This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

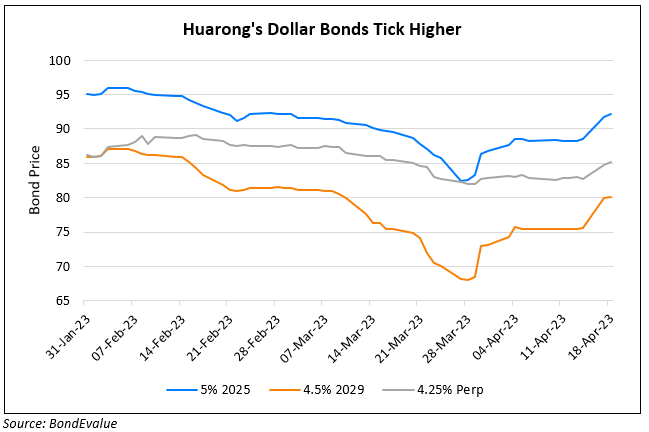

Huarong’s Dollar Bonds Rally Over 4% on Demand from HY Funds

April 18, 2023

Dollar bonds of China Huarong rallied by over 4% despite its downgrade to Baa3 by Moody’s. While the issuer’s rating is still at investment grade status, Moody’s had cut its offshore financing vehicles’ ratings. In particular, it downgraded the senior unsecured ratings of Huarong Finance 2017 Co., Huarong Finance II Co. and Huarong Finance 2019 Co. to Ba1 from Baa3. The difference between the issuer and its issuing entities’ ratings comes on the back of the fact that “keepwell deeds are different from explicit guarantees in the procedures of enforcement”.

The downgrade of its issuing entities to junk has a silver lining, going by Nicholas Yap, Nomura’s head of Asia flow credit desk notes. He says that the downgrade should fuel demand from high-yield funds as Huarong’s bonds will now enter HY indices given that it “will be one of the highest-quality” names in the sector.

Go back to Latest bond Market News

Related Posts: