This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Huarong Says It Is Prepared To Pay Debt; No Change in State Support

May 14, 2021

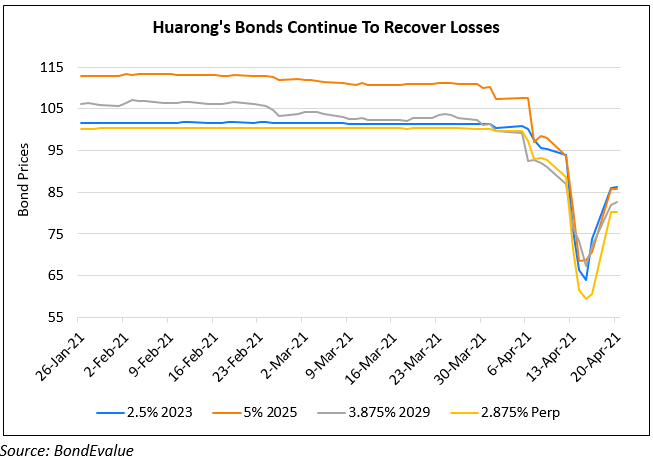

China Huarong said that their liquidity position was “fine” and that they made “proper arrangement” and “adequate preparation” for future bond payments. In a response to Bloomberg, Huarong also said that “At present, there is no factual basis to indicate any change in the shareholding structure or control in ownership, neither is there evidence to indicate any change of support the company receives from the government.” Huarong’s bonds dropped as much as 5% on Wednesday after Caixin Media’s WeNews reported that Huarong had been advised by regulators to solve its financial issues on its own, adding that they return to core businesses and dispose of some domestic units to reduce capital needs. Bloomberg Intelligence’s Dan Wang said “We still expect state support for Huarong but this may not be a blank cheque bailout, as the government seeks to balance the large contagion risk against promoting market discipline for SOEs.”

Huarong’s bonds are lower today – its 3.75% 2024s are down 1 point to 76.5, yielding 13.4% and its 5.5% 2047s are down 0.7 to 69, yielding 8.47%.

Go back to Latest bond Market News

Related Posts:

Huarong Downgraded Three Notches To BBB By Fitch

April 27, 2021

Huarong Wires Funds to Repay $300mn Bond

May 19, 2021