This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

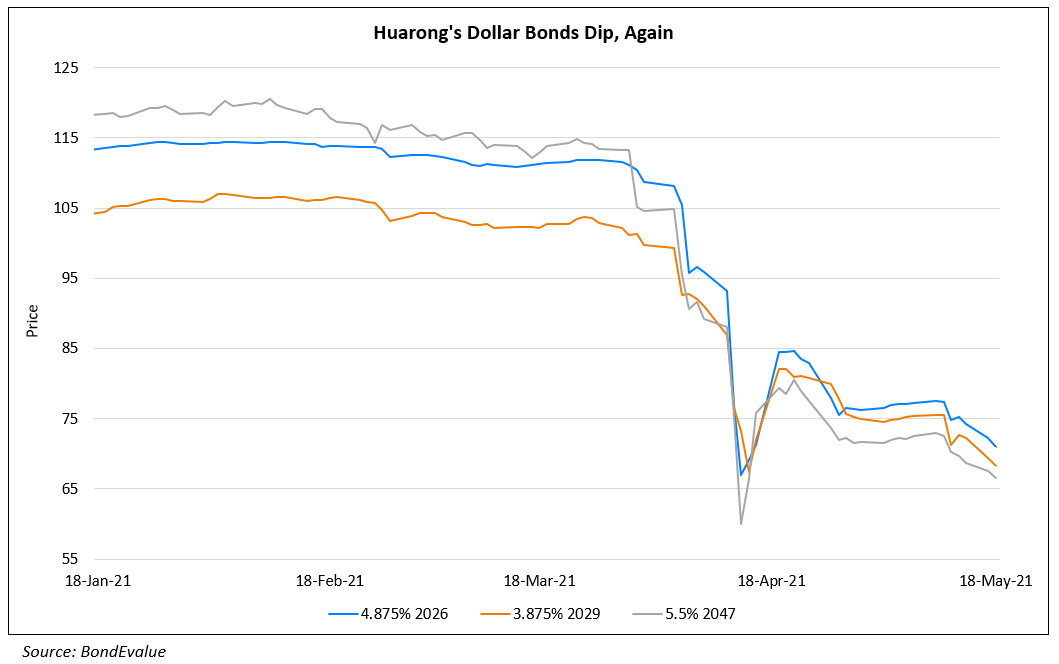

Huarong Said to Have Secured Funding from State Banks Till August

May 18, 2021

China Huarong Asset Management Co. is said to have closed funding arrangements with China’s state-owned lenders to repay debts due through “at least the end of August”, as per people familiar with the matter reported by Bloomberg. The sources added that Huarong expects to complete its 2020 financial results by end-August, which have been delayed since April triggering a massive sell-off in its bonds and credit rating downgrades. The sources mentioned that under the new arrangements, the distressed asset manager would be able to secure funding from the likes of ICBC under guidance of the regulators. However, it is unclear whether the funding arrangements will hold beyond August. Updates from the Huarong saga are being closely watched by bond investors globally as it would provide an insight into the extent, if any, of Beijing’s support towards distressed Chinese corporates. Huarong’s dollar bonds continue to trade at distressed levels – its 2.5% bonds due in July this year are trading at 95.5, its 4.875% 2026s at 71 and its 4.5% perp at 64.25. The stress seems to be spreading to onshore bond investors as well with its CNY denominated bond due 2023 falling ~19 points on Monday to 80.

For the full story, click here

Go back to Latest bond Market News

Related Posts: