This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Hong Kong Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 17, 2021

US equities ended higher with the S&P and Nasdaq up 0.4% and 0.8% respectively. Sectoral gains were led by Consumer Discretionary and IT, up over 1% each. US 10Y Treasury yields rose 4bp to 1.64% after strong retail sales numbers. European markets were mixed with the DAX and CAC up 0.6% and 0.3% while FTSE was down 0.3% respectively. Brazil’s Bovespa ended 1.9% lower. In the Middle East, UAE’s ADX was up 1% and Saudi TASI was down 0.1%. Asian markets have opened broadly lower – HSI, STI and Nikkei were down 0.5%, 0.3%, 0.4% while Shanghai was up 0.2%. US IG CDS spreads tightened 0.1bp and HY CDS spreads were 1bp tighter. EU Main CDS spreads were 0.2 and Crossover CDS spreads were 2.1bp tighter. Asia ex-Japan CDS spreads widened 0.1bp.

US Retail Sales were up 1.7% MoM in October, higher than the 1.2% forecast. Retail Sales ex-Gas/Auto were also up 1.4% MoM vs. 0.5% in September. Industrial Production picked up in October to 1.6% MoM vs -1.3% in September, and higher than 0.7% forecasted.

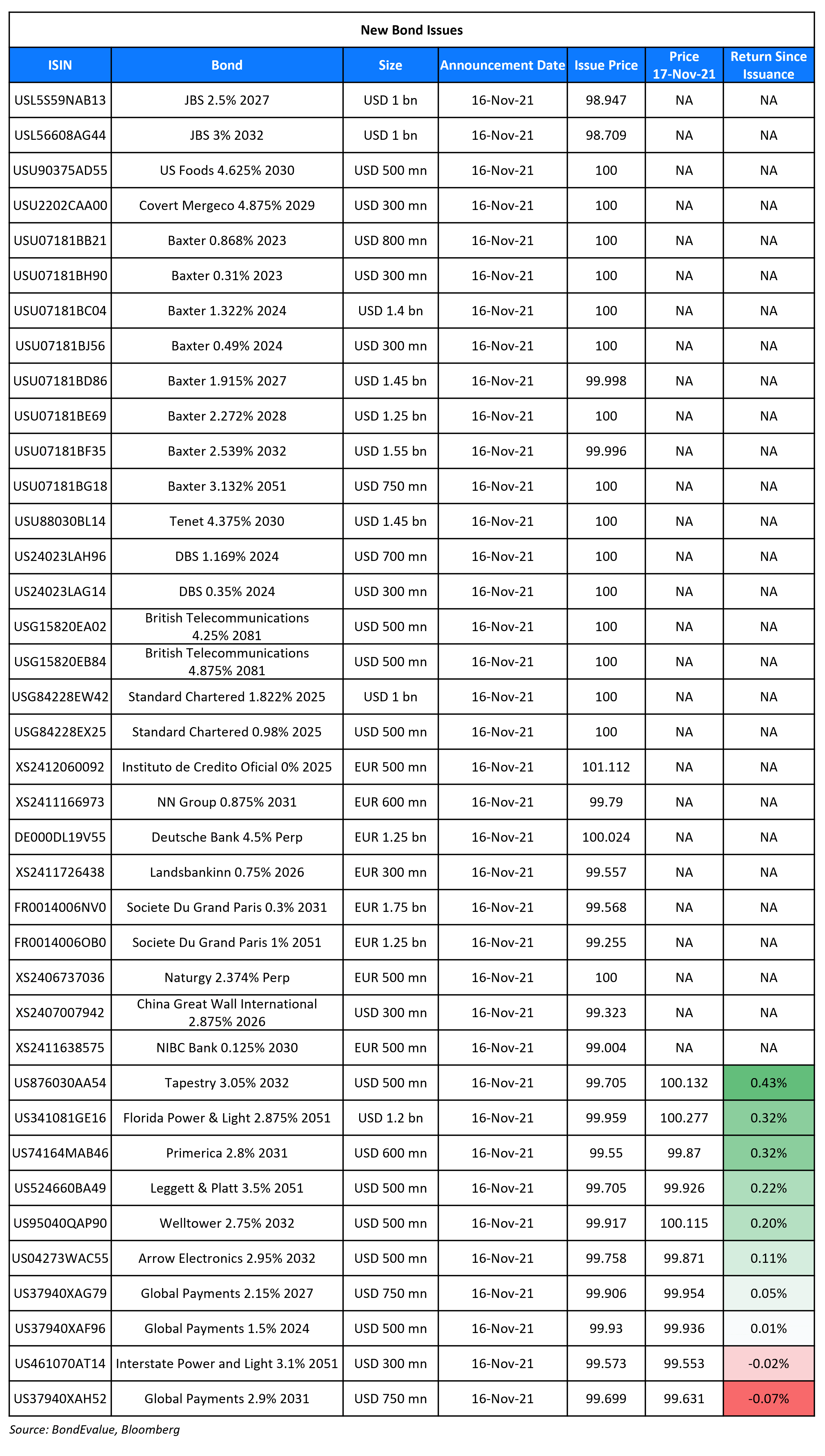

New Bond Issues

- Government of Hong Kong $ 10Y green at T+50bp area

- Cromwell EREIT S$ Perp NC5 at 5.125% area

- Guotai Junan Securities $ 3Y Yulan at T+115bp area

- Jinan Hi-tech Holding $ 3Y at 3.3% area

Standard Chartered raised $1.5bn via a two-tranche deal. It raised $1bn via a 4NC3 bond at a yield of 1.822%, 15-20bp inside the initial guidance of T+110-115bp, and $500mn via a 4NC3 FRN bond at a yield of 0.98% or SOFR+93bp vs. initial guidance of SOFR-equivalent. The bonds have expected ratings of A3/BBB+/A. The new 4NC3 fixed rate bonds have a new issue premium of 23.2bp over its existing 3.785% 2025s callable in May 2024.

Deutsche Bank raised €1.25bn via a PerpNC5 AT1 bond at a yield of 4.5%, 25bp inside initial guidance of 4.75% area. The bonds have expected ratings of Ba3/BB-/BB, and received orders over €2.3bn, 1.8x issue size. The bonds have a first call date on November 30, 2026, and if not called, the coupon will reset on April 30, 2027 to the prevailing EUR 5Y Swap Rate + 455.2bp. The new Perps offer a new issue premium of 30bp over its older EUR 4.625% Perps callable in October 2027 that are currently yielding 4.2%.

Olam raised S$125mn via a tap of its 5.375% Perp at a yield of 5.306%, 6.2bp inside initial guidance of 5.368% area, bringing the total size of the bond to S$525mn. The bonds are unrated. The bonds have a first call on July 18, 2026, and if not called, the coupon will reset on the same day and every five years thereafter to the prevailing 5Y SOR + 680.7bp. The tap offers a new issue premium of 43.6bp over the existing 5.375% Perp that yield 4.87%.

DBS raised $1bn via a two-tranche deal. It raised $700mn via a 3Y bond at a yield of 1.169%, 20bp inside initial guidance of T+50bp area, and $300mn via a 3Y FRN bond at a yield of 0.35% or SOFR+30bp vs. initial guidance of SOFR-equivalent. The bonds have expected ratings of Aa2/AA– (Moody’s/Fitch).

HDB raised S$1bn via a 5Y bond at a yield of 1.645%, unchanged from initial guidance and upsized from the planned S$800mn. The bonds have expected ratings of AAA (Fitch). Proceeds will be used to support HDB’s development programmes and to fund working capital as well as refinance debt. The new bonds are priced 3.5bp tighter to its existing 1.76% Feb 2027s that yield 1.68%.

China Great Wall AMC (International) raised $300mn via a 5Y bond at a yield of 3.022%, 40bp inside initial guidance of T+215bp area. The bonds have expected ratings of BBB+/A (S&P/Fitch), and received orders over $2.1bn, 7x issue size. The bonds are issued by wholly owned subsidiary China Great Wall International Holdings V Limited and guaranteed by China Great Wall AMC (International) Holdings. The new bonds are priced 6.2bp above its existing 3.875% bonds due August 2027s that yield 2.96%.

Shaoxing Shangyu Urban Construction raised $240mn via a 5Y sustainability bond at a yield of 3.3%, 40bp inside initial guidance of 3.7% area. The bonds have expected ratings of BBB– (Fitch), and received orders over $820mn, 3.4x issue size. Proceeds will be used for debt refinancing in accordance with the group’s sustainable finance framework. The bonds are issued by wholly owned subsidiary Shangyu Urban Construction Hong Kong and guaranteed by Shaoxing Shangyu Urban Construction.

New Bonds Pipeline

- Export-Import Bank of Malaysia hires for $ bond

- Sinochem Hong Kong hires for $ 3Y and € 4/7Y bond

- Renesas Electronics hires for $ 3Y green / 5Y bond

- NTT hires for € bond

- Port of Newcastle hires for $ 10Y bond

- Plaza Indonesia hires for $ 5NC3 sustainability-linked bond

Rating Changes

- Moody’s upgrades Usiminas’ ratings to Ba2; stable outlook

- Fitch Downgrades Kaisa to ‘C’ from ‘CCC-‘ on Missing Interest Payments

- Fitch Downgrades China SCE to ‘B+’; Outlook Stable; Removes from UCO

- China Aoyuan Downgraded to ‘CCC’ On Liquidity Crunch; Outlook Negative

- Moody’s revises Marks & Spencer’s outlook to stable, Ba1 affirmed

Term of the Day

Yulan Bonds

Yulan bonds named after Shanghai’s city flower, a ‘magnolia’ are bonds that are denominated mainly in US Dollars and Euros which are issued through Shanghai Clearing House, a Chinese interbank bond market clearinghouse. Whilst similar to traditional dollar and euro denominated bonds, Yulan bonds will help international investors be able to benefit from real time multi-currency DVP (delivery-vs-payment) settlement with any counterparty within Euroclear Bank’s network where Chinese issuers are expected to access a deeper liquidity pool in a cost efficient way. For mid-sized Chinese companies with little experience in global markets, Yulan bonds offer “much wider access to an international investor base, and… a lower cost of borrowing”, said Ms Urbain, CEO of Euroclear Bank. Guotai Junan has launched 3Y Yulan bond.

Talking Heads

On Fed’s Daly Saying She Is ‘Definitely More Bullish’ on Economy Than a Year Ago

“The whole linchpin here is do I see things persisting when the tentacles of the long tail of the delta variant start to move past us… If we don’t have another surge and we’ve got the same data you see today, and we’re in June or July, well it’s a different conversation… reacting in response to things that aren’t likely to last will move us farther from — not closer to — our goals”

On One of Asia’s Oldest Hedge Funds LIM Advisors Buying Distressed China Debt

George Long, LIM Advisors’ founder and CIO

“We’re looking very closely at buying some other distressed Chinese property companies…[The Chinese government] don’t want to have these units where people have made a deposit and the developer goes bust”

“The market is pricing in the first rate hike literally right after when tapering ends… Our view is that there are huge Covid impacts on inflation that are going to start to decelerate. Growth is going to slow, inflation will peak… It is not obvious to us that the Fed has to turn around and start hiking aggressively … We actually have the first rate hike much later than when the market is pricing in, a steeper curve, the front end staying a lot more anchored.”

On Investors Scrutinizing Green Claims in $80bn Sustainability Bond Market

James Rich, a portfolio manager at Aegon

“I think there is tremendous promise in sustainability-linked bonds… But the reality, unfortunately, is that the structures and the penalties for not achieving the targets are mostly not substantial enough to drive real and true change among these companies”

Charles Portier, a portfolio manager at Mirova

“There is a huge gap between what we need and what we are seeing”

Anjuli Pandit of HSBC

“Investors aren’t buying it in the hope they get the step-up or that they can punish the company… This instrument is about companies asking to be held accountable on these targets and giving investors data to track that. We want that data. We want to open up the door between issuers and investors to get this conversation going.”

Top Gainers & Losers – 17-Nov-21*

Other Stories:

Go back to Latest bond Market News

Related Posts: