This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

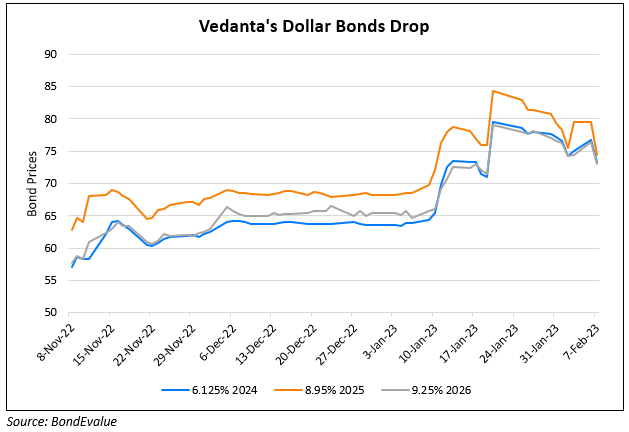

Vedanta’s Dollar Bonds Drop After Zinc Assets Sale to Hindustan Zinc Opposed by Government

February 7, 2023

Vedanta’s dollar bonds have fallen by over 4-6%, reversing the rally late last month where Vedanta Ltd was to sell overseas zinc assets for over $3bn to Hindustan Zinc. The drop in bonds occurred after the government’s nominees on the board of Hindustan Zinc strongly opposed the plan. The government has a 29.5% stake in Hindustan Zinc and the directors said that they were not convinced with the valuation. Had the deal been approved, Vedanta Limited would have received an immediate cash consideration of $2.4bn for the sale of THL Zinc Ltd., Mauritius, with the remaining ~$580mn being paid later.

An official said, “How can the deal go through without government approvals? All three of our directors have opposed it and we will also oppose it at the shareholders’ level as well”. Regarding whether the government will be considered a minority shareholder, Arun Misra, Hindustan Zinc’s CEO said, “As of now, we have only got the Board approval and we will go for shareholder’s approval and we will see it at that point of time. As of now, we are not making any opinion on such things, which are subject to legal opinion.”

Go back to Latest bond Market News

Related Posts: