This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

10 New Deals Including Abu Dhabi, Westpac, OUE; Macro; New Issues; Rating Changes; Talking Heads; Top Gainers & Losers

May 25, 2021

US markets ended higher with the S&P up 1% while the tech heavy Nasdaq up by 1.4%. Tesla closed higher by 4.4%, Microsoft was up 2.3%, while Apple and Amazon were up 1.3%. US 10Y Treasury yields dipped slightly to end at 1.61%. European Indices also closed higher by ~0.4% – FTSE was up 0.5%, while DAX and CAC closed higher by 0.4%. US IG CDS spreads were 1.1bp tighter and HY spreads were 3.2bp tighter. EU main spreads were 0.8bp tighter and crossover spreads were 4.7bp tighter. Asian equities have followed the track of the US equities with initial gains of ~1%. Asia ex-Japan CDS spreads tightened 1.9bp. Asian primary markets are busy ahead of the Vesak day holiday in Singapore on Wednesday.

Do you invest or plan to invest in CoCo/AT1 bonds?

If yes, do attend the upcoming masterclass conducted by debt capital market professionals Pramod Shenoi, Head of Research APAC at CreditSights and Rahul Banerjee, Founder and CEO at BondEvalue. The session will cover understanding the AT1 structure, common features & covenants, and how to pick the right AT1 bond(s) for you. Click on the banner below to register.

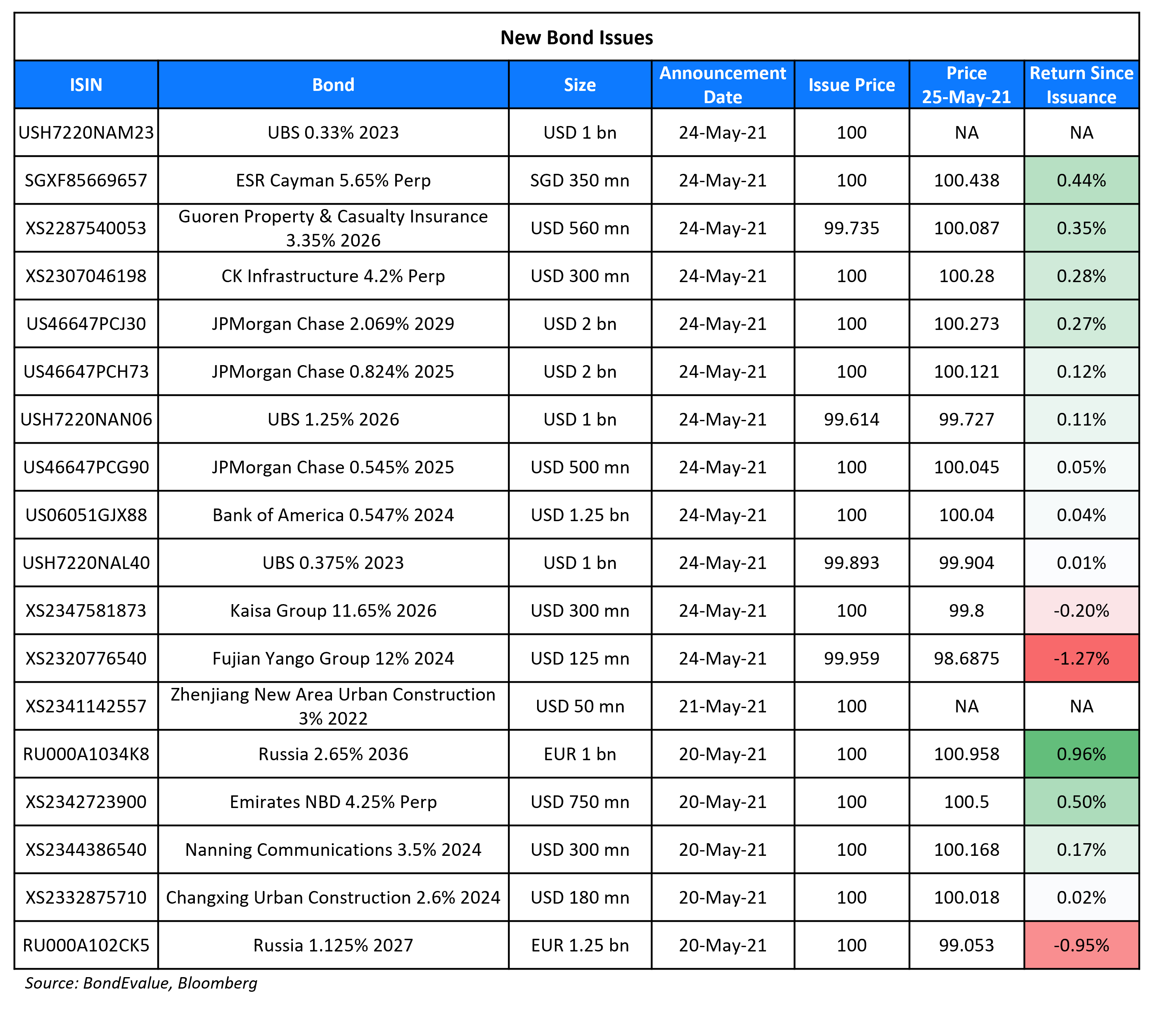

New Bond Issues

- Abu Dhabi $ 7Y at T+70-75bp

- Westpac $ 5Y fixed/floater at T+62.5bp/SOFR equiv. area, 10Y at T+87.5bp area

- OUE Commercial REIT S$ 5Y at 4.15% area

- CMB International Capital 3yr $ bonds at T+150bp area

- Jiangsu Shagang Group capped $300m 3yr at 3.8% area

- Zhongyu Gas $ 3yr bonds at 6.1% area

- AAC Technologies $ 5yr/10yr at T+225bp/T+270bp area

- Jiujiang Municipal Development Group capped $300m 3yr bonds at 3.9% area

- Chinalco $ 5yr senior bonds IPG T+185bp area

- Jinke Property $ 3yr at 7.7% area

Kaisa Group raised $300mn via a 5Y non-call 3Y (5NC3) sustainable bond at a yield of 11.65%, 35bp inside the initial guidance of 12% area. The bonds have expected ratings of B2/B, and received orders over $2.5bn, ~8.3x the issue size. Asia took 90% and Europe 10%. Fund managers received 81%, private banks 15%, corporates 3% and financial institutions 1%. The bonds were priced 37bp over their 11.7% 2025s callable in 2023 that are currently yielding 11.28%. The proceeds are likely to be used to finance the offshore debt.

Kaisa Group raised $300mn via a 5Y non-call 3Y (5NC3) sustainable bond at a yield of 11.65%, 35bp inside the initial guidance of 12% area. The bonds have expected ratings of B2/B, and received orders over $2.5bn, ~8.3x the issue size. Asia took 90% and Europe 10%. Fund managers received 81%, private banks 15%, corporates 3% and financial institutions 1%. The bonds were priced 37bp over their 11.7% 2025s callable in 2023 that are currently yielding 11.28%. The proceeds are likely to be used to finance the offshore debt.

JPMorgan raised $4.5bn via a three-trancher. It raised:

- $2bn via a 4NC3 bond at a yield of 0.824%, 20bp inside initial guidance of T+70bp area

- $500mn via a 4NC3 floater (FRN) at SOFR+53.5bp vs. guidance of SOFR equivalent

- $2bn via an 8NC7 bond at a yield of 2.069%, 20bp inside initial guidance of T+100bp area

The bonds have expected ratings of A-. Proceeds will be used for general corporate purposes. The bonds have an optional redemption one year prior to maturity on all tranches and are callable at par 1 month, 1 month and 2 months prior to maturity. Barring the FRN, the other two bonds have a make whole call beginning December 1, 2021.

UBS raised $3bn via a three-trancher. It raised:

- $1bn via a 2Y bond at a yield of 0.429%, ~19.5bp inside initial guidance of T+45/50bp area

- $1bn via a 2Y floater (FRN) at SOFR+32bp vs. guidance of SOFR equivalent

- $1bn via a 5Y bond at a yield of 1.33%, ~19.5bp inside initial guidance of T+70/75bp area

The bonds have expected ratings of Aa3/A+/AA-. Proceeds will be used for general corporate purposes.

Bank of America raised $1.25bn via a 3Y non-call 2Y (3NC2) floater (FRN) at a yield of 0.547%, 2bp inside the initial guidance of 3mBSBY+45bp area (the Bloomberg 3 Month Short Term Bank Yield index). The bonds have expected ratings of A2/A-, in line with the issuer rating. The bonds have a par call 1 year prior to maturity (May 28, 2023) and anytime on or after May 28, 2024. The proceeds will be used for general corporate purposes.

ESR Cayman raised S$150mn ($113mn) via a tap of their S$ 5.65% Perpetual non-call 5Y (PerpNC5) at 100/5.64%, unchanged from initial guidance of 100 area/5.64% YTC. The bonds are unrated and received orders over S$210mn, 1.4x issue size. If the notes are not called, the coupon will reset every five years to the 5Y SOR + initial spread of 473bp along with a coupon step-up of 200bp. Proceeds will be used for refinancing debt, financing potential acquisition and investment opportunities, working capital requirements and general corporate purposes. There is a 25 cent rebate for private bank orders.

Guoren Property and Casualty Insurance raised $560mn via a 5Y bond at a yield of 3.35% or T+260bp, 40bp inside the initial guidance of T+300bp area. The bonds have expected ratings of BBB+ and received orders over $2.5bn, 4.5x the issue size. It also raised CNY 250mn ($39mn) via a 2Y bond at a yield of 4.2%, 35bp inside the initial guidance of 4.55%. The proceeds of the bonds are likely to be used for general corporate purposes. Shenzhen Investment Holdings owns 41% of Guoren P&C, which offers motor, commercial property, liability and accident and health insurance.

CK Infrastructure raised $300mn via a fixed-for-life Perpetual non-call 5Y (PerpNC5) at a yield of 4.2%, 30bp inside initial guidance of 4.5% area. The bonds have expected ratings of BBB, and received orders over $1.2bn, 4x issue size. There is a 20 cent rebate for private bank orders. This is CK Infra’s first dollar bond issuance since 2017. As per IFR, CK Hutchison holds a 71.93% stake in CK Infra and this is the first USD fixed-for-life offering in Asia since sister company CK Asset sold a $300mn PerpNC3 in September last year.

Fujian Yango Group raised $125mn via a tap of their 12% 2024s at a yield of 12%. The bonds have expected ratings of B-. Yango (Cayman) Investment is the issuer and Fujian Yango Group is the parent guarantor. Proceeds will be used for offshore debt refinancing and the development of its education business.

New Bond Pipeline

- Greenland Hong Kong hires banks for $ bond offering

- Pakistan WAPDA $ green bond

- Shandong Fi-nance Investment hires for $ bond

- Maldives HDC $ sukuk

Rating Changes

Term of the Day

Frontier Market Bonds

These are bonds issued by frontier markets, which are considered to be smaller/riskier/more illiquid compared to emerging markets. These are generally considered the next generation of emerging markets. Aberdeen notes that from a geographical standpoint, “Africa is most associated with frontier markets”. Some examples of frontier markets are Guatemala, Bolivia, Kenya, Zambia, Ghana, Pakistan, Sri Lanka etc. Bloomberg reports that based on the JPMorgan NEXGEM index, which includes frontier markets, bonds have returned 2.6% YTD while higher-ranked peers like the the emerging markets bonds have lost 2% during the same period.

Talking Heads

On the expectation that pricing pressures will subside over time – Lael Brainard, Federal Reserve Board Governor

“We’re in the middle of a pretty unprecedented rebound in the U.S. economy,” Brainard said.

“The Monetary Policy Committee judges that these transitory developments should have few direct implications for inflation over the medium term,” Bailey said.

“I am not inclined to dismiss today’s pricing signals or to be overly reliant on historical relationships and dynamics in judging the outlook for inflation,” George said. “The structure of the economy changes over time, and it will be important to adapt to new circumstances rather than adhere to a rigid formulation of policy reactions,” she said. “With a tremendous amount of fiscal stimulus flowing through the economy, the landscape could unfold quite differently than the one that shaped the thinking.”

Dalio said the economics of investing in bonds “has become stupid” because they pay less than inflation. “I have some Bitcoin,” Dalio said. Bitcoin’s “greatest risk is its success.”

On Libor replacements multiplying in shift that could fracture markets

Mark Cabana, head of US interest-rate strategy at Bank of America Corp

“While there was a big push to try and have SOFR be the monolith, the market seems to have other views of the type of benchmark it would like to have for very specific transactions,” said Cabana. “Will SOFR end up being the key lending rate in the future? I don’t know. I think there are real questions around that.”

Meredith Coffey, executive vice president of research & public policy at the Loan Syndications and Trading Association

“The key thing is we’re going to be in a multirate environment,” Coffey said. “We’ve seen it. We’ve expected it. And it’s not a tragedy.”

Dave Loretta, Duluth Chief Financial Officer

“We appreciated it had a very high correlation to Libor and we could set some term portions on it, which under the SOFR arrangement it was going to be a little more complicated,” said Loretta.

Priya Misra of TD Securities

“We are concerned that it may fragment markets or decrease derivatives market liquidity.” “It is unclear how any credit-sensitive rate would behave in a credit event.”

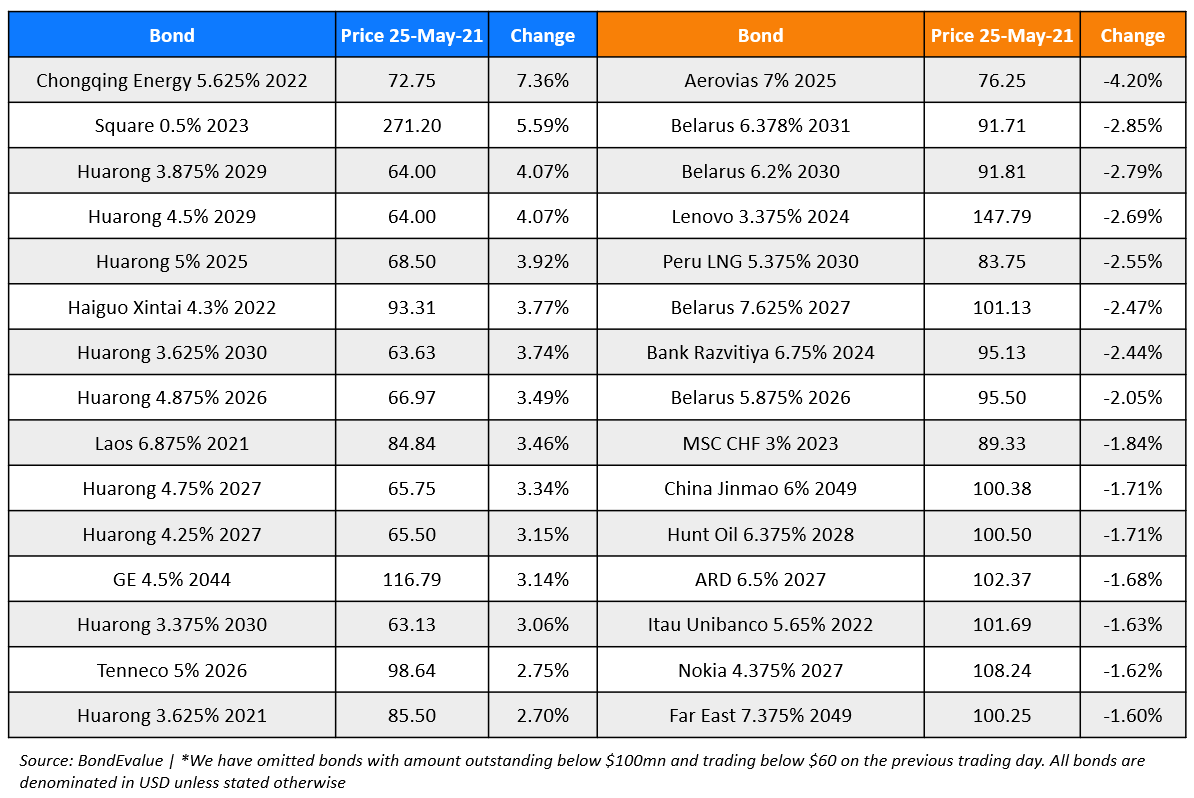

Top Gainers & Losers – 25-May-21*

Go back to Latest bond Market News

Related Posts: