This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Axiata, MTR, China Great Wall AMC Launch $ Bonds; Temasek Pulls Out of Keppel Deal; Vedanta’s Bonds Rise Ahead of New Issuance

August 12, 2020

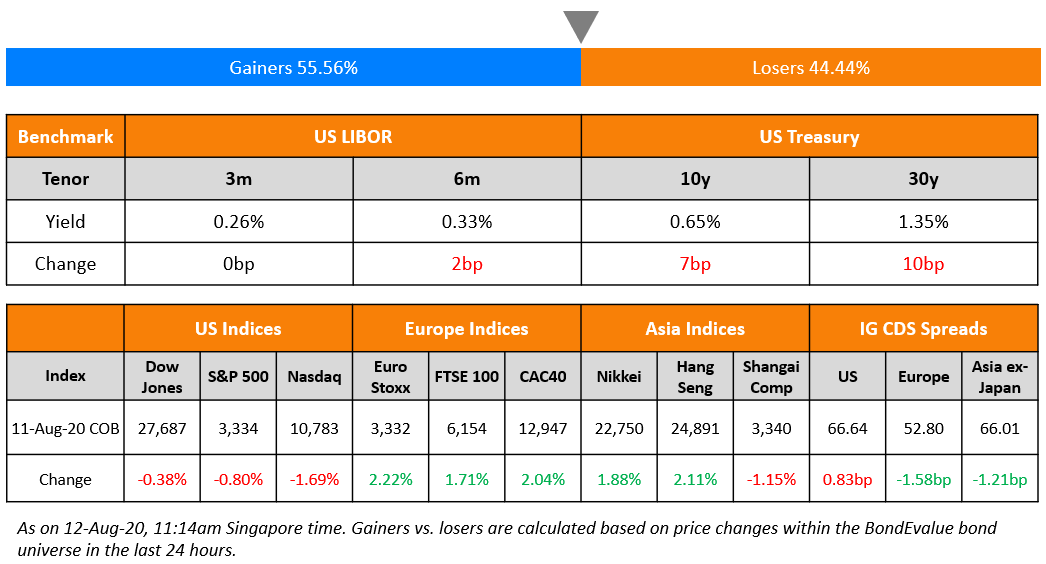

Wall Street slipped overnight as US lawmakers have not resumed talks regarding the coronavirus aid package after it broke down last week. This move broke a seven-day rally of the DJI and S&P and the Nasdaq underperformed the most due to further rotations out of technology into value stocks. European shares did better with a surprise 12.2 point jump in Germany’s ZEW economic sentiment index from 59.3 to 71.5. Treasuries failed to rally on the risk-off sentiment as focus remained on this week’s huge government supply. CDS spreads narrowed a bit in US and Europe and Asian dollar bonds seem to have enough mandates to give the market momentum to continue the rally. Asian markets are opening lower this morning.

New Bond Issues

- Axiata Group $ 10Y Sukuk/30yr @ T+200/220bp area

- MTR Corp $ 10yr green @ T+150bp area

- China Great Wall AMC $ 500 mio 10yr @ T+215bp area

- Guotai Leasing $ 3yr @ 4.35% area

- Keong Hong S$ 3yr @ 6.25%

- Yunda Holding $ 5yr @ T+245bp area

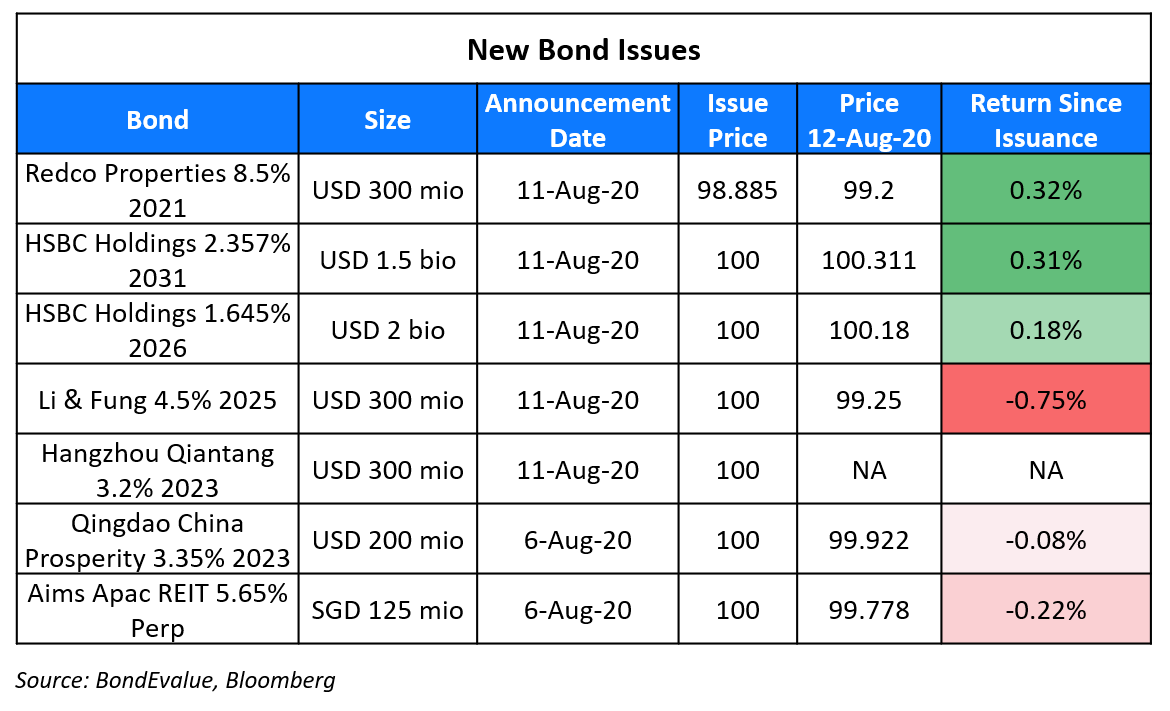

HSBC has raised a total of $3.5bn via a dual-tranche SEC-registered bond offering. It raised $2bn via a short 6Y non-call 5Y (6NC5) to yield 1.645%,137bp over Treasuries and 3bp inside initial guidance of T+140bp area. It also raised $1.5bn via 11Y non-call 10Y (11NC10) to yield 2.357%, 172bp over Treasuries and 3bp inside initial guidance of 175bp area. HSBC plans to use a portion of the proceeds to satisfy its obligations in connection with a tender offer launched on August 11. The new bonds offer a new issue premium of ~7bp and ~6bp over its 6NC5/11NC19 bonds issued in May this year. The older bonds are currently yielding 1.58% and 2.3% respectively on the secondary markets.

Supply chain manager Li & Fung raised $300mn via 5Y bonds to yield 4.5%, 40bp inside initial guidance of 4.9% area. The bonds are expected to be rated Baa3/BBB. The coupon will increase by 25bp for each notch that the bonds are downgraded to below investment grade by each agency, capped at a total of 100bp. If the rating agencies subsequently upgrade them again, the interest rate will decrease by 25bp per notch, subject to a floor at the initial rate. This downgrade protection will drop away if Li & Fung is ever upgraded to Baa1/BBB+, each with a stable or positive outlook.

Chinese developer Redco Properties Group, raised $300mn via 364-day bonds to yield 9.70%, 42.5bp inside initial guidance of 10.125% area. The bonds, with an expected rating of B, drew final orders exceeding $2.4bn, 8x issue size.

Hangzhou Qiantang New Area Construction and Investment Group raised $300mn via 3Y bonds to yield 3.2%, 70bp inside initial price guidance of 3.9% area.The bonds received orders over $1.2bn when final guidance was announced, 4x issue size.

Rating Changes

Moody’s downgrades Lifestyle’s ratings, outlook stable

General Motors Co. ‘BBB’ Rating Affirmed And Removed From CreditWatch; Outlook Negative

Ford Motor Co. ‘BB+’ Ratings Affirmed, Removed From CreditWatch; Outlook Negative

Axiata SPV2 Bhd.’s Proposed Sukuk Trust Certificates Assigned Preliminary ‘BBB+’ Rating

Fed Supports Auto Companies Via Bond Purchases in July

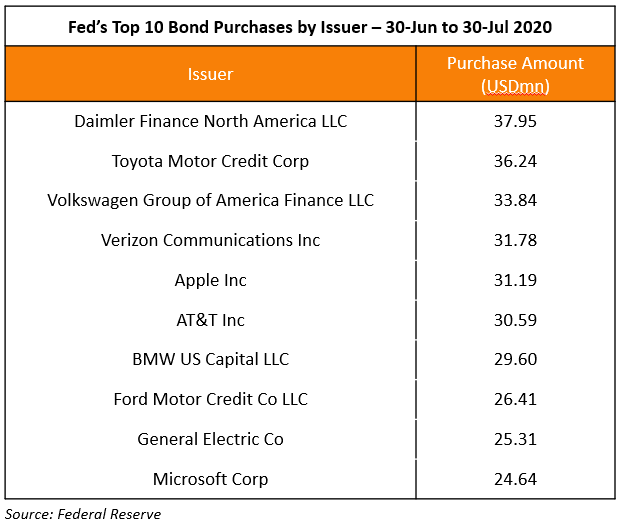

As per the Federal Reserve’s disclosure on its Secondary Market Corporate Credit Facility (SMCCF) published on Monday, it seems to be ramping its direct purchases of bonds issued by auto companies. The Feb bought bonds worth $224mn that were issued by companies linked to the auto industry since its last update was published on July 10. This indicates the central bank’s support for one of its largest homegrown industries that employs nearly 10mn people and contributes ~3% to the US economy, according to Alliance of Automobile Manufacturers. We have listed the top 10 direct bond purchases – by issuer between June 30 and July 30 in the table below.

Half of the top 10 issuers operate in the auto industry with Daimler, Toyota and Volkswagen at the top of the list. Matt Brill, head of U.S. investment-grade credit at Invesco Ltd explained the Fed;s focus on auto industry bonds by saying, “There’s the math and then there’s the mission. This is making sure the plumbing works, and then everybody benefits.” Auto companies have been one of the worst hit due to the pandemic as shelter-in-place rules closed U.S. plants in May and June and kept consumers from dealerships. Incidentally, S&P removed General Motors’ and Ford’s rating from CreditWatch and affirmed their ratings at BBB and BB+ respectively with a negative outlook on both.

For the full story, click here

Temasek Pulls Out of Deal to Increase Its Stake in Keppel

In a move that caught markets off-guard, Kyanite Investment Holdings, a unit of Singapore state-owned investment company Temasek, pulled out of its deal to increase its stake in Keppel Corp. Kyanite had, in October last year, made an offer to purchase an additional 30.6% stake in Keppel for S$4bn ($2.9bn) to own a majority stake of 51% in the company. The partial offer was subject to the satisfaction of a number of pre-conditions, which included “there being no material adverse change in the Group’s financial performance and condition (the MAC Pre-Condition)”. The MAC clause had mandated that Keppel’s profit after tax must not fall by more than 20%, or below S$557mn ($405mn) over the cumulative four quarters from the third quarter ended September 2019. This clause was breached with Keppel’s announcement of Q2 earnings, with a cumulative loss after tax for the year to end-June stood at S$165mn ($120mn), amid massive impairments of S$919mn ($668mn) in its Q2 results. Keppel’s stock opened 13% lower on Tuesday before recovering slightly. Keppel’s bonds were largely unchanged with its US dollar denominated bonds due 2025 down 0.70 points since Monday’s close to trade at 98.97. Its SGD bonds had a knee-jerk reaction falling slightly on Tuesday but back up this morning.

For the full story, click here

Aramco Pledges $75bn Dividend Despite a Difficult Economic Environment

Saudi Aramco entered 2020 after raising $25.6bn in the largest ever IPO. However, that was before the pandemic and the Oil Shock later in the year. The pandemic triggered drop in oil demand has had a huge impact on the top line of all oil companies. The crisis has been so large that it has even forced Aramco to borrow significant debt to pay for its $69bn acquisition of a majority stake in petrochemical company, Sabic. The cash flows of the company in the first half stood at $21.2bn, which is even insufficient to cover the promised dividend payments of $37.5bn for the period. Despite the stress induced by the slowing economy, CEO Amin H Nasser has pledged to pay the company’s $75bn dividend, most of which goes to the government, which still owns a 98% stake in the company. The company is taking the following steps to offset the losses it suffered in the last few months:

- It has extended its payment schedule over 8 years for the Sabic deal

- It is committed to reducing the annual capital spending by 25% to ~$25bn for 2020

- It made cost savings of $1bn by resorting to measures including renegotiating with contractors, extending project timelines, suspending drilling in a few projects and has laid off higher-paid foreign staff

- Talks for a stake in Reliance Industries Limited have been delayed

- It has incurred debt to support the Sabic deal that has resulted in its gearing ratio increasing to 20.1% from minus (4.9%) in the previous quarter.

“Given current gearing levels, either oil prices need to continue to rise . . . or more difficult choices need to be made, which ultimately includes the dividend,” said Mr Neil Beveridge, analyst at Bernstein. Aramco’s dollar bonds were largely unchanged on the secondary markets.

For the full story, click here

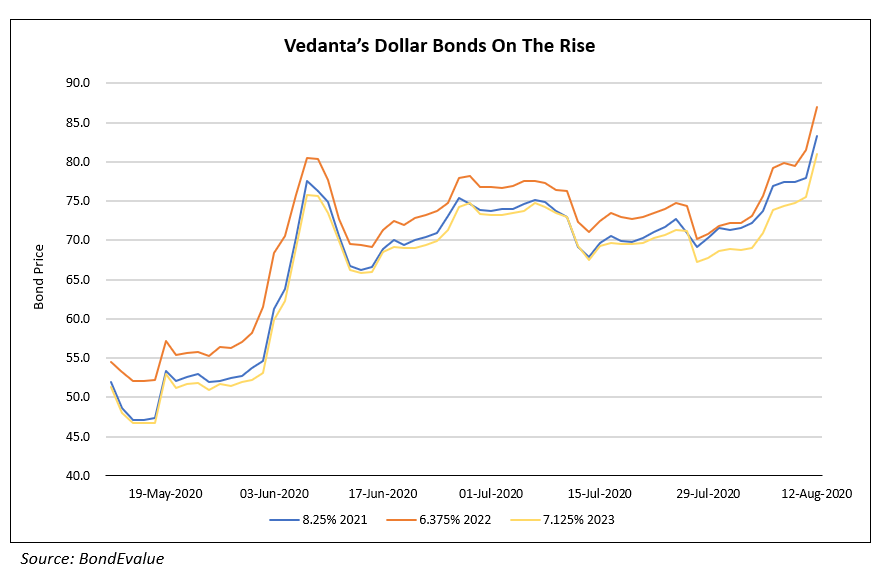

Vedanta’s Proposed Bonds Assigned a B3 Rating by Moody’s and B by S&P; Older Bonds Trade Higher

Vedanta Resources Ltd (VRL) is in the process of taking its subsidiary Vedanta Limited (VDL) private by increasing its stake to 100% from the current 50.1% by raising US$1.5bn via offshore bonds. The transaction has been approved by the shareholders of both companies. Both Moody’s and S&P view a successful privatization as credit positive and have rated the proposed notes.

Moody’s has assigned a B3 rating with a negative outlook to the proposed notes intended to fund the privatization while S&P has assigned a LT rating of B to the proposed senior secured notes of Vedanta Holdings Mauritius II Ltd. S&P has placed Vedanta Resources rating of B- on CreditWatch over the uncertainty over the outcome arising from the shareholder expectations on the delisting price, which shall be determined by a book building process. As per S&P, a successful privatization would result in a one notch upgrade of Vedanta Resources to B and an unsuccessful privatization would lead to a downgrade from the B- rating. “The proposed USD notes will fund the transaction, and will be guaranteed by VRL, an intermediate holding company, Vedanta Holdings Jersey Limited (VHJL), and an associate company, Vedanta Holdings Mauritius Limited (VHML),” as per the Moody’s report that added that Moody’s views the privatization plan by Vedanta as a credit positive and a major step in simplifying the complex group structure of VRL, whose less than 100% ownership in its operating subsidiaries has historically hindered its credit profile.

Vedanta’s dollar bonds witnessed trended higher on Tuesday with its 8.25% and 6.375% bonds due 2021 and 2022 traded up by 5 and 5.5 points to trade at 95.5 and 87 cents on the dollar respectively.

For the rating action by Moody’s click here and for the rating action by S&P, click here

Lebanon Debt Talks on Hold As Government Resigns

Lebanon faces political uncertainty as the government resigned over last week’s explosions in the port city of Beirut. The ammonium nitrate blasts that killed over 160 people, resulted in at least 300,000 people being made temporarily homeless and the collective losses could be as high as $10-15bn. The unfortunate explosions and the resulting political uncertainty come at a time when the country is already reeling under under heavy debt pressure. Lebanon had defaulted on $30bn of foreign currency bonds earlier in March as it faces its worst economic crisis. The Lebanese government had proposed a restructuring plan in April, which aimed to reduce the borrowings to half by the end of the year. However, with the absence of a credible government in the center, analyst believe that the restructuring attempts would come to a halt till an alternative is found. There also has been little headway with the IMF over financial aid. The departure of the government at this crucial time has only complicated the debt restructuring plans of the country. Asset managers who invested in its sovereigns bonds face heavy losses. As per The Institute of International Finance (IIF) estimates, the blast will deepen the contraction in the economy from the envisaged -15% 2020 to -24% for 2020.

“This was always going to take a long time,” said Uday Patnaik, head of emerging markets at Legal & General Investment Management, which holds small amounts of Lebanese bonds. “The problem now is, who are you going to negotiate with? You need a government with some sort of credibility. I would think there’s not likely to be a restructuring until next year at some point.” Lebanon’s 8.25% and 6.85% bonds due 2021 and 2027 have been trading at 18.7 and 16.9 cents on the dollar respectively.

For the full story, click here

Web Developer Wix.com Raises $500mn Via 5Y Convertibles That Pay 0%

Israeli software company Wix.com Ltd. managed to raise $500mn via convertible bonds due 2025 that pay 0% coupon, priced yesterday. The interesting aspect of the 144A deal, sold to qualified institutional buyers, was that the bonds pay 0% coupon despite a conversion price or strike price that is at a 45% premium to its current share price. This is different from most convertibles, which pay a fixed coupon to holders to compensate them for the risk of the stock price not exceeding the strike price during the lifetime of the bond. The 0% coupon makes Wix’s new convertibles more like a call option on Wix’s shares. The only difference is that the convertibles are ranked senior to its shares and that the investors will get back their principal if the share price does not cross the strike price.

Bond market veterans would recall that there have been negative yielding convertibles deals such as French aerospace company Safran’s issuance in 2016 or Tata Motors’ JPY denominated issuance in 2006. However, these were from rather well-established and profitable companies, not a loss-making website developer with lofty valuations (~20x Market Cap/Sales for the past 12 months).

For the full story, click here

Term of the Day

Interest Rate Corridor

An interest rate corridor (IRC) is a system for guiding short-term market interest rates towards the central bank target/policy rate. It consists of a rate at which the central bank lends to banks (typically an overnight lending rate) and a rate at which it takes deposits from them (deposit rate). In a standard corridor, the lending rate will be above the central bank target/policy rate (thereby forming an upper bound for short-term market rates), and the deposit rate will be below the central bank rate, thereby forming the lower bound.

Torn between market pressure to raise borrowing costs and President Recep Tayyip Erdogan’s persistent calls to lower them, Turkey’s central bank is trying to keep everyone happy and appears to have ditched a 2018 decision to focus on a single benchmark rate and go back to the IRC policy. The advantage of running policy like this is that the central bank can effectively raise funding rates to as high as 11.25% — the very top end of its corridor — without making any changes at a monetary policy meeting. And more importantly, without evoking a political backlash.

Talking Heads

On the impact of €750bn issuance on EU’s credit rating

Dietmar Hornung, associate managing director of Moody’s

“Our credit rating focuses on the ability and willingness of the issuer to service the debt,” said Mr Hornung. “In this context, the origin of the proceeds is of secondary importance,” he said.

Arnaud Louis, head of supranational ratings at Fitch

“Higher budget contributions could exacerbate divergences between net contributors and net beneficiaries,” said Mr Louis. “Political developments that lead to a weakening in cohesion among member states or a reassessment of their propensity to support the EU could lead to negative rating pressure.”

David Zahn, head of European fixed income at Franklin Templeton

“I don’t think triple A is the be-all-and-end-all. It’s really the backing of the collective taxation of the countries underneath that gives you confidence.”

On $1 billion valuation of electronic bond trading platform Trumid

Dwayne Middleton, global head of fixed income trading at T. Rowe Price

“Working from home has really highlighted the importance of technology for the future of fixed income — not only trading, but the entire investment process,” said Middleton. “We’re looking for tech partners that can provide solutions in a multitude of asset classes.”

TPG principal John Flynn

“We are convinced that bond trading is on the verge of a dramatic shift towards electronic trading, which will drive greater liquidity and efficiency for buy-side and sell-side traders,” Flynn said.

On US sanctions on Hong Kong leader Carrie Lam and other government-related officials

Michael Hirson, practice head, China and Northeast Asia, at Eurasia Group

“It is at the very least awkward for US and foreign banks wanting to take advantage of market opening in China,” Hirson said. “Banks that don’t comply with these sanctions risk losing access to the US financial system, which is of course an existential threat.”

On US inflation threat as money supply rockets

Mike Wilson, Morgan Stanley’s chief US equity strategist

“While we are likely to experience big imbalances in the real economy for several more quarters, if not years, the most powerful leading indicator for inflation has already shown its hand — money supply, or M2,” said Mr Wilson. “The problem may be that equity market leadership is skewed toward deflationary winners, making any sudden surges in inflation quite disruptive to portfolios,” he warned.

On Keppel’s failed Temasek deal

Song Seng Wun, an economist at CIMB Private Banking in Singapore

“It’s not a light decision to make because there is a risk on the reputational side, although this is an unprecedented time so people will expect it’s not unreasonable for Temasek to walk away,” said Song. “It’s not about Temasek being in a weaker position – it’s about not wanting to waste bullets unnecessarily and not being stupid.”

On Saudi Aramco’s $75bn dividend dilemma

Steffen Hertog, an expert on the Gulf political economy at the London School of Economics

“Compared to other countries, the fiscal hit for Saudi Arabia because of coronavirus is much greater because of their dependence on the oil sector for income.”

Neil Beveridge, analyst at Bernstein

“Given current gearing levels, either oil prices need to continue to rise . . . or more difficult choices need to be made, which ultimately includes the dividend,” said Mr Beveridge.

Biraj Borkhataria at RBC Capital Markets

“The key question is, how far are you willing to keep pushing the balance sheet to keep paying the dividend in full, if the oil price stays low?”

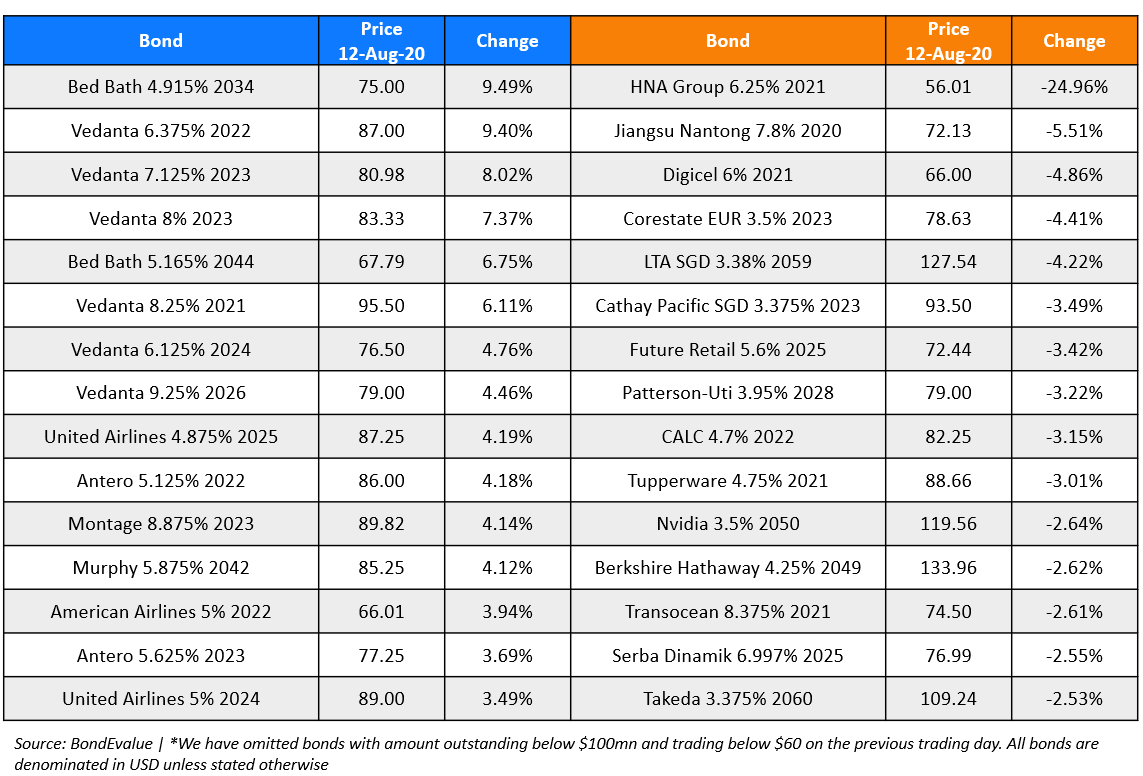

Top Gainers & Losers – 12-Aug-20*

Go back to Latest bond Market News

Related Posts:

Fed’s Dudley Shakes Up Complacent Markets

June 20, 2017

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017