This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

10 New $ Deals incl. MUFG, AgBank; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 11, 2022

US equity markets ended mixed with the S&P down 0.1% and the Nasdaq flat after initial losses of 2% and 2.7% respectively. Healthcare led the gainers, up 1% while Industrials led the losers, down 1.2%. US 10Y Treasury yields were down 1bp to 1.76%. European markets were lower with the DAX, CAC and FTSE down 1.1%, 1.4% and 0.5% respectively. Brazil’s Bovespa was down 0.8%. In the Middle East, UAE’s ADX was down 1% while Saudi TASI was up 0.9%. Asian markets have opened mixed – Shanghai and Nikkei were down 0.1% and 0.9% while HSI and STI were up 0.1% and 0.3%. US IG CDS spreads were 0.1bp tighter and HY CDS spreads widened 4.6bp. EU Main CDS spreads were 0.6bp wider and Crossover CDS spreads were 1.3bp wider. Asia ex-Japan CDS spreads widened 1.1bp.

Asian primary markets are having its busiest day yet in 2022 with 10 new dollar deals. Rating agencies are back to downgrading Chinese property developers with five downgrades on Monday including Shimao and Yuzhou.

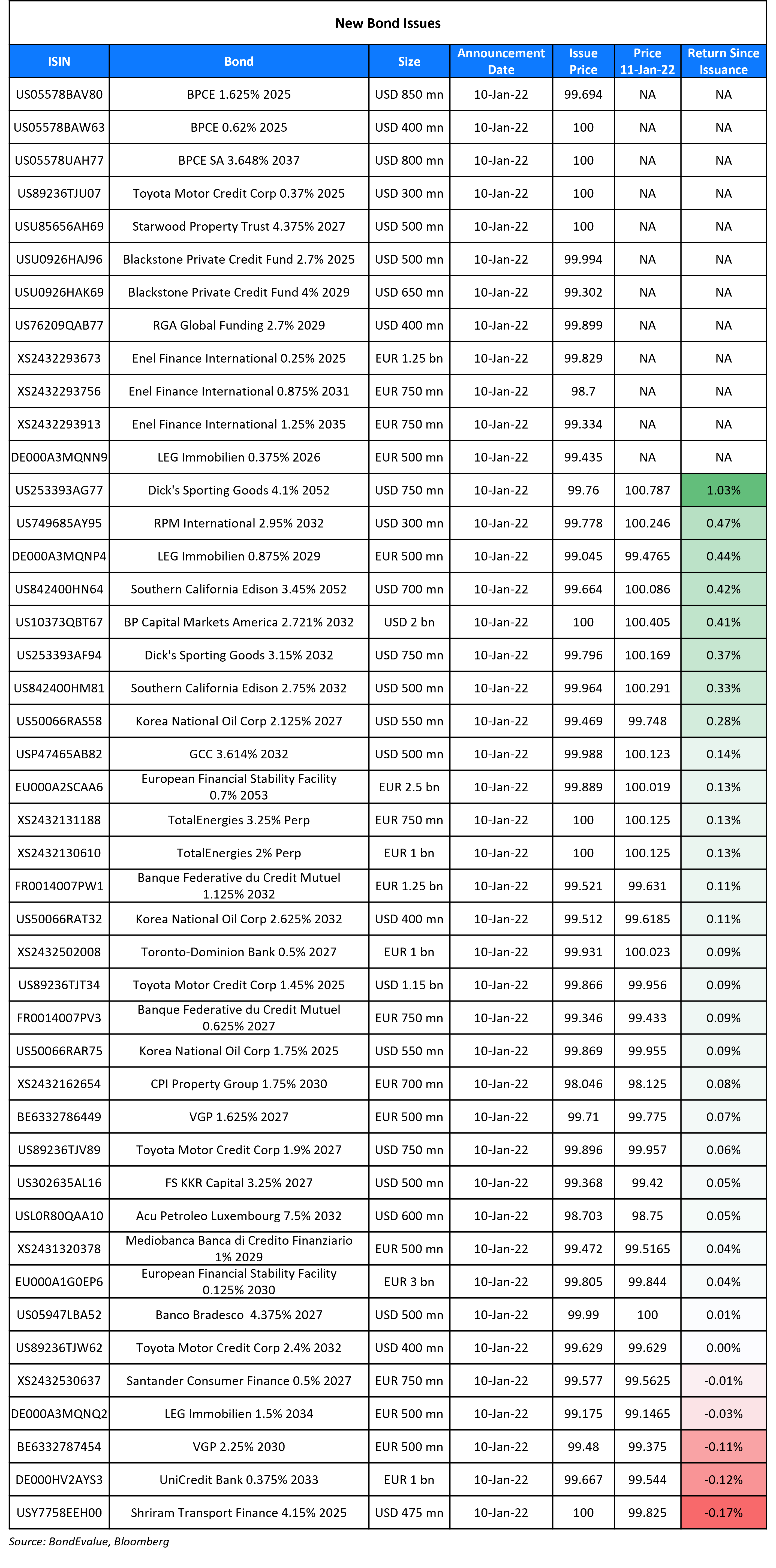

New Bond Issues

- MUFG $ 6NC5/11NC10 at T+105/130bp area

- Agricultural Bank of China $ 3Y/5Y green at T+70/85bp area

- Guangzhou Development District $ 5Y green at 3.3% area

- Link REIT $ 10Y at T+140bp area

- Beijing Gas Group $ 3Y green at T+115bp area

- HKT Group $ 10Y at T+155bp area

- SF Holding $ tap of 2.375% 2026 at T+160bp area; $ tap of 3.125% 2031 at T+195bp area

- Zhenjiang State-owned Investment Holding $ 364-day at 1.98% area

- Jiangsu Dieshiqiao Home Textile $ 3Y at 3% final

- Chongqing International Logistics Hub Park Construction $ 3Y at 5.3% final

KNOC raised $1.5bn via a 3-tranche deal. It raised:

- $550mn via a 3.25Y bond at a yield of 1.792%, 20bp inside initial guidance of T+80bp area.

- $550mn via a 5.25Y bond at a yield of 2.333%, 25bp inside initial guidance of T+95bp area.

- $400mn via a 10.25Y bond at a yield of 2.68%, 30bp inside initial guidance of T+120bp area.

The bonds have expected ratings of A2/AA (Moody’s/S&P). Proceeds will be used for general corporate purposes and not for any activities relating to the construction or development of its oil sands projects. The new 3.25Y bonds are priced 9.2bp wider to its existing 3.25% 2025s that yield 1.7%.

Shriram Transport Finance raised $472mn via a 3.5Y social bond at a yield of 4.15%, 30bp inside initial guidance of 4.45% area. The bonds have expected ratings of BB–/BB (S&P/Fitch), and received orders over $960mn, 2x issue size. Proceeds will be used in accordance with the issuer’s social finance framework as well as for onward lending and other activities. STF’s social finance framework has received a second-party opinion from Sustainalytics and a limited assurance report from KPMG. The security on these bonds will be in the form of a exclusively earmarked specified pool of receivables. No other details were released on the receivables. Fund managers, hedge funds and pension funds took 92% of the deal, banks 4% and private banks 4%. Asia accounted for 66%, EMEA 18% and the US 16%. The new bonds are priced 47bp wider to its existing 4.4% 2024s that yield 3.68%.

New Bonds Pipeline

- Chengdu Jingkai Guotou Investment Group hires for $ tap of 5.3% 2024s bond

- IRFC hires for $ bond

- Singapore Airlines hires for $ bond

- Guangdong Provincial Communications Group hires for $ bond

- CIMB Bank hires for $ 5Y or 5.5Y sustainability development senior bond

- Mitsui & Co hires for $ 5Y bond

- Woori Bank hires for $ sustainability bond bond

- China Oilfield Services Limited hires for $ bond

- ADB marketing hires for $ 5Y bond

- JSW Infrastructure hires for $ 7Y SLB bond

- JY Grandmark hires for $ bond

- State Bank of India hires for $ 5Y formosa bond

- China Chengtong HK hires for $ bond

Rating Changes

- Fitch Downgrades Yuzhou Group to ‘CCC-‘ on Higher Bond Refinancing Risk

- Moody’s downgrades Yuzhou to Caa2/Caa3; outlook negative

- Shimao Group Downgraded To ‘B-‘ On Weak Liquidity; Ratings Placed On CreditWatch Negative

- Moody’s downgrades DaFa to Caa2/Caa3, changes outlook to negative

- Moody’s downgrades Shimao to B2; rating remains on review for downgrade

- Moody’s withdraws Yango’s ratings due to insufficient information

- Ratings On Industrial and Commercial Bank Of China, Most Subsidiaries Affirmed Under Revised Criteria; Outlooks Stable

Term of the Day

Second Party Opinion (ESG)

A Second Party Opinion (SPO) in the ESG space refers to an independent review of the selection criteria for the projects financed ESG green bonds and of the allocation of funds. An SPO tries to provide assurance that the bond framework is aligned to accepted market principles like the ICMA Green Bond Principles for example. There are separate companies that provide SPOs, having been considered to have expertise and reputation in this field. Prominent players in this space include Sustainalytics, CICERO, Vigeo Eiris, ISS ESG, S&P Global amongst others,

Talking Heads

“We will use our tools to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched.” “We can begin to see that the post-pandemic economy is likely to be different in some respects. The pursuit of our goals will need to take these differences into account.” “We worked to improve the public’s access to instant payments, intensified our focus and supervisory efforts on evolving threats such as climate change and cyberattacks, and expanded our analysis and monitoring of financial stability,” he said.

“If we’re lucky, the Fed will slow things down, and we’ll have what they call a soft landing.” “It’s going to be a little bit like threading a needle.” “I’d personally be surprised if it’s just four increases,” he added. “Four increases of 25 basis points is a very, very little amount, and very easy for the economy to absorb.”

On the possibility of a faster pace of policy tightening

Lou Crandall, chief economist at Wrightson ICAP

“It’s quite possible that the Fed is forced to be more aggressive in this cycle.” “You could see wage inflation numbers that require a more aggressive policy response.”

Guneet Dhingra, head of U.S. interest-rate strategy at Morgan Stanley

“The idea that the Fed sticks to a template of four rate hikes this year is challenged by what has already happened, with the pace of tapering accelerating in the past three months.” “If they need to hike fast, they will. There is a high degree of variability that could result in more than four hikes — or less — dependent on whether inflation is slower during the second half of the year. The Fed is showing urgency and being flexible.”

Bill Dudley, former New York Fed President

“The Fed will have to respond by taking interest rates above neutral well before the end of 2024.”

On China’s property woes continuing into 2022

Himanshu Porwal, emerging markets corporate credit analyst at Seaport Global

“I think the worst might be yet to come.” “A lot will depend on what the Chinese government does in terms of liquidity measures… But it has been four months already so I don’t know what they would be waiting for.”

Kington Lin, managing director of the asset management department at Canfield Securities Limited

“It’s going to be the peak of repayment period and we’ll see more developers default.” “The market is watching how many SOEs (state-owned enterprises) will get more M&A loans to help the developers in distress.”

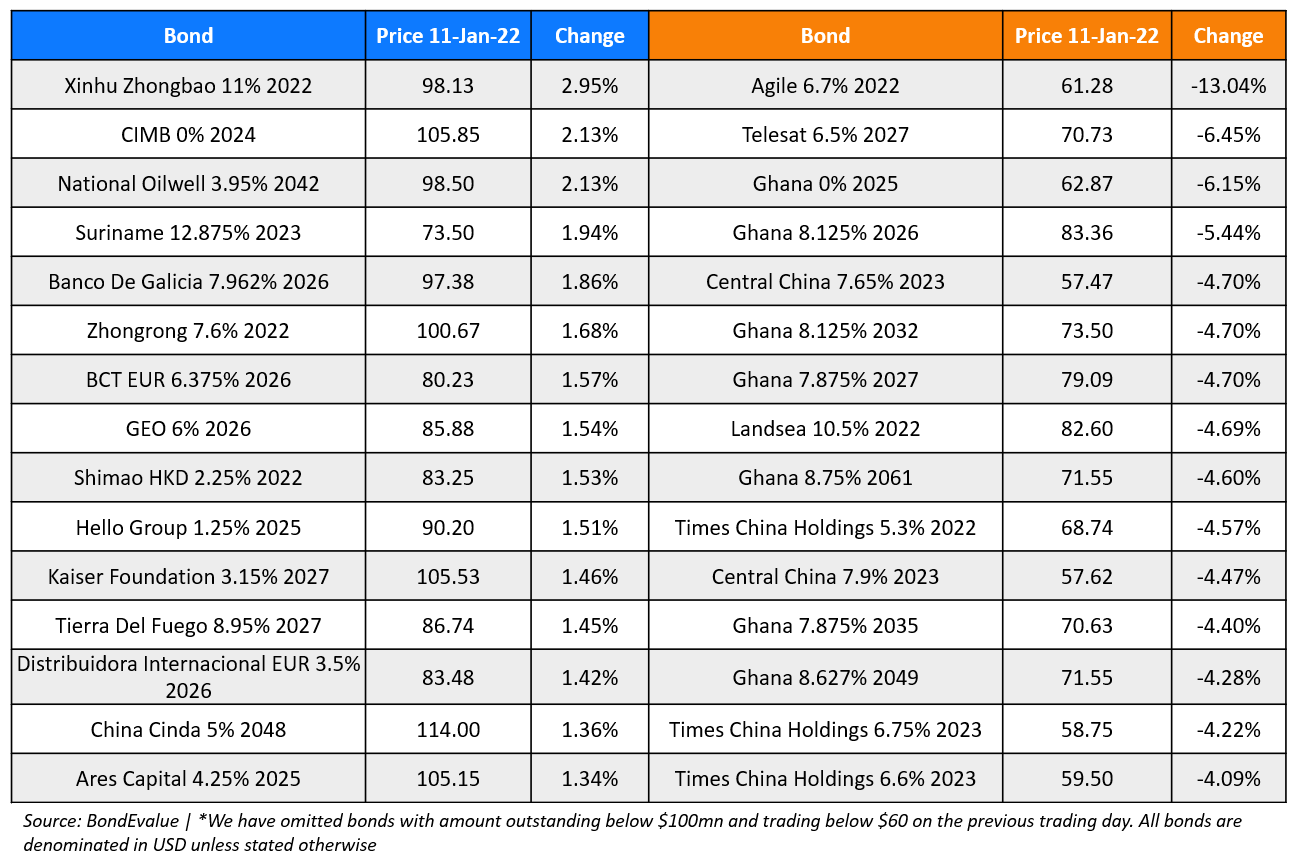

Top Gainers & Losers – 11-Jan-22*

Other Stories

Garuda Creditors Submit Claims Worth $13.8bn

Go back to Latest bond Market News

Related Posts: