This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

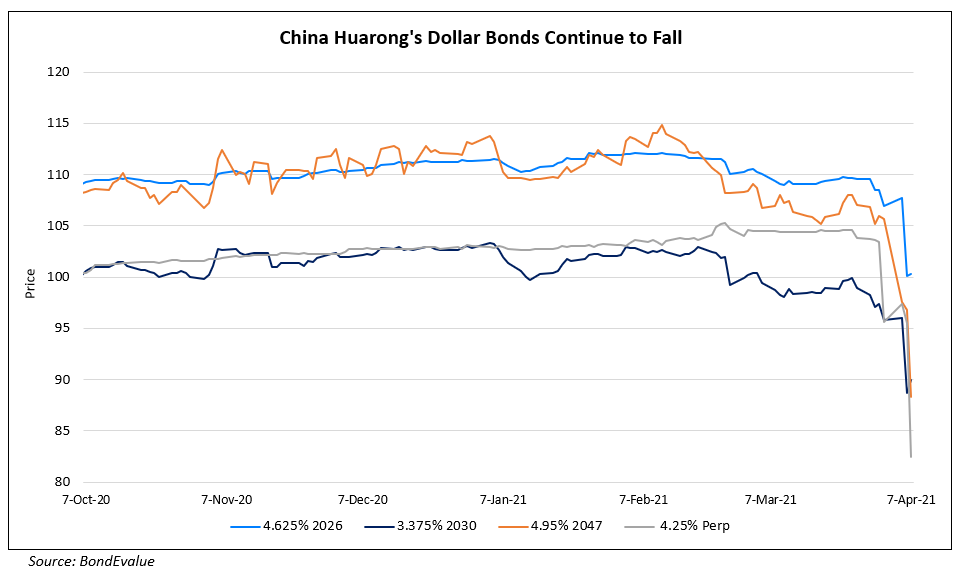

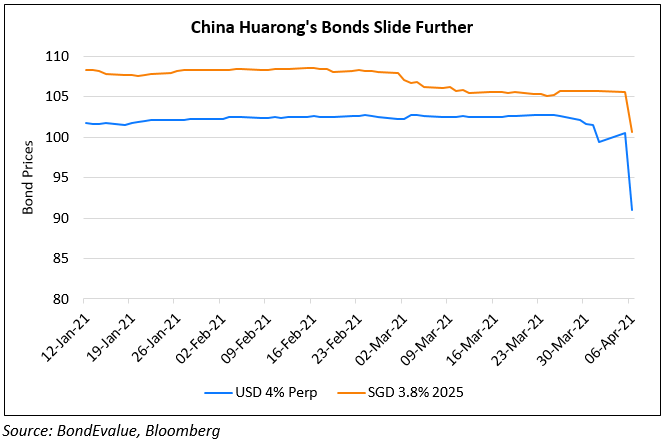

Huarong’s Perp and SGD 2025s Slip Following USD 2047s

April 6, 2021

Huarong’s USD 4% perp callable in November 2022 at 100 slipped to 91.33 cents on the dollar yielding 10.06% on Monday following its 4.95% 2047s, which opened lower by 8 points on Monday morning. This comes after the company announced a delay in releasing its annual results due to which a trading halt was put in place late last week. Huarong Finance is rated Baa1 while its parent China Huarong International is rated BBB+ by S&P.

Go back to Latest bond Market News

Related Posts: