This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

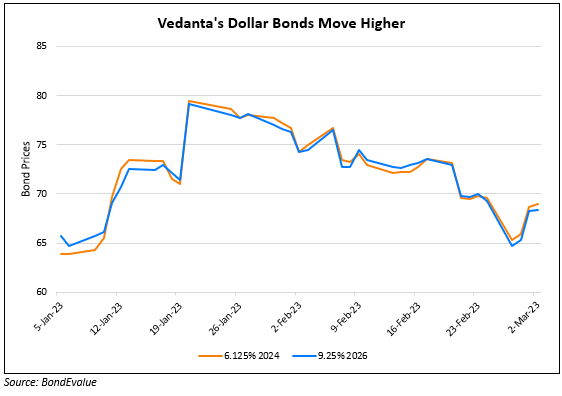

Vedanta’s Dollar Bonds Jump Over 2 Points After Details on Debt Repayment Plans

March 2, 2023

Vedanta’s dollar bonds were up over 2 points across the curve after it provided some details on its debt repayment plans. The metals and mining conglomerate said that it was in advance stages of securing a $1bn syndicated loan, apart from “almost finalizing” $750mn of bilateral facilities with various relationship banks, as per IFR. Further the company added that it was fully confident of meeting its bond maturities in the upcoming quarter. It has $900mn in dollar bonds due in April and May as part of its overall maturities of $2.05bn during the quarter. In early February, IFR reported that Vedanta was in advanced talks to raise at least $1.2bn from Oaktree Capital and banks combined. The latest update provided some relief after concerns had emerged on blocking its zinc asset sale to Hindustan Zinc due to opposition by government representatives on the latter’s board, which had pushed its dollar bonds lower over the past few weeks.

Go back to Latest bond Market News

Related Posts: