This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande’s Dollar Bonds Down ~10%; Cascading Effect on Peers

July 6, 2021

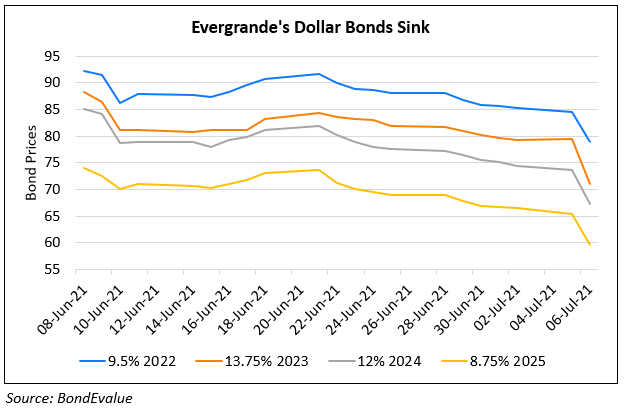

Bonds of China Evergrande crashed over 5 points with its 13.75% 2023s guaranteed by Tianji falling the most, by 8.4 points to 71. HY bond trading company SC Lowy’s CEO Michael Lowy said that Evergrande’s dollar bonds were not providing the buying opportunity that they did during last September’s selloff. He said, “We’re a lot more nervous about Evergrande than we were a few months ago, and certainly the tone coming out of Beijing is a lot more strict”, adding that the company would be in serious trouble if they included accounts payable in their three red-lines as it has doubled over the last 2-3 years. SC Lowy is known as an active dealer in Evergrande’s dollar bonds with Bloomberg reporting that it traded $200mn worth of notes a few days after Evergrande’s bonds tumbled in September on liquidity concerns. Bonds of peers also fell on the above backdrop:

- Risesun’s dollar bonds were down over 10 points – its 8% 2022s issued by Rongxingda were down 12.5 to 67

- Zhongliang Holdings’ dollar bonds were down ~2.5 points and its 7.5% 2022s were down 3.4 to 92.25

- Kaisa’s dollar bonds were down over 1.5 points and its 10.5% 2025s down 2.5 to 90.16

- Sunac’s dollar bonds were also down over 1.5 points and its 6.5% 2025s were down 2.9 to 95.4

Go back to Latest bond Market News

Related Posts: