This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Central China Real Estate Redeems 6.75% 2021s

November 10, 2021

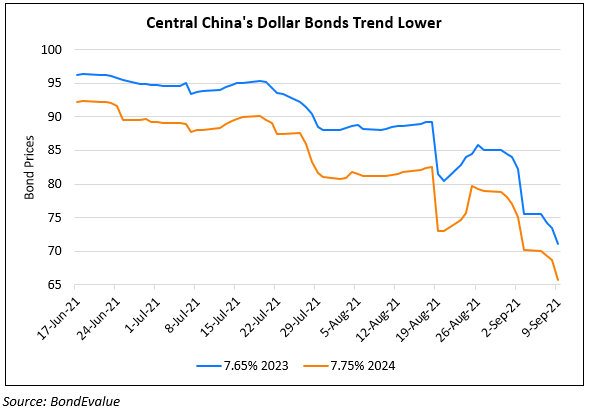

Central China Real Estate (CCRE) redeemed its $363.22mn 6.75% bond due November 8, 2021. Last week, CCRE said it remitted RMB3bn ($469mn) offshore which would be used for redeeming the dollar bond. The developer paid around $375.479mn, including accrued interest, and said there will be no material impact on its financial position due to the redemption. USD-denominated debt makes up ~65% of its total debt, as of end-June 2021. Last month, Moody’s downgraded CCRE to B1 from Ba3 with a negative outlook. A day later Fitch cut the rating to B+ from BB- with a negative outlook.

CCRE’s dollar bonds due 2024 and 2025 trade just over 40 cents on the dollar and its 2023s over 45 cents on the dollar. Its 6.875% 2022s trade at 63 cents on the dollar.

Go back to Latest bond Market News

Related Posts: