This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

AVIC, Goho Launch $ Bonds; Macro; Rating Changes; New Bond Issuances; Talking Heads; Top Gainers & Losers

March 24, 2021

S&P ended 0.8% lower and Nasdaq was 1.1% lower, reversing Monday’s gains. The US 10Y Treasury yield dipped 7bp to 1.60%. US Treasury Secy. Janet Yellen said that there were no current plans to lengthen the maturity of debt issuance. European equities also struggled with the DAX flat while FTSE and CAC were down 0.4% each. US IG CDS spreads were 0.5bp wider and HY was 6.8bp wider. EU main CDS spreads were 0.6bp tighter and crossover spreads tightened 0.3b. Asian equity markets have opened lower by 0.6% and Asia ex-Japan CDS spreads are tighter 1.7bp.

Bond Traders’ Masterclass | Today at 6pm SG/HK | US$375 for 5 Session Bundle

Keen to learn bond market fundamentals from industry professionals? Sign up for our Bond Traders’ Masterclass that consists of five modules starting with A Practical Introduction to Bonds today at 6pm SG/HK. Avail a 25% discount on a bundle of five sessions!

The modules are specially curated for private bond investors and wealth managers to develop a strong fundamental and practical understanding of bonds. Given the ultra-low interest rate environment, flurry of new bond deals particularly from junk-rated issuers and tightening credit spreads, it is now more important than ever for investors to understand bond valuation, portfolio construction and new bond issues to help them get better return for risk. The sessions will be conducted by debt capital market bankers who have previously worked at premier global banks such as Credit Suisse, Citi and Standard Chartered.

New Bond Issues

- AVIC International Leasing $ 3Y at T+200bp area; books over $1bn

- Goho Asset Management $ 2Y11M SBLC-backed bond at 4.5% area

Banco Santander raised $2.25bn via a dual-trancher. It raised $1.5bn via a 5Y bond at a yield of 1.849%, 22bp inside initial guidance of T+125bp area. It also raised $750mn via a 10Y bond at a yield of 2.958%, 22bp inside initial guidance of T+155bp area. The bonds have expected ratings of Baa1/A-. Proceeds will be used for general corporate purposes.

China SCE Group Holdings raised $300mn via a 3.5Y non-call 2.5Y bond (3.5NC2.5) at a yield of 5.95%, 45bp inside initial guidance of 6.4%. The bonds have expected ratings of BB- and received orders over $2.3bn, 7.7x issue size. Asian investors took 98% of the bonds and EMEA 2%. Fund managers bought 87%, private banks 8%, insurers and sovereign wealth funds 4%, banks 1%. The property company will use the proceeds to refinance offshore debt due within a year.

GLP China Holdings raised $700mn via a 5Y bond at a yield of 3.172%, or T+235bp, 40bp inside initial guidance of T+275bp area. The bonds have expected ratings of BBB- and received orders over $5bn – Asia took 92% and Europe 8%; Asset/fund managers booked 76%, sovereign wealth funds and public institutions 16%, banks and financial institutions 7%, and private banks 1%. Proceeds will be used to refinance debt and for general corporate purposes.

Bank Negara Indonesia raised $500 via a 5Y tier 2 bond at a yield of 3.75%, 45bp inside initial guidance of 4.2% area. The bonds have expected ratings of Ba2/BB with Asia taking 73%, EMEA 25%, US offshore 2%. Fund/Asset Managers got 87%, Banks/Insurance/Sovereign funds 7%, private banks & others 6%. The bonds will be written down permanently if Indonesia’s Financial Services Authority determines the bank to be non-viable. There is a dividend stopper. Proceeds will be used for funding and general corporate purposes. The Indonesian government has a majority stake in the bank.

Nomura raised $3.25bn via a three-trancher. It raised:

- $1.25bn via a 5Y bond at a yield of 1.864%, or T+105bp, 25bp inside initial guidance of T+130bp area

- $750mn via a 7Y bond at a yield of 2.471%, or T+120bp, 25bp inside initial guidance of T+145bp area

- $1.25bn via a 10Y bond at a yield of 2.919%, or T+130bp,30 bp inside initial guidance of T+160 area

The bonds have expected ratings of Baa1/BBB+ with proceeds going towards loans to the bank’s subsidiaries, including Nomura Securities, which will use the funds for general corporate purposes.

Science City (Guangzhou) Investment Group raised $550mn via a two-part debut dollar offering. It raised $400mn via a 3Y bond at a yield of 3%, 30bp inside initial guidance of 3.3% area. It also raised $150mn via a 5Y bond at a yield of 3.8%, 20bp inside initial guidance of 4% area. The bonds have expected ratings of BBB and received orders over $1.4bn, 2.5x issue size. The bonds have a change of control put at 101. Proceeds will be used for project construction, debt refinancing and general corporate purposes. SCI Group is a government-related entity that is fully owned by the Guangzhou Development District Administrative Committee focusing on city renewal, infrastructure construction engineering and commodity trading.

New Bond Pipeline

- Lionbridge Capital 364-day $ bond

- London Stock Exchange planning USD/EUR/GBP offering

- KNOC $ bond

- Power Construction Corporation of China $ Perp

- CAR Inc $ bond

- Maldives $ 5Y sukuk

- IRFC $ 5Y bond

- Doha Bank bond

- Tunas Baru Lampung $ bond

- Pakistan sovereign bond

- Nickel Mines $ 3NC2 bond

- Merck $10.5bn offering

- Meinian Onehealth Healthcare $ bond

Rating Changes

- Moody’s downgrades Yuzhou’s CFR to B1; outlook negative

- Moody’s downgrades ExxonMobil to Aa2; outlook stable

- Moody’s downgrades BP’s rating to A2, stable outlook

- Fitch Affirms Suzano’s IDR at ‘BBB-‘; Outlook Revised to Stable

- Fitch Affirms AutoNation at ‘BBB-‘; Outlook Revised to Positive

- American Airlines Group Inc. Ratings Affirmed By S&P On Improved Liquidity, Continued Losses; Various Issue Ratings Changed

- Fitch Assigns IDR of ‘BBB-‘ to Nordstrom; Outlook Negative

- CAR Inc. Placed On CreditWatch Positive; Proposed Notes Assigned Preliminary ‘B-‘ Rating

Term of the Day

IPO Redemption Option

This refers to an option for the bondholder that when exercised, requires the issuer to redeem the outstanding bonds on the date of the company’s IPO. Telegram’s latest 7% 2026s has an IPO redemption option subject to a few conditions laid out in the prospectus. These include completion of the IPO, bondholders complying with the company’s procedures and regulations. Once redeemed, bondholders can convert their bonds into shares at a ratio specified by Telegram. The bond prospectus is available for download on the BondEvalue App.

Talking Heads

“It is therefore imperative to put in place sound public policy incentives to encourage market forces to fill in the gap,” Yi said. “Green transition may cause the value of carbon-intensive assets to fall and sour the balance sheet of firms and financial institutions,” he said. “This will heighten credit risk, market risk and liquidity risk, and further undermine the stability of the entire financial system.” “The financial system can play a key role in supporting green transition and managing climate-related risks,” the governor said.

“In order to calm down markets and improve sentiment, we need to find a plateau where rates could stay for several days,” said Dergachev.

On investors seeking out ‘back to the future’ trades to beat inflation as bond yields rise

Matt Freund, co-chief investment officer at Calamos Investments

“We are going to see some really high inflation numbers in the next two or three quarters,” said Freund. “Why would you buy a 10-year bond and lock in a negative real yield for the entire 10-year period?” Freund said.

Mark Egan, portfolio manager of the Carillon Reams Core Bond Fund

“You have to go back a long time to where people can remember a rising interest rate environment for more than a few months,” he said. “The price of safety is relatively low and the price of yield or return is very high.”

Gregory Peters, head of PGIM Fixed Income’s multi-sector and strategy

“Is inflation going to rise in the next couple months? Absolutely,” said Peters. “But the gravitational pull is for inflation to go lower not higher.”

Greg Whiteley, portfolio manager at DoubleLine Capital

“It seems like the rise in breakeven inflation rates … has pretty much allowed the market to fully price in what they see coming in the way of inflation,” said Whiteley. “And now they’re saying we’re seeing stronger real growth alongside inflation.”

On US investors still interested in investing in the Chinese market

Tao Wang, head of Asia economics and chief China economist at UBS

“U.S. investors continue to be very interested in investing in (the) Chinese market,” Wang said. “Especially from the bond market perspective, there is a structural increase in the interest.”

Jason Pang, Asia fixed income portfolio manager at J.P. Morgan Asset Management

“There’s not any clear reason why we shouldn’t be disengaged from this particular market,” he said. The probability of “a much bigger sell-off in China rates is much lower than the rest of the world.”

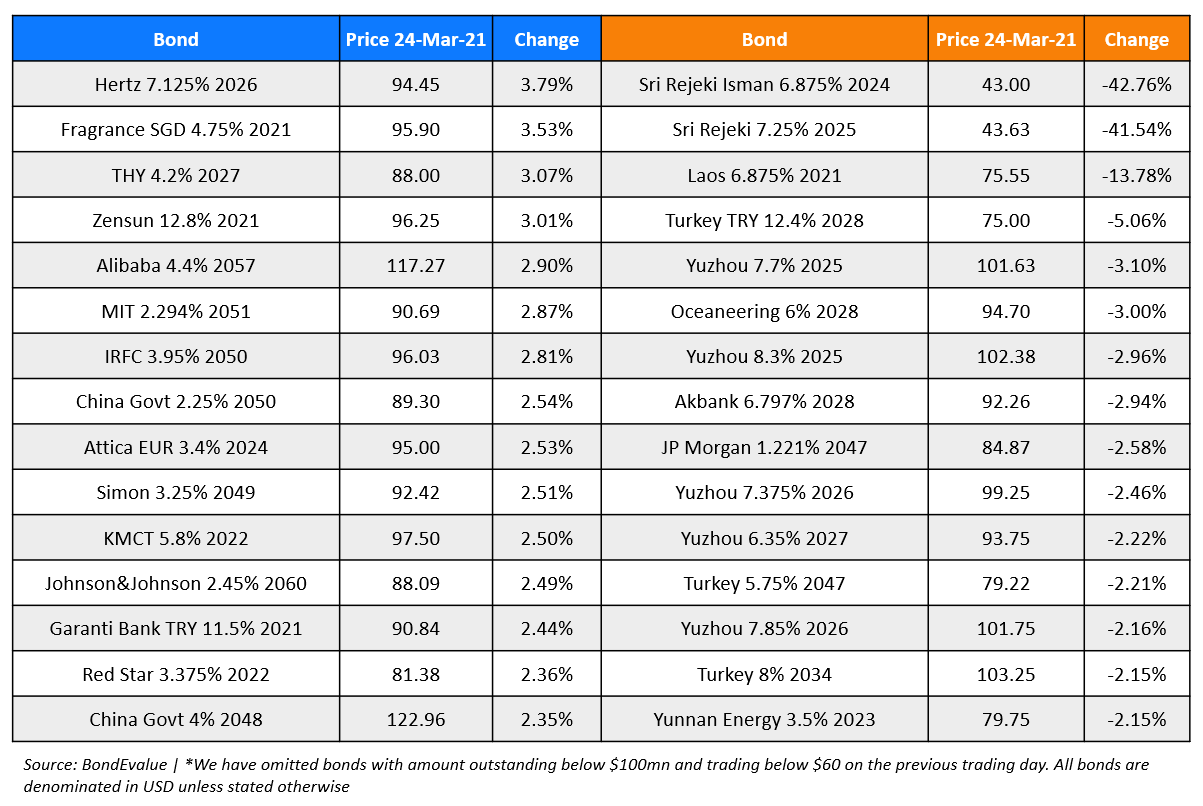

Top Gainers & Losers – 24-Mar-21*

Go back to Latest bond Market News

Related Posts: