This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

BEA Launches $ Bond; US IG Issuance Crosses $1tn; Sri Lanka Says It Won’t Default, $ Bonds Rally

May 21, 2020

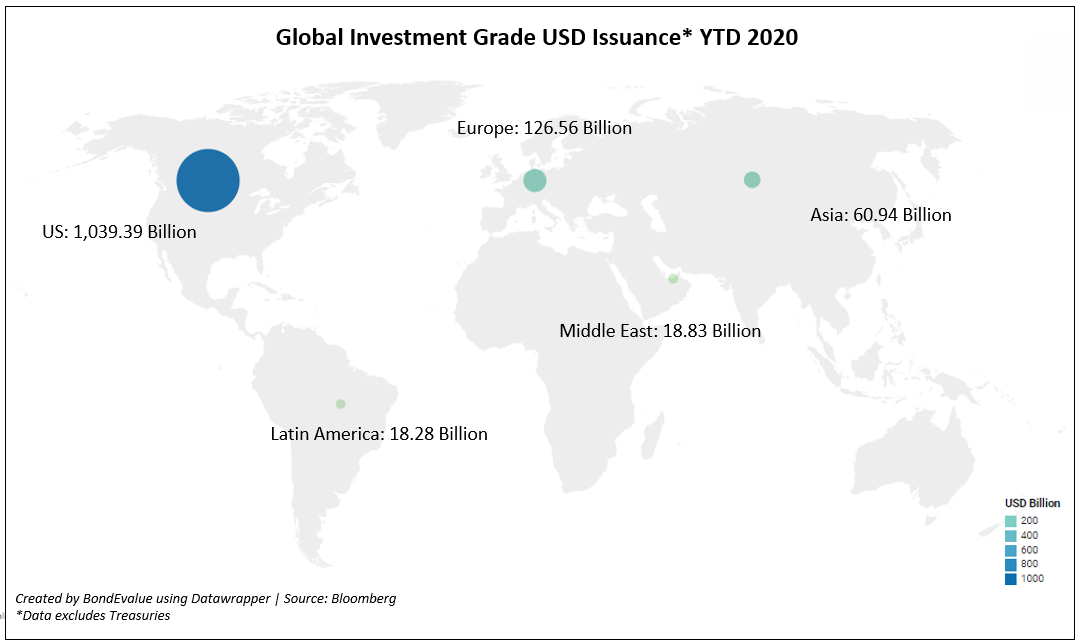

Rally in US and European markets continue and Asian stocks are set to open higher today as investors concentrate on economies reopening. The number of newly reported coronavirus cases worldwide hit a daily record this week with more than 100,000 new cases over the last 24 hours, according to the World Health Organization. Treasuries managed to push higher, despite Wednesday’s general risk-on tone and a rather underwhelming $20bn 20-year note auction. Asian dollar bond spreads have tightened this week to their lowest level in the last two months as more deals flow in. Seven more borrowers jumped into the U.S. investment-grade market Wednesday in what may have been the week’s last sizable session before the long Memorial Day weekend. US IG issuance has crossed $1tn this year.

New Bond Issues

- Doosan Bobcat $ 300 mio 5NC2 @ 6.5% area

- Bank of East Asia $ 10NC5 @ T+425bp area

- Hotel Properties S$ 5Y @ 3.8%

UK Sells Negative-Yielding Government Bonds for First Time

The UK broke new ground for a bond sale on Wednesday, borrowing at negative rates for the first time in a sign that investors expect more economic stimulus from the Bank of England. The move would be unprecedented in the Bank’s 325-year history and would leave only the US Federal Reserve among major central banks to rule out negative rates. The UK sold £3.8bn of three-year gilts at a yield of minus 0.003%, the Debt Management Office said. The slightly negative yield means investors who hold the debt to maturity will get back less than they paid, when accounting for regular interest payments and the return of principal. Japan’s central bank and the European Central Bank, which sets interest rates for the 19-member eurozone, have already adopted negative interest rates to stimulate borrowing and discourage saving. Singapore is just a whisker away from joining the global negative-rate club. The nation’s overnight borrowing rate was less than two basis points above zero on Tuesday, down from the year’s high of 1.68% in January. It has never gone negative before based on central bank data compiled by Bloomberg.

The case for negative interest rates in the US has strengthened, according to a note from Goldman Sachs published Tuesday. Minutes from a late 2019 Federal Open Market Committee meeting reported, “All participants judged that negative interest rates currently did not appear to be an attractive monetary policy tool in the United States.”

For the full story, click here

The table below shows the 10-year government yields of key countries before the pandemic broke out vs. today.

US Investment-Grade Debt Issuance Tops $1 Trillion

US investment-grade (IG) companies have issued more than $1 tn in debt in the year-to-date, offering bonds at a voracious pace as the coronavirus pandemic lifts cash demand. High-grade issuance on Tuesday reached $11.2bn across 11 deals, Bank of America strategists said in a note. The single-day sum brings the year’s total to $1.003tn. This trounced the $1.14tn in IG debt through all of 2019. Nearly $200bn in debt has been issued in May so far as companies capitalize on growing risk-on attitudes. The corporate bond market has enjoyed a sharp recovery from initial coronavirus-fueled lows following unprecedented Federal Reserve intervention. The Fed’s ETF purchases began on May 12. The monetary authority’s program for direct bond purchases should be operational by June, chair Jerome Powell said during Tuesday Senate testimony.

Sri Lanka Committed to meets its Financial Obligations amid S&P Downgrade; Bonds are among the Top Gainers

The Government of Sri Lanka reiterated its commitment to meeting all its financial commitments. The Sri Lankan government allayed recent media reports questioning its ability meet its obligation. It has initiated proactive measures to mobilize funds amid a deteriorating fiscal condition. Sri Lanka’s sovereign bonds had been trading at a steep discount to the face value, which seem to be rebounding after the government’s assertion.

Interestingly, based on the worsening fiscal position due to COVID-19, S&P has downgraded Sri Lanka’s credit rating to B- from B. Fitch had downgraded Sri Lanka’s Long Term IDR to B- in Apr 2020 amid the rising public debt following tax cuts and policy changes by the government. Moody’s had also placed Sri Lanka’s B2 rating under watch for three months on 24 Apr 2020. Sri Lanka had been downgraded from B+ to B in Nov 2018 after a political crisis in the country.

In an earlier news report on Bloomberg, Sri Lanka dollar bonds were noted to be the worst performers till March this year. A statement by the Treasury Secretary about multiple streams being available to repay debt and the fact that the nation was in talks with IMF, ADB and China had resulted in the bonds gaining briefly. The country’s dollar bonds due in 2030 traded up 4.9% on Wednesday morning.

For the full story, click here

Geo Energy Resources Tender Offer

Coal mining company Geo Energy Resources has announced a tender offer on its dollar bonds at a steep haircut. The company is offering $43 per $100 of principal on its $154mn 8% bonds due 2022 to holders that tender by Jun 4, and $40 per $100 of principal for those that tender between Jun 4 and Jun 18. This is almost 10 points lower than its current price on the secondary markets.

The coal miner has had a series of credit rating downgrades in March.

- S&P cutting its issuer rating to SD (selective default) and the bonds rating to D from B- on Mar 19

- Moody’s cut the issuer and bond’s rating to Caa3 from Caa1 on Mar 20

- Fitch cut the issuer rating to CC from B- on Mar 25, but expected a default in the next 12 months

Geo Energy is also seeking consent to amend the bond terms such that it can be allowed to take on new debt and that it does not require to redeem the existing bonds by Apr 2021. It is offering $1 per $100 of principal to holders that consent to the change of terms but do not tender their bonds. Holders that tender their bonds are deemed to have granted consent to the change of terms and do not stand to get an additional payout. The company needs 75% of the bondholders to consent to the proposed changes.

Pandemic Driven Boom in ESG Bond Issuance Here to Stay?

The coronavirus pandemic has led to an increase in demand for social and sustainable bonds. Social bonds are instruments whose proceeds are used for projects that have a social impact such as affordable housing, education and health. Sustainable bonds are a hybrid between social and green bonds. According to Bloomberg, social bonds issuance to fight the coronavirus pandemic has reached $108.4bn year-to-date. Most recent was Bank of America’s $1bn fix-to-float bond issuance to fund the healthcare industry. Karen Fang, the bank’s global head of sustainable finance said “ESG is not just a bull market luxury, it is a bear market necessity.” Other entities that have recently issued coronavirus bonds include Pfizer, USAA Capital, African Development Bank, IFC and the Nordic Investment Bank. “We expect other sponsors to continue to innovate the structure and provide investable impact opportunities at scale,” said Vishal Khanduja, head of investment-grade portfolio management at Eaton Vance, an ESG-focused asset manager. However, research firm CreditSights does not see this trend continuing post the pandemic. “We’re a little doubtful we’re going to see an imminent increase in ESG-type offerings from the banks,” CreditSights’ chief of ESG and sustainability Josh Olazabal and the head of U.S. financials Jesse Rosenthal, wrote in an email to Bloomberg.

For the full story, click here

Term of the Day

Negative Yields

This is a bond market phenomenon where bond yields are below zero or negative. This may happen during a new issuance or in the secondary market. Usually the bonds that trade into negative territory are government bonds. Historically, this has been a rare phenomenon. It is caused by severe deflationary pressures or in time of high risk in the financial markets, where investors demand for risk free assets increases abnormally.

Talking Heads

Kit Juckes, Macro Strategist at Société Général

He said it would be a bad idea for the Bank to lower rates below zero. “The chancellor has dramatically increased government borrowing and the Bank of England is buying the economy time by mopping most of it up,” he said. “How on earth does it make sense to even consider adding negative rates to the mix?”

Andrew Wilson – Chairman, Global Fixed Income, Goldman Sachs Asset Management

“Negative interest rates are a tool that has limited value and the escape from negative rates is extremely challenging, as the ECB is discovering.”

Zhiwei Ren – Portfolio Manager at Penn Mutual Asset Management

“The expectation was it would be hard for investors to digest the 20-year bond. It doesn’t have a natural buyer and the size of the issuance was much larger than expected. For all these reasons, it wasn’t going to do well today”

On Coronavirus Relief Social Bond Issuance

Karen Fang – Global Head of Sustainable Finance, Bank of America

“ESG is not just a bull market luxury, it is a bear market necessity.”

Vishal Khanduja, head of investment-grade portfolio management at Eaton Vance Management

“We expect other sponsors to continue to innovate the structure and provide investable impact opportunities at scale”

Josh Olazabal & Jesse Rosenthal – Chief of ESG and Sustainability & Head of US Financials at CreditSights

“We’re a little doubtful we’re going to see an imminent increase in ESG-type offerings from the banks”

Top Gainers & Losers – 21-May-20*

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017