This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Adani Ports, Temasek Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 26, 2021

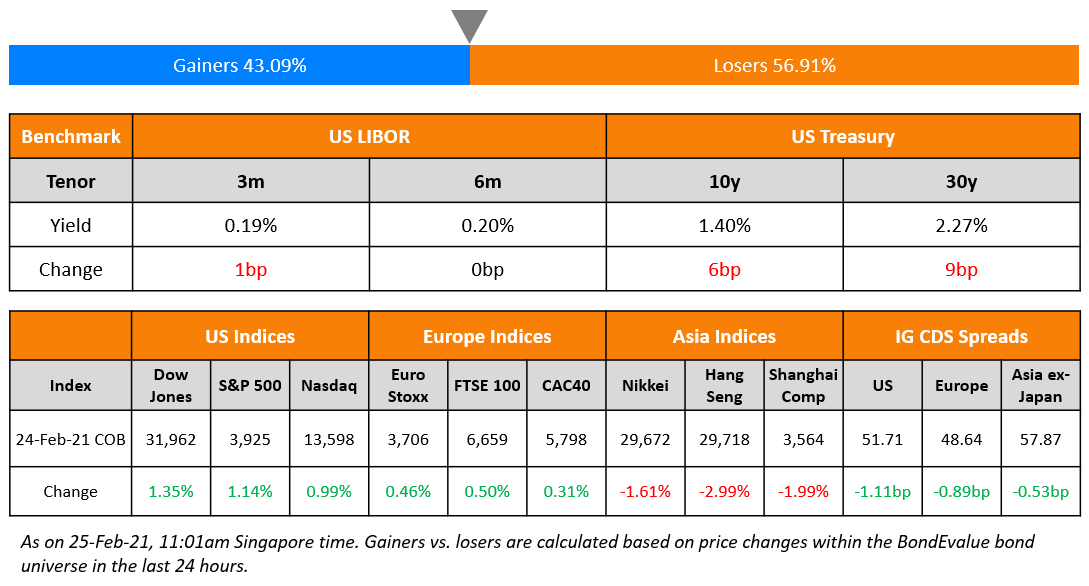

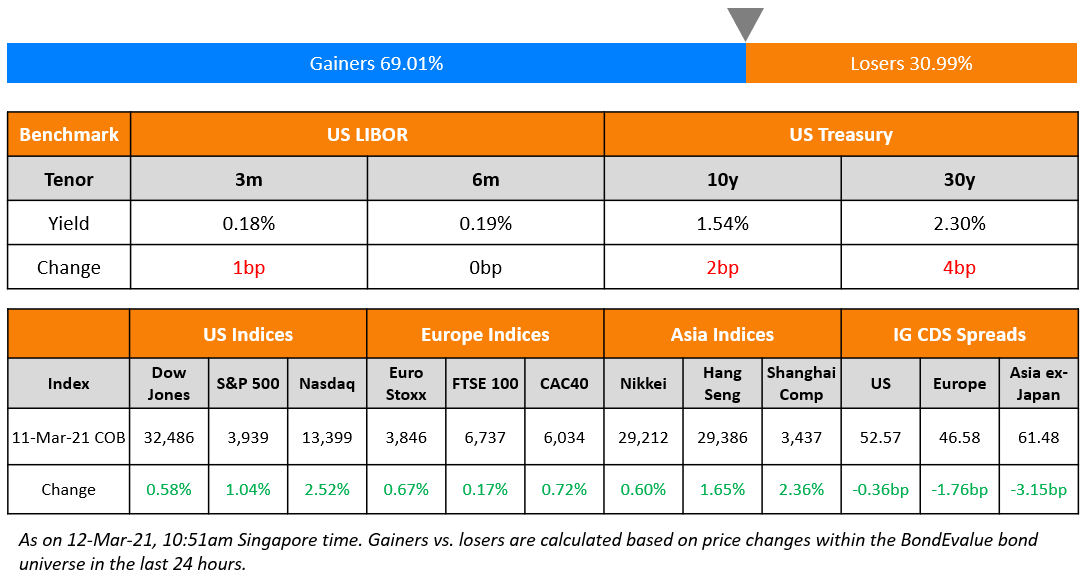

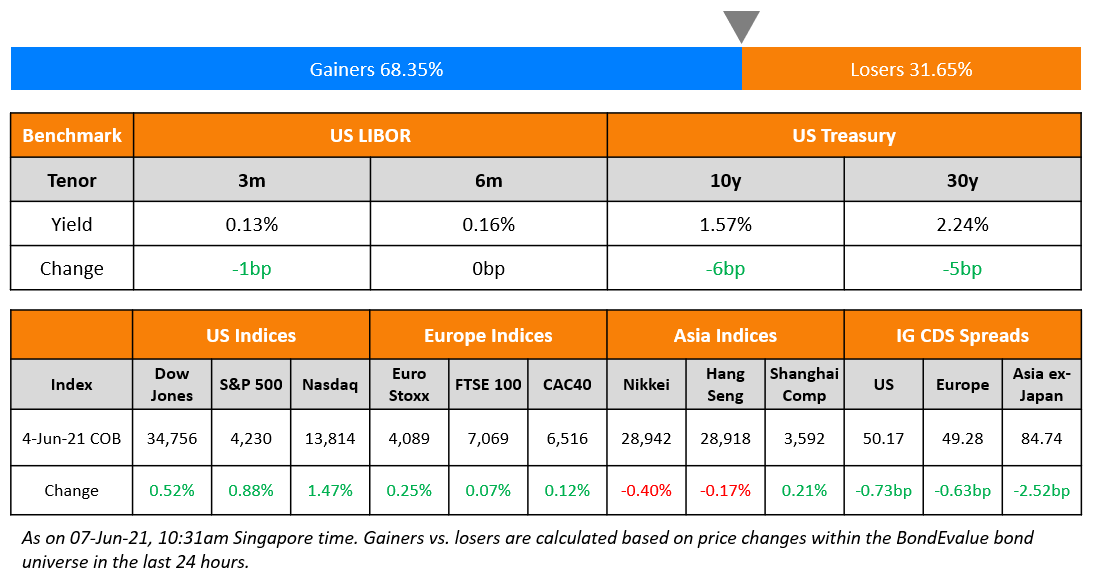

US markets ended the week on another record high. S&P and Nasdaq were both up 1% and markets enter the upcoming week with a Fed Meeting lined up along with high profile earnings reports from Apple, Alphabet, Facebook, Amazon, Microsoft, Tesla and Boeing. Consumer Services led the gains up 2.7%. Utilities, Consumer Stables, Health Care, and IT were up ~1%. Markit Flash US composite and services PMIs for July came in lower at 59.7 and 59.8 respectively vs. last month’s 63.7 and 64.6 while the manufacturing PMI was higher at 63.1 vs 62.1 last month. US 10Y Treasury yields tightened by 2bp to 1.26%. Euro zone activity grew in July to a 21-year high with flash composite PMI at 60.6 vs. 59.5. The European bourses also closed higher – CAC, DAX and FTSE were up 1.4%, 1% and 0.9%. US IG CDS spreads tightened 0.7bp and HY tightened 3.4bp. EU Main and Crossover spreads tightened 0.9bp and 3.4bp respectively. Brazil’s Bovespa was down 0.9%. Middle East markets opened the week in the green after the Eid break. Saudi TASI and UAE’s DAX were up 0.8% and 0.6% respectively. Asian markets looked for direction as Chinese tech shares continued to drop as Chinese regulators barred Tencent from exclusive rights in online music – the Nikkei is up 1.3% while HSI, Shanghai and Singapore’s STIs are down 2.4%, 0.8% and 0.2% respectively. Asia ex-Japan CDS spreads were 0.3bp wider.

Navigating The Bond Markets by Leveraging the BEV App | July 28

New to the BondEvalue App? We will be conducting a complimentary session on Navigating The Bond Markets by Leveraging the BEV App on July 28, 2021. This session is aimed at helping bond investors in tracking their investments using the BondEvalue App. Click on the banner below to register.

New Bond Issues

-

Adani Ports SEZ $ 10.5Y/20Y at T10+ 280bp/ 5.25% areas

-

Temasek $ 10/20/40yr @ T+60/80/100bp area

- ICBC Financial Leasing $ 3Y/5Y/10Y at T+130bp/145bp/185bp area

-

Fujian Yango Group $ 2 year 5 months final at 12.5%, alongside tender offer

.png?width=1600&upscale=true&name=New%20Bond%20Issues%2026%20Jul%20(1).png)

JPMorgan raised $2bn via Perpetual non-call 5Y (PerpNC5) depositary shares at a yield of 4.2%, ~23.75bp inside initial guidance of 4.375-4.5% area. The depositary shares each represent a 1/400th interest in a share of JPMorgan Non-Cumulative Preferred Stock, Series MM. The offering price is $25 per depositary share and can be redeemed on any dividend payment date on or after September 1, 2026, or at any time following a “capital treatment event”. Proceeds will be used for general corporate purposes. The coupon is fixed for life.

Nanchang Jinkai Group raised $225mn via a 2.92Y credit-enhanced bond maturing at a yield of 3.45%, unchanged from initial guidance. The bonds are unrated and supported by an irrevocable standby letter of credit from Bank of Jiujiang. Proceeds will be used for project development, debt repayment and working capital.

New Bonds Pipeline

-

Gemdale Corp hires for $ green bonds; calls today

-

AVIC International Leasing hires for 364-day euro bonds; calls today

Rating Changes

-

Moody’s upgrades Cyprus’s rating to Ba1, changes outlook to stable from positive

- SP PowerAssets Upgraded To ‘AA+’ from ‘AA’ By S&P Following Rating Action On Parent; Outlook Stable

- Singapore Power Rating Raised To ‘AA+’ From ‘AA’ By S&P Following Tariff Resets; Outlook Stable

- Navios Maritime Holdings Downgraded To ‘CCC’ By S&P On Mounting Refinancing Risk; Outlook Negative

- Fitch Revises Outlook on Nordea Bank to Stable; Affirms at ‘AA-‘

- Fitch Revises Lear’s Outlook to Stable; Affirms IDR at ‘BBB’

- Fitch Revises the Outlook on Svenska Handelsbanken to Stable; Affirms at ‘AA’

- Fitch Revises Gulf International Bank (UK) Limited Outlook to Stable; Affirms at ‘BBB+’

-

Moody’s withdraws Languang Development’s ratings due to insufficient information

ICYMI: Chinese Developers’ Bond Spreads Widen as Focus on Three Red Lines Increases

In case you missed it – China’s real estate developers’ high yield Index underperformed its peers witnessing a sharp drop of 6% in June and down 3.7% YTD. Investor concerns were apparent since the start of Q2 with Z-Spreads widening across certain Chinese real estate developers. China Evergrande’s Z-Spread widened by a massive 1,800bp since April, the highest in the sector as investor concerns grow over its liquidity position. The ‘three red-lines’, a key regulatory threshold for property developers set by Beijing has become an important factor that separates the winners and the losers.

In this editorial piece, we detail the widening Z-Spreads across companies in the Chinese property sector, the sector’s underperformance, and the three red-lines calculations of the key players.

Term of the Day

FTZ Bond

A Free Trade Zone (FTZ) bond is a bond issued by a company that operates an FTZ or subzone. FTZ’s are a special economic zone for commerce purposes where imported goods are not subject to customs. According to Asia Financial, an analysis by industry insiders show that FTZ bonds can be regarded as foreign bonds, and they are basically the same as foreign bonds in terms of foreign debt filing, projection procedures, fund return and supervision.

Chinese conglomerate Shanghai Fosun High Technology (Group) priced a $200mn 3Y Shanghai Pilot Free Trade Zone bond at par to yield 4.3% on Friday.

Talking Heads

On the warning to Congress on US debt limit

Janet Yellen, US Treasury Secretary

“If Congress has not acted to suspend or increase the debt limit by Monday, August 2, 2021, Treasury will need to start taking certain additional extraordinary measures in order to prevent the United States from defaulting on its obligations.”

Jen Psaki, White House Press Secretary

“We certainly expect Congress to act in a bipartisan manner, as they did three times under the prior administration, to raise the debt limit,” Psaki said.

“Inflation is not going to be transitory.” “I’ve been pretty certain in my mind about three prior calls. This is the fourth one.” “I have a whole list of companies that have announced price increases, that have told us they expect further price increases, and that they expect them to stick.” “The Fed should ease its foot slowly off the accelerator,” he said.

Scott Thiel, chief fixed-income strategist at BlackRock

“We remain of the view that the restart is real, and that economies are recovering.” “Treasury yields are too low in the current environment. Markets are too pessimistic about the prospects for the economy.”

“We remain of the view that the restart is real, and that economies are recovering.” “Treasury yields are too low in the current environment. Markets are too pessimistic about the prospects for the economy.”

Antoine Bouvet, a senior rates strategist at ING

“On the face of it, this is a level consistent with a recessionary environment.” “I’m not sure that’s really what the market is thinking. You simply have some moderate doubt about the strength of the recovery which means more demand for safe assets at a time when central banks are still hoovering up most of them. That’s the explosive recipe behind this move.”

“On the face of it, this is a level consistent with a recessionary environment.” “I’m not sure that’s really what the market is thinking. You simply have some moderate doubt about the strength of the recovery which means more demand for safe assets at a time when central banks are still hoovering up most of them. That’s the explosive recipe behind this move.”

Iain Stealey, international chief investment officer for fixed income at JPMorgan Asset Management

“Stepping in front of this move doesn’t feel like the right thing to do at the moment,” he said. “I would be more comfortable seeing a turn in the market before we do.”

“Stepping in front of this move doesn’t feel like the right thing to do at the moment,” he said. “I would be more comfortable seeing a turn in the market before we do.”

Matthew Hornbach, global head of macro strategy at Morgan Stanley

“The economic data is certainly one factor that I would expect to catalyse a continued upward trajectory in interest rates,” he said. “Since the June [Fed] meeting, the data has been unequivocally strong and financial conditions are easier.” “Our view is that by the end of this year the Fed will be much closer to the point where they no longer think that additional easing every month is required in order to keep the economy moving towards the Fed’s goals,” said Hornbach. “If that plays out as we expect, interest rate markets will be trading at higher yields.”

“The economic data is certainly one factor that I would expect to catalyse a continued upward trajectory in interest rates,” he said. “Since the June [Fed] meeting, the data has been unequivocally strong and financial conditions are easier.” “Our view is that by the end of this year the Fed will be much closer to the point where they no longer think that additional easing every month is required in order to keep the economy moving towards the Fed’s goals,” said Hornbach. “If that plays out as we expect, interest rate markets will be trading at higher yields.”

On the value in BBB to BB-rated Asian dollar credits – Kenneth Akintewe, head of Asian sovereign debt at Aberdeen

“The high end of the credit curve in Asia offers less value, as do sovereigns such as Indonesia.”

Go back to Latest bond Market News

Related Posts: