This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

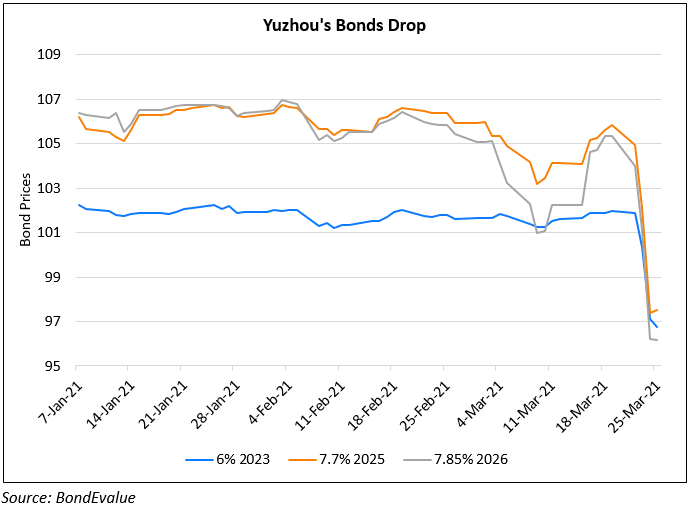

Yuzhou’s Dollar Bonds Trend Higher On Continued Buybacks

July 15, 2021

Yuzhou Group’s dollar bonds have been trending higher since the firm started buying back its dollar bonds a week earlier. Yuzhou’s bonds had been moving lower since the beginning of June with concerns on Evergrande spilling over to peers. Prior to that in March, Yuzhou warned of weaker earnings that led to a Moody’s downgrade to B1 from Ba3. A week later it reported a 97% drop in 2020 net profits and a subsequent downgrade by Fitch to B+. At the time, BOC International said Yuzhou’s poor result should be a “one-off earnings shock” and that prices reflected all the near-term negatives.

On July 8, Yuzhou bought back $1mn of its 8.3% 2025s in the open market, its third repurchase this year, with the company saying the repurchases are an attempt to “send a positive signal to the market and investors”. A day later the developer again repurchased another $1mn of its 8.3% 2025s. Prior to that, Yuzhou on March 31 bought back a total of $16mn of four of its dollar bonds in the open market – the 8.3% 2025s, 7.375% 2026s, 7.85% 2026s and 6.35% 2027s. Separately, Bloomberg also reported that Yuzhou received CNY 4bn ($619mn) in credit lines from local banks.

Go back to Latest bond Market News

Related Posts: