This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Zhenro Properties’ Bonds and Shares Collapse on Uncertainty Over Perp’s Redemption

February 14, 2022

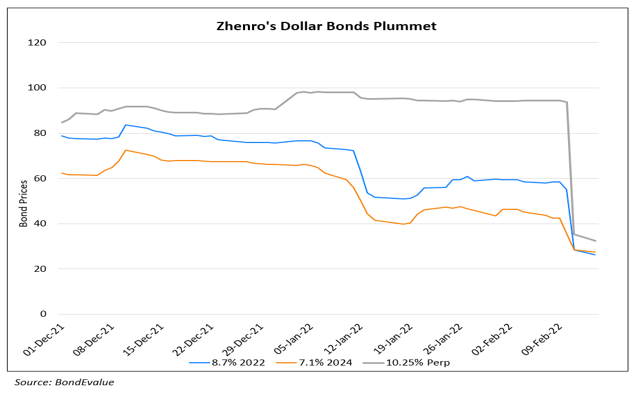

Dollar bonds of Zhenro Properties crashed on speculation that the developer will not redeem its $200mn 10.25% Perp which has a call option exercisable on March 5, 2022 in a bid to maintain sufficient liquidity. Sources told the Post that Zhenro was debating whether it was necessary to buy back all of the Perps at once, as it has other debts due in 2022 and since other developers were extending their bond repayment schedule. Zhenro’s sales in January were down 30% YoY to RMB 7.9bn ($1.2bn). As per SCMP’s sources, Zhenro told investors late on Thursday that its plan to call the bond remain unchanged. Despite the reassurance by the company, its bonds and shares plummeted.

The Perp collapsed by 58.5 points to trade at 34 cents on the dollar. Its shares dropped almost 81% before recovering a bit. Last month in an exchange filing, Zhenro said it would redeem the note in full. Its 2022s were down 22-28 points and those bonds maturing beyond 2022 were down over 13 points.

Go back to Latest bond Market News

Related Posts:

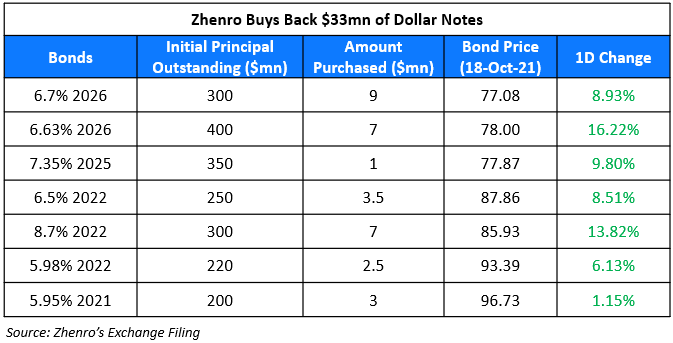

Zhenro’s Dollar Bonds Jump after $33mn Buyback

October 20, 2021

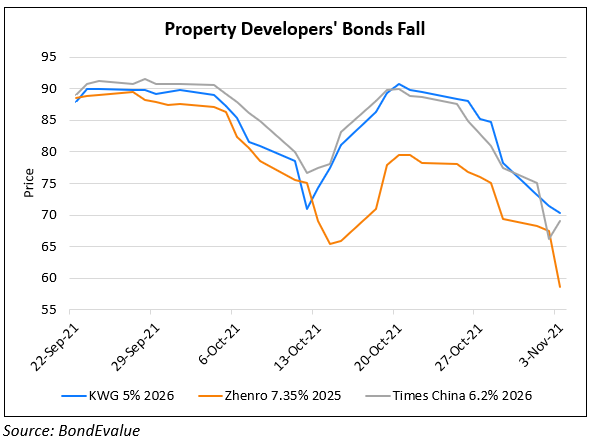

Times China, Zhenro, KWG Dollar Bonds Drop Sharply

November 3, 2021

Zhenro’s Dollar Bonds Rise as January Bond Will Be Redeemed Early

December 13, 2021