This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Invest in curated bond portfolios with just $10kLearn More

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Adani Ports’ Bonds Rally on Launch of Buyback to Convey “Comfortable Liquidity”

April 24, 2023

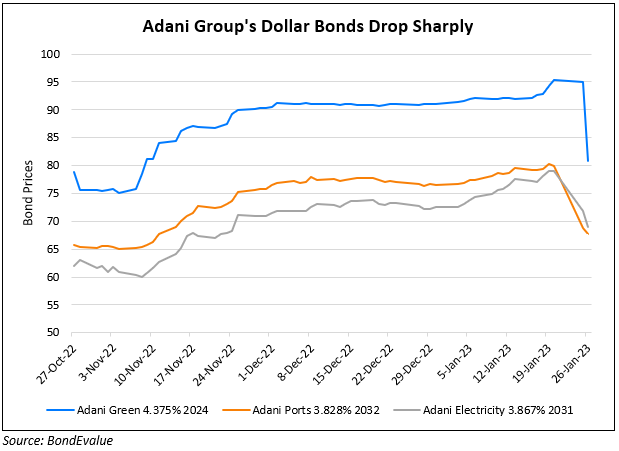

Dollar bonds of Adani Ports and SEZ were among the top gainers last week as the company launched a tender offer to buyback up to $130mn of its outstanding $650mn 3.375% bonds due July 2024. The company said it was part of a liability management exercise and will be funded from cash reserves. The company said in a statement, “The purpose of the tender offer is to partly prepay the company’s near-term debt maturities and to convey the comfortable liquidity position of the company”.

Bondholders tendering their bonds before the early deadline of May 8 will receive an early tender premium of $15, included in the total cash consideration of $970 per $1,000 principal. Those tendering their bonds beyond this date but before the final deadline of May 22 will receive $955 per $1,000 in principal. Further, Adani Ports added that it is planning buybacks of about $130mn in each of the next four quarters. Its 3.375% 2024s are trading at 95.6 cents on the dollar, yielding 7.1%.

The buyback confirmation comes just days after the company said that it was looking to buy back bonds denominated in INR or USD. Adani Ports’ dollar bonds were up over 3-5% last week led by its 4% 2027s that were up 4.7% to trade at 83.9, yielding 8.58%.

Go back to Latest bond Market News

Related Posts: