This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

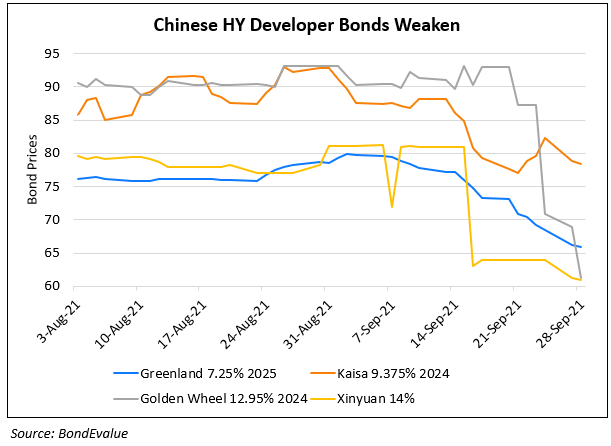

Xinyuan Real Estate Calls for Exchange Offer

October 6, 2021

Xinyuan Real Estate said it will hold calls to update bondholders on an exchange offer and consent solicitation regarding its outstanding $229mn 14.2% bonds due October 15 2021. There are two options under the exchange offer:

- Option 1: Bondholders would receive $60 in cash and $950 in principal of new USD 14.2% 2023s plus accrued and unpaid interest for each $1,000 in principal of the 14.2% 2021s.

- Option 2: Bondholders would receive $10 in cash and $1,000 in principal of the new USD 14.2% 2023s plus accrued and unpaid interest for each $1,000 in principal of the 14.2% 2021s

The deadline is October 12 and settlement will be on October 15. IFR notes that bondholders that are validly accepted for the exchange will be deemed to waive any and all actual or potential defaults or events of default under the 2021s. Early last month, Xinyuan was downgraded by Fitch to CCC from B–, citing heightened refinancing risk on the 2021s.

Xinyuan’s 14.2% bonds due October 15, 2021s saw a massive drop of 11.2 points to 78.8.

Go back to Latest bond Market News

Related Posts: