This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

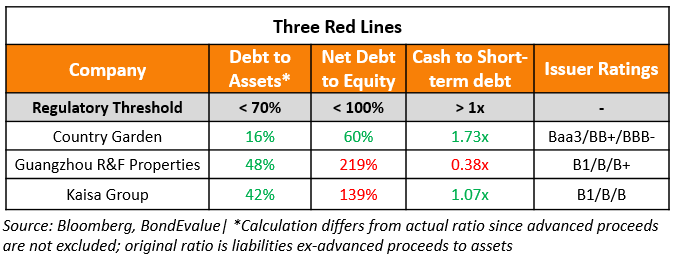

Country Garden, R&F and Kaisa Trim Debt Pile as Per 2020 Results

March 26, 2021

Chinese real estate developers Country Garden, R&F Properties and Kaisa Group have reduced debt as per their latest results. Country Garden cut debt by CNY 43.1bn ($6.6bn) to CNY 326.5bn ($49.9bn) last year, according to its annual results. They reported a net profit decrease by 11.4% to CNY 35bn ($5.4bn) and saw revenues fall 4.7% to CNY 46.3bn ($7.1bn) in 2020. The president of the company said “Our financial position is healthy and we hope to lower our debt to below 300 billion yuan ($45.8bn) this year.”

Kaisa Group said its net gearing ratio fell to 97.9% in 2020 from 144% in 2019. Net profits increased 18.6% last year to CNY 5.4bn ($830mn). Franco Leung, MD of Corporate Finance at Moody’s said “We expect Chinese developers will continue to control debt growth in 2021, given the tight regulatory conditions.” He added that while only a handful are being monitored by regulators, even companies that are not have been trying to adhere to the three red-lines and this may decrease margins.

Country Garden’s bonds were flat with its 3.875% 2030s at 100.06, yielding 3.9%. R&F’s bond issued by Easy Tactic was also flat with its 8.625% 2024s at 94.25, yielding 11% while Kaisa’s bonds were stable with its 10.875% Perp at 97.25, yielding 12.2%.

Go back to Latest bond Market News

Related Posts: