This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Green Bonds – Everything You Need to Know

April 7, 2021

What are green bonds?

Green bonds are different from conventional bonds in their use of proceeds – they are to be exclusively used towards financing or re-financing ‘green’ projects, such as to develop renewable energy technologies or to mitigate climate changes. In 2007, financial markets began its response to climate changes with the European Investment Bank issuing the first ever green bond. The World Bank Group has since followed suit and provided a steady stream of investable green bonds to speed up the funding supply much needed to reverse damages mankind has done to the earth.

It is highly recommended that green bond issuers comply with the core components of the International Capital Market Association’s Green Bond Principles (“GBP”). Other than issuing with proceeds that are limited to specific ‘green’ purposes, GBP also encourages issuers to abide by stricter reporting requirements. These include being responsible for making clear to investors which objects are environmentally sustainable and separating the net proceeds of the green bonds from the issuers’ ordinary investment accounts.

Who are the issuers of green bonds?

Green bonds have gained much traction over recent years, with issuance in 2020 reaching a record USD 270 billion vs USD 229 billion and USD 141 billion in 2019 and 2018 respectively as per Bloomberg data. Before 2015, the main issuers were supranational institutions and national governments. More recently, issuers are no longer limited to governments but the markets have seen a considerable amount of bonds being issued by banks or corporates, especially in the years 2015 to-date. The biggest issuer of green bonds in 2020 was The French Government with a combined issue size totaling USD 13.14 billion, while the biggest green bond issuer amongst financial institutions was KfW with a combined total issuance amounting to USD 9.48 billion.

State Bank of India issued a USD denominated green bond in 2018. Here is the bond, as seen on the BondEvalue Mobile App, along with an extract of its offering circular, which clearly lays out the use of proceeds.

Extract: State Bank India 4.5% 2023 green bond details and offering prospectus clearly laying out the use of the bond’s proceeds

Among 35 nations that have issued green bonds in 2021, Germany has been the biggest issuer (USD 14.9 billion), followed by Italy (USD 14.6 billion) and France (USD 12.8 billion).

Why do corporates issue green bonds?

The primary reason for issuing green bonds is to contribute towards environment preservation via funding of ‘green’ projects. Another reason is to have a more diverse investor base, as green bonds tend to attract investors that have a bias towards investing in environmentally-friendly companies. Investor demand for green bonds has picked-up over the past few years.

How ‘green’ are green bonds in reality?

While there is no strict regulation that governs the use of proceeds from green bonds, there are independent organizations that provide a certification to green bond issuers in exchange for proper disclosures and a certification fee. Some of the popular organizations that provide certifications include Sustainalytics, Ernst & Young and CICERO.

For example, here is an excerpt from the green bond certification or ‘second opinion’ provided by CICERO for Modern Land China’s 6.875% bonds due 2019.

CICERO allocates a ‘shade of green’ in their certifications to indicate how ‘green’ the bonds really are. The shades of green are:

- Dark green for projects and solutions that are realizations today of the long-term vision of a low carbon and climate resilient future. Typically, this will entail zero emission solutions and governance structures that integrate environmental concerns into all activities.

- Medium green for projects and solutions that represent steps towards the long-term vision but are not quite there yet.

- Light green for projects and solutions that are environmentally friendly but do not by themselves represent or is part of the long-term vision (e.g. energy efficiency in fossil-based processes).

- Brown for projects that are irrelevant or in opposition to the long-term vision of a low carbon and climate resilient future.

Who are the buyers of green bonds?

Currently, mainstream institutional investors like Amundi and BlackRock are the main purchasers. Specialist ESG (Environmental, Social, Governance) and Responsible Investors such as Natixis, Mirova, ACTIAM are big players in the scene too. For individual investors, it is likely that investors who are more environmentally conscious and are looking for “responsible” investments would put their funds into green bonds. Private investors from certain jurisdictions might also purchase green bonds to take advantage of tax benefits, as they might be exempt from paying income tax on the interest payments from the green bonds they hold.

Selection of green bonds under BondEvalue coverage

| Bond | Amount Outstanding (mn) | Yield to Maturity* |

|---|---|---|

|

500 |

3.16% |

|

|

1,110 |

0.41% |

|

|

500 |

0.84% |

|

|

500 |

0.63% |

|

|

500 |

0.42% |

|

|

585 |

4.39% |

|

|

500 |

0.90% |

|

|

19,500 |

6.63% |

|

|

750 |

0.39% |

|

|

20,000 |

6.19% |

|

|

400 |

1.86% |

*As on 7-Apr-21.

Go back to Latest bond Market News

Related Posts:

Masala Bonds – Everything You Need to Know

December 17, 2024

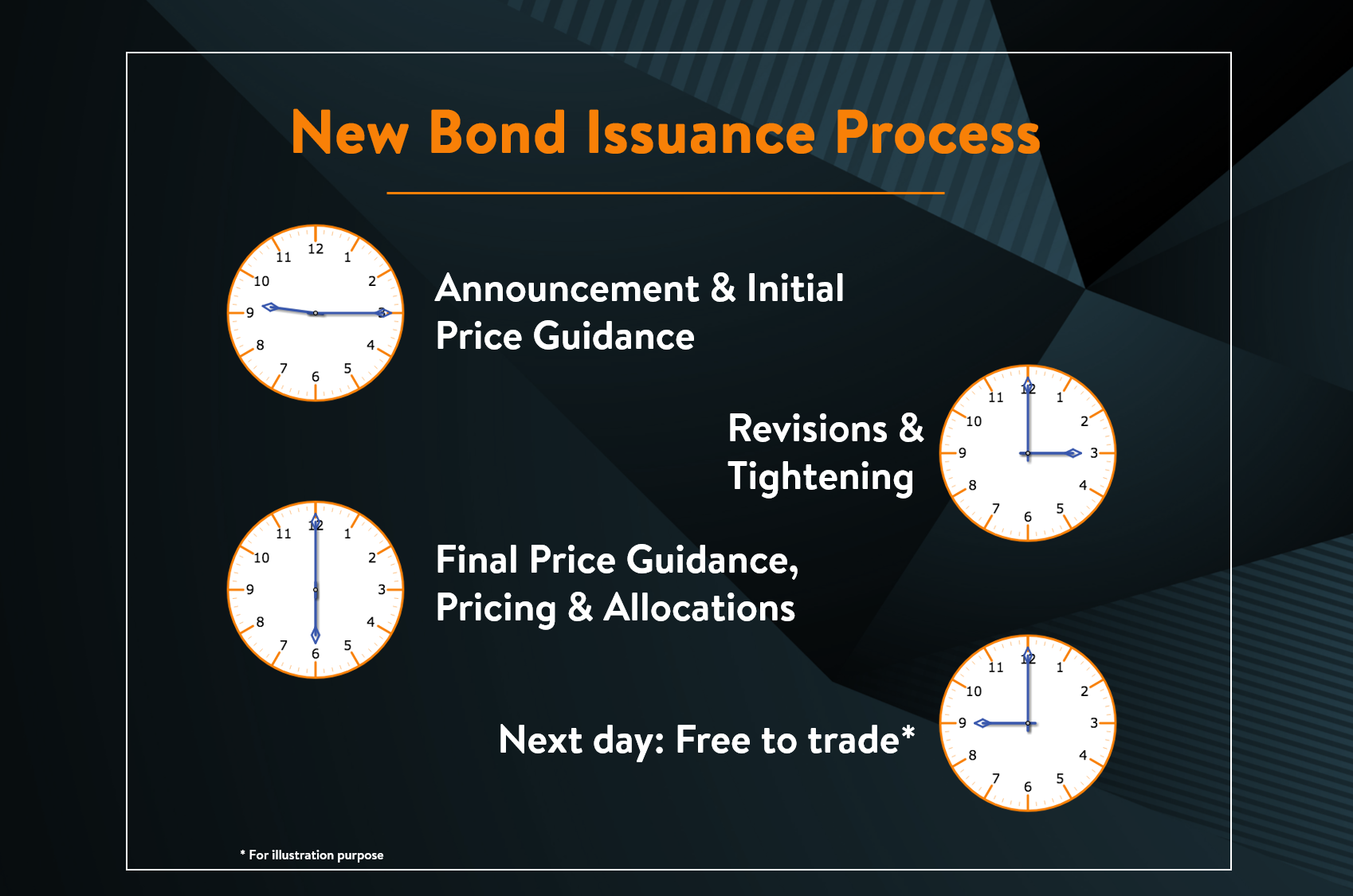

New Bond Issue Process – Explained

December 13, 2024

Transition Bonds – Helping Polluters Turn Green

July 18, 2019