This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

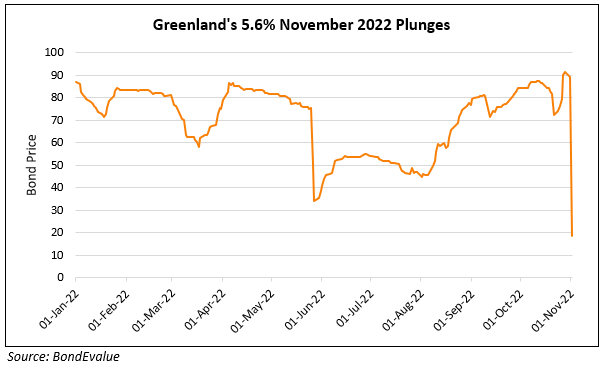

Greenland Holdings’ November Dollar Bond Crashes 70 Points after Warning of Likely Default

November 1, 2022

Greenland Holdings’ $370mn 5.6% dollar bond due 13 November 2022 crashed by 70 points to trade at 18.7 cents on the dollar after the company warned of a likely default on the bond in a statement. It plans to extend the November bond due by two years. Greenland said that the impact of the Covid-19 situation in Shanghai earlier this year coupled with negative market conditions have seen the group witness a significant declines in its sales and operations. This in turn has affected its cash flow and liquidity position making an event of default likely on the bond. Greenland added that it was also seeking to extend the maturity of its June 2023s by a year and other bonds by two years. Greenland was considered to be among the few resilient developers with support from the government as it is partially owned by local government entities. However with the latest update, the materiality of this support has reduced. Apart from the bonds due later this month, Greenland’s other dollar bonds also fell by over 10-20 points.

For the full story, click here

Go back to Latest bond Market News

Related Posts: