This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CIFI Downgraded to BB-; Evergrande Mulling Asset Transfers to Property Unit to Pay Debt

September 22, 2022

Chinese property developer CIFI Holdings was downgraded to BB- from BB with a negative outlook by Fitch on the reduction in its liquidity buffer and higher leverage. In 1H 2022, its liquidity deteriorated with cash resources falling 30%. Fitch estimates that CIFI’s RMB 20bn ($2.8bn) in cash was just about enough to cover short-term debt (1x) in 1H 2022, vs. 1.4x in 2021. The rating agency expects leverage to remain above 50% for the medium-term due to weak sales and ongoing working capital commitments. This is a negative rating threshold and can affect CIFI’s deleveraging effort. In 1H 2022, leverage has risen due to major construction expenditures and elevated JV cash outflow. CIFI indicated that it had RMB 200bn ($28.2bn) in saleable resources as of June 2022 and believes it will generate at least RMB 15bn ($2.1bn) in monthly sales over the coming months. Construction cash outflows are expected to ease to RMB 10bn ($1.4bn) in 2H 2022, from RMB 21bn ($3bn) in 1H 2021. Fitch sees uncertainty relating to CIFI’s JV-related capital commitments, which may further dampen its deleveraging efforts. CIFI has significant offshore debts with 40% in short-term offshore loans, 11% in offshore bonds and 49% in onshore debt. Last week, CIFI Holdings was also downgraded to B1 from Ba3 by Moody’s.

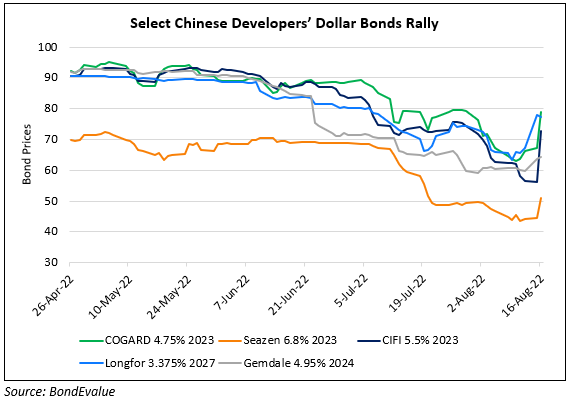

CIFI’s dollar bonds are trading at 45-55 cents on the dollar.

Separately, Evergrande said that it was considering transferring some assets from other units to its property unit. This will be used to settle some of the unit’s debt payments. In July, Evergrande had diverted loans secured by Evergrande Property Services to the parent company.

Go back to Latest bond Market News

Related Posts:

Country Garden Reports a Massive 96% Profit Drop

August 31, 2022

Country Garden, CIFI and Seazen’s Dollar Bonds Extend Gains

September 1, 2022