This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

AVIC Intl., NBN Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 28, 2021

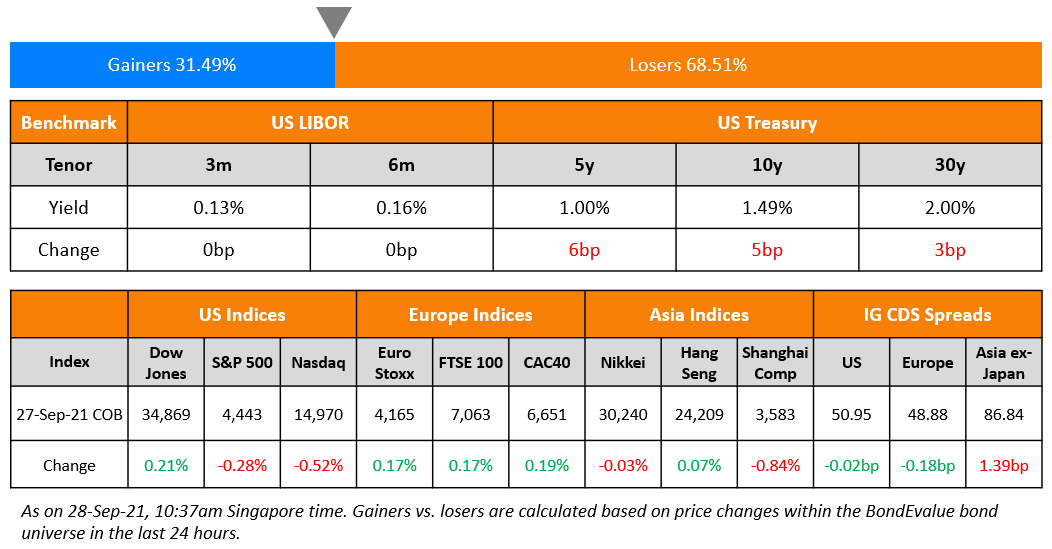

US markets ended weaker with the S&P closing 0.3% lower and the Nasdaq 0.52% lower. US 10Y Treasury yields saw another leg higher, up by 5bp to 1.49%. Energy led again, up 3.4%, and financials were up 1.3% while Real Estate and Healthcare fell 1.7% and 1.4%. European stocks inched higher with the DAX up 0.3% and the CAC and FTSE up 0.2% each. Brazil’s Bovespa also moved 0.3% higher. In the Middle East, UAE’s ADX was down 0.3%. Asia Pacific markets have started broadly mixed – HSI was up 1.7% and Shanghai was up 0.4% while Singapore’s STI and Nikkei were down 0.3%. US IG CDS spread were flat and HY CDX spreads widened 1.2bp. EU Main CDS spreads were 0.2bp tighter while Crossover CDS spreads widened 0.1bp. Asia ex-Japan CDS spreads widened 1.4bp.

Durable goods orders jumped 1.8% in August beating expectations of 0.7 showing signs of economic strength.

Starts Today | 8 Module Masterclass on Bonds

Last call to sign up for our 8-module masterclass on bonds starting with A Practical Introduction to Bonds today at 5pm Singapore / 1pm Dubai / 10am London. The masterclass is designed & curated to help develop a comprehensive understanding of bonds along with practical and actionable insights on how to trade and advise on bonds better. The course will be conducted via Zoom by senior debt capital market bankers. The modules will cover bond valuation and risk, portfolio and leverage, AT1 bonds, high yield bonds, ESG bonds and more.

Attendees on a trial plan will receive a 1-month complimentary Premium subscription to the BondEvalue App and attendees with a current subscription will receive a 1-month free one-tier plan upgrade. All attendees will also receive a certificate, presentations materials and 14-days access to video recordings to re-watch the sessions.

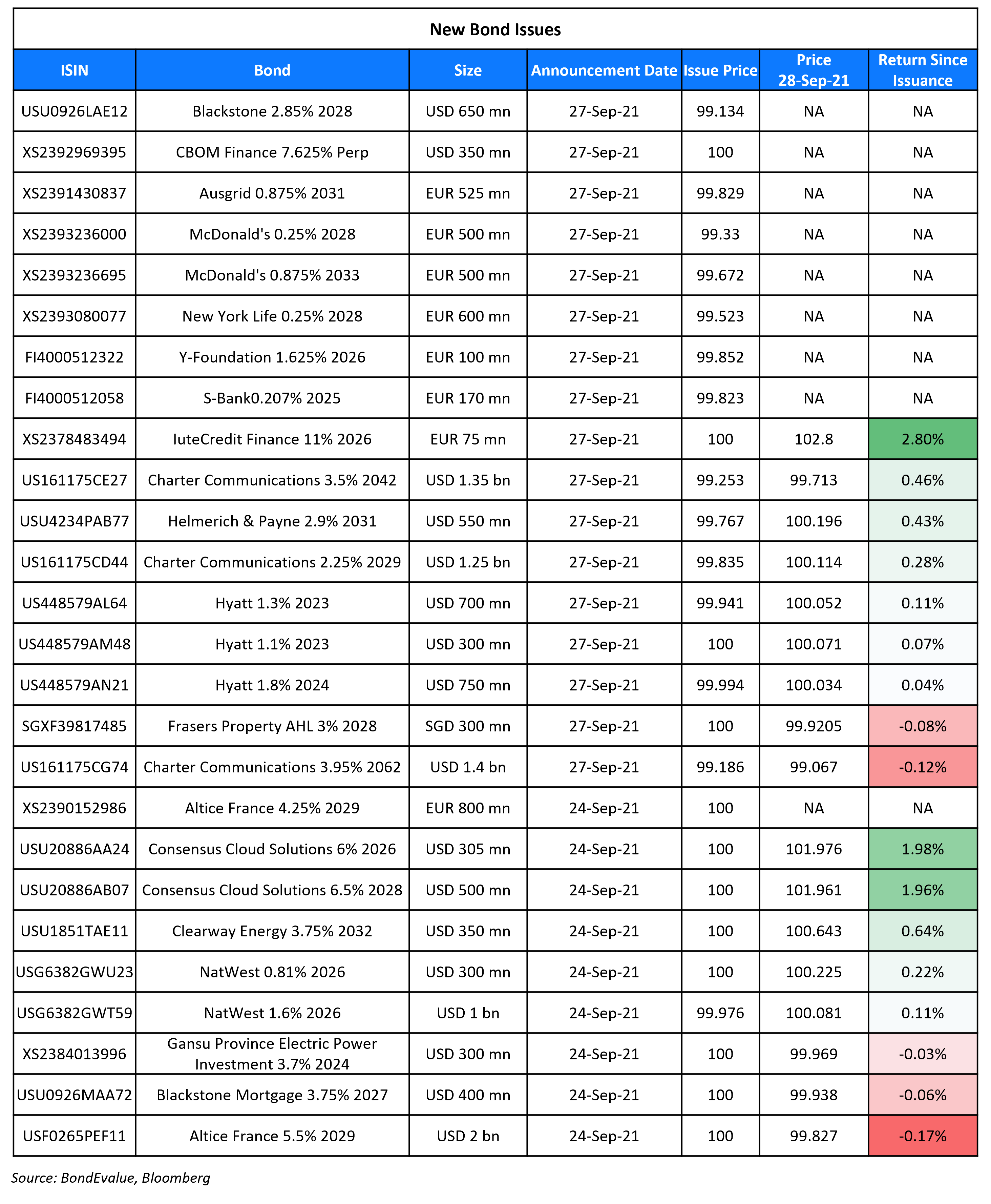

New Bond Issues

- Chengdu Xingcheng Investment $ 300mn 5Y green at 2.75% area

- AVIC International Leasing $ 3Y at T+165bp area

- NBN $ 3/5.25/10.25Y at T+65/87.5/120bp areas

CBOM raised $350mn via a PerpNC5.5 AT1 bond at a yield of 7.625%, 25bp inside the initial guidance of 7.875% area. The bonds have expected ratings of B- (Fitch), and received orders over $900mn, 2.6x issue size. The bonds will be issued by Credit Bank of Moscow via CBOM Finance PLC. The AT1s have a first call date on April 4, 2027, and if not called, the coupon will reset then to the prevailing US 5Y swap rate + 656.1bp. The AT1s have a trigger if (i) the CET1 Capital Ratio of the issuer falls below 5.125% for six or more operational days in aggregate during any consecutive period of 30 operational days in Moscow, or (ii) the Central Bank of Russia (CBR) approves a plan for the participation of the Deposit Insurance Agency of Russia (DIA) in bankruptcy prevention measures which contemplates the provision of Financial Assistance by the CBR or the DIA.

Frasers Property AHL raised S$100mn via a tap of 3% 2028 sustainability bond at 100, unchanged from final guidance, bringing the total amount outstanding to S$300mn. The bonds are unrated and are guaranteed by Singapore-listed parent Frasers Property. The existing issuance was trading at 99.92, yielding 3.01%.

New Bonds Pipeline

- Saigon-Hanoi Bank hires for $ bond

- Burgan Bank hires for $ 500mn 6NC5 bond

- Ganzhou Urban Investment Holding Group hires for $ 3Y bond

- Kexim hires for $/€ bond

- AVIC International Leasing hires for $ 3Y bond

- NBN hires for $ 3/5.25/10.25Y bond

- Chengdu Xingcheng Investment hires for $ green bond

- Clover Aviation Capital hires for $ bond

- Apicorp hires for $ 5Y green bond

- Dat Xanh Group hires for $ debut bond

- Helenbergh China hires for $ 270 mn 2Y green bond

- GD-HKGBA Holdings hires for $ 2Y bond

- NH Investment & Securities hires for $ 5Y bond

Rating Changes

- Moody’s downgrades Fantasia to B3/Caa1; reviews ratings for further downgrade

- Sunshine 100 China Holdings Ltd. ‘D’ Rating Withdrawn At The Company’s Request

- Moody’s affirms Takeda’s Baa2 ratings, changes outlook to positive

- Moody’s upgrades Welltec’s CFR to B2, assigns B2 rating to proposed $325 million notes

- Oil and Gas Well Technology Firm Welltec Outlook Revised To Stable From Negative On Proposed Refinancing; ‘B-‘ Affirmed

- Moody’s upgrades Lamar’s CFR to Ba2; outlook stable

- Devon Energy Corp. Outlook Revised To Positive On Improved Credit Measures And Debt Repayment; Ratings Affirmed

Term of the Day

Convexity Hedging

Convexity hedging refers to a phenomenon of hedging portfolio interest rate exposure through bonds that stand to get impacted due to duration and convexity changes. This is most commonly used in mortgage-backed securities (MBS), given the prepayment profiles. For example, when interest rates rise, MBS investors would see their portfolio duration rise (as prepayments slowdown) and therefore they would have to reduce duration to their holdings. This reduction could be through selling longer duration treasuries or swaps. Thus for example, if rates rise, principally MBS duration rises and Treasury duration falls thus changing the hedge ratio of MBS vs. Treasuries – effectively having to sell more Treasuries than otherwise to hedge their MBS portfolios. These Treasuries would generally be higher duration/convexity bonds since they correspond to mortgage-related securities which have high durations. This is considered among the factors that can exacerbate sell-offs in Treasuries. Some analysts say that the recent sell-off in US Treasuries can get exacerbated due to convexity hedging.

Talking Heads

Lael Brainard, Fed Governor

“No signal about the timing of liftoff should be taken from any decision to announce a slowing of asset purchases.”

John Williams, New York Fed President

“There is still a long way to go before reaching maximum employment.”

Neel Kashkari, Minneapolis Fed President

“We don’t want to overreact to short-term price movements. We want to make sure we can get the economy back to full strength,” he said. “It wouldn’t surprise me if it takes six months or most of next year to get people fully back to work.”

“Yields are rising sharply, reflecting investors’ expectations about monetary tightening amid surging inflationary pressures.” “If yields climb higher, this could weigh especially on the overstretched growth stocks in the technology sector, which have low dividend yields.”

On government bond yields rising as investors look to higher interest rates

Kathy Jones, chief fixed-income strategist at Schwab Center for Financial Research

Markets are “getting past some of the fears about the economy being held back.”

Caroline Simmons, UK chief investment officer at UBS Wealth Management

“We’ve had quite a lot of news flow [from central banks] in the last two days and that’s obviously triggered some momentum towards what we’ve been expecting for a while, which is for bond yields to be higher.”

Scott Ruesterholz, portfolio manager at Insight Investment

“This is a patient, data-dependent Fed that will do everything it can to aid the labour market, so long as inflation permits.”

Robert Carnell, regional head of research for Asia-Pacific at ING

“The narrative has moved away from Evergrande being a systemic issue, to one where Evergrande is eventually restructured, but where collateral damage will be localised.”

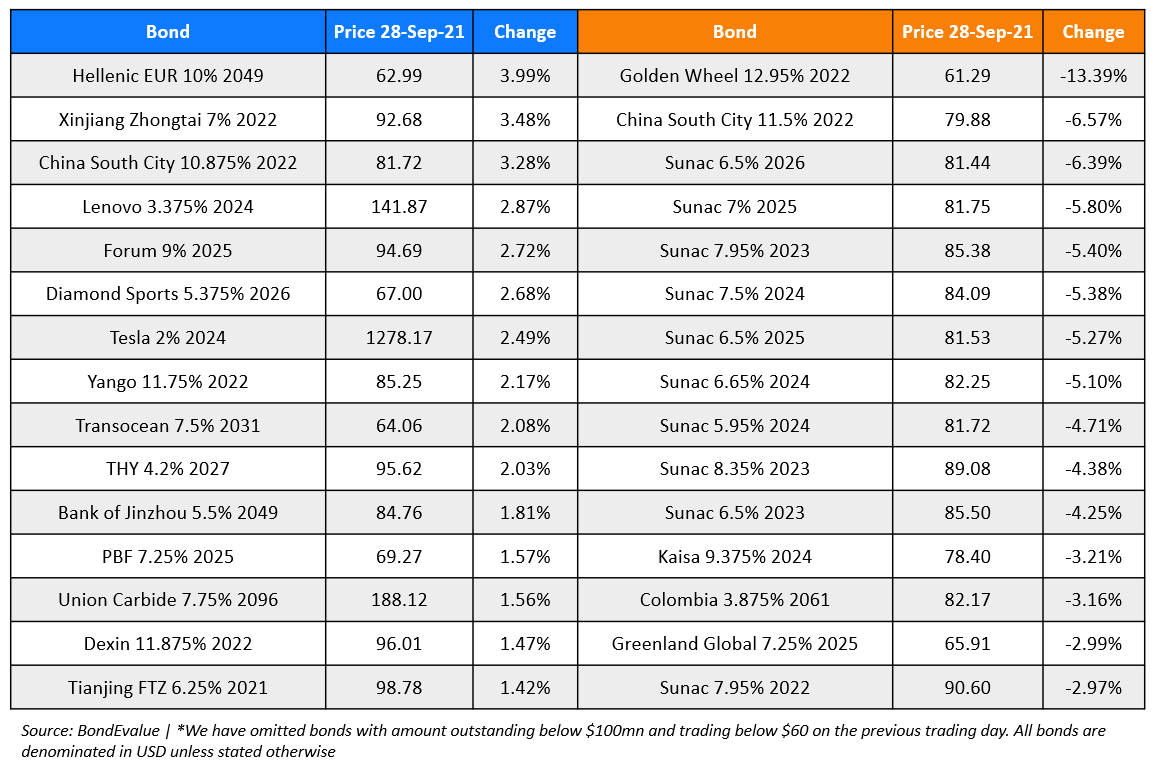

Top Gainers & Losers – 28-Sep-21*

Other Stories:

Go back to Latest bond Market News

Related Posts:.png)