sense, but it’s going to take a while”

George Pearkes, Bespoke Investment Group

“The Treasury market isn’t trading every moment in pure fear mode, but that doesn’t mean that what’s currently in the price is some sort of prescient, ‘This is how to think about it’ signal”

Dominique Dwor-Frecaut, a senior market strategist at Macro Hive

“The bond market has gone berserk. For once, I’m on the side of equity markets. I don’t see a recession coming”

On Fed Traders Eyeing CPI After Jobs Data Boost Odds of a May Hike

Kevin Flanagan, head of fixed income strategy at Wisdom Tree Investments

“Is the final arbiter as we approach the May Fed meeting, and a consensus or stronger CPI read will challenge the Treasury market… The Treasury market is telling you what direction they would like to go in, and that’s lower yields, but it looks vulnerable to any type of economic numbers that don’t tell us recession is imminent”

Priya Misra, global head of rates strategy at TD Securities

“Across the board strength” in the US jobs report “will boost the chances of a 25-basis-point hike in May. It should push out the timing of cuts as well. But the market will remain focused on other, less lagging, data and bank earnings”

On Dollar firming as US jobs report backs Fed rate hike in May

Karl Schamotta, chief market strategist at Corpay

“Federal Reserve officials are likely to continue delivering their higher-for-longer message in the run-up to the May policy meeting, supporting expectations for a final rate hike and putting a floor under the dollar… recent data would suggest that the economic risk backdrop is turning more negative “

Charlie Ripley, senior investment strategist, at Allianz Investment

“(This) should be an encouraging sign to the Fed some effects of monetary policy are starting to take hold”

Top Gainers & Losers – 10-April-23*

Go back to Latest bond Market News

Related Posts: