This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Colombia’s $3bn Two-Trancher 3.4x Covered

April 20, 2021

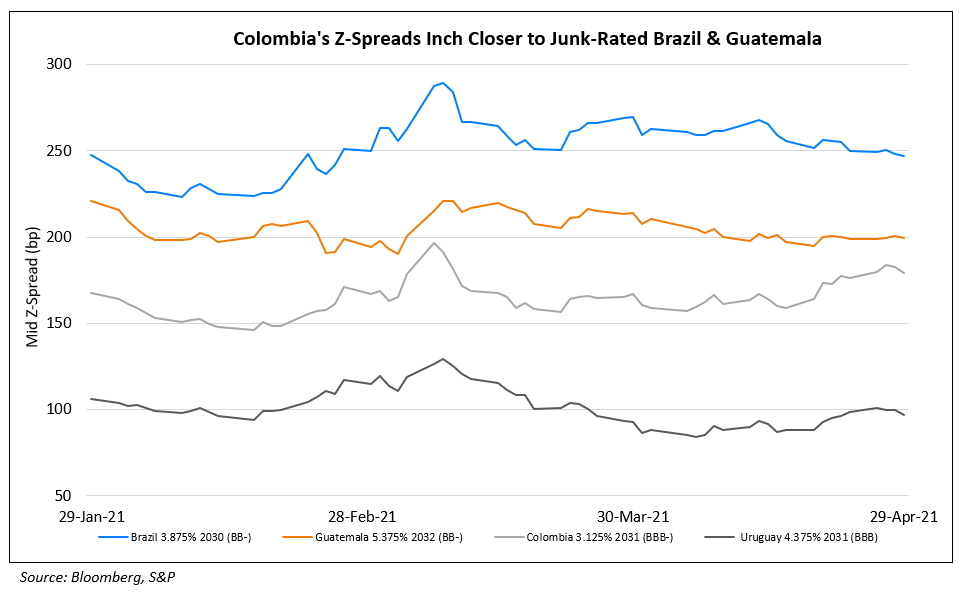

Colombia raised $3bn via a dual tranche offering. It raised $2bn via a 11Y bond at a yield of 3.356% or T+175bp, 30bp inside initial guidance of T+205 area. It also raised $1bn via a 20Y bond at a yield of 4.235% or T+205bp, 30bp inside initial guidance of T+235 area. The notes received orders over $10.2bn ~3.4x issue size. Proceeds will be used for general budgetary purposes. The bonds are expected to be rated BBB-/Baa2 in line with its issuer rating. The new 20Y bonds were priced 6.5bp inside its older 4.125% bonds due 2051 that are currently trading at 97 yielding 4.3%.

Colombia´s USD bonds were slightly up. Its 4.125% 2051s up 0.25 points to 98.803, yielding 4.2% and its 4.95% 2030s were up 0.29 to 105.408, yielding 4.22%

For the full story, click here

Go back to Latest bond Market News

Related Posts: