This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

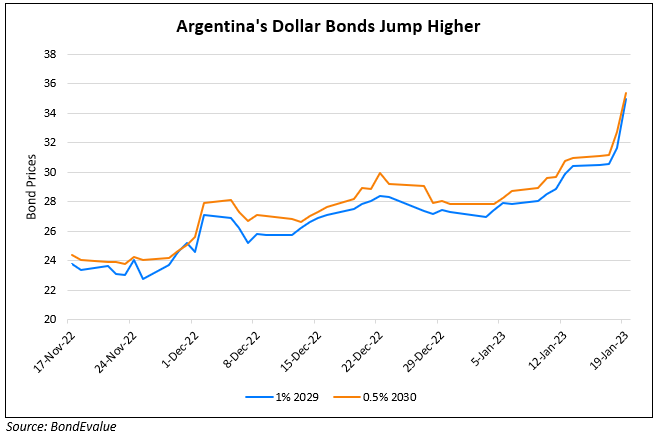

Argentina’s Dollar Bonds Move Higher on Planned $1bn Bond Buyback

January 19, 2023

Argentina’s dollar bonds were higher by over 1 point across the curve after the nation said it planned to repurchase about $1bn of debt. Their Economy Minister Sergio Massa said that they plan to buy some of its 2029s and 2030s. Bloomberg cites sources noting that Argentina is planning to use dollars held by the Treasury to fund the buyback. This includes money that the sovereign is expecting to save from energy imports it believes that it will not need in 2023. Argentina is trying to align itself to its agreement with the IMF where its reserves stand at $42.9bn, below the latter’s recommended level. The buyback would see its reserve levels drop $1bn.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Argentina Closes $45bn Deal with IMF

March 4, 2022

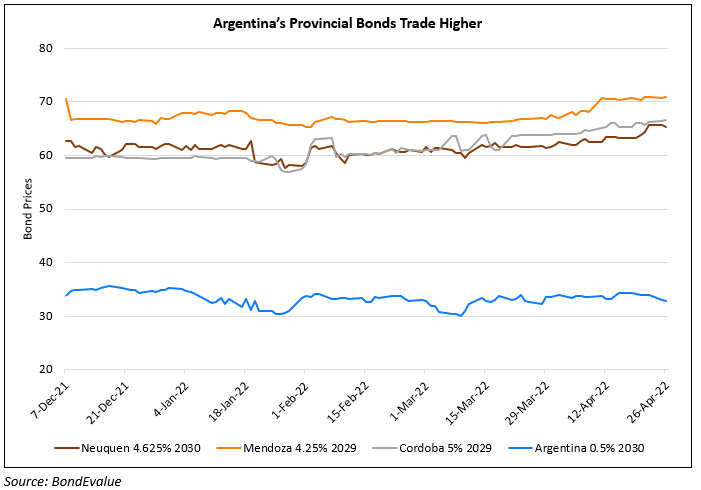

Argentina’s Province Bonds Outperform Sovereign Bond

April 26, 2022