This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

ICBC, Far East Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 21, 2021

US equities had a mixed day with the S&P up 0.4% while the Nasdaq was flat. Sectoral gains were led by Utilities, Real Estate and Healthcare, up 1.4-1.6%. US 10Y Treasury yields were flat at 1.66%. European stocks were only marginally higher with the DAX and FTSE eking out less than 0.1% in gains while CAC was up 0.5%. Brazil’s Bovespa was also 0.1% higher. In the Middle East, UAE’s ADX was 0.2% lower and Saudi TASI was up 0.9%. Asian markets have opened mixed – Shanghai was up 0.5%, HSI and STI were flat and Nikkei was down 0.3%. US IG and CDS spreads were 0.3bp tighter and HY CDS spreads were almost unchanged. EU Main CDS spreads were 0.2bp tighter and Crossover CDS spreads were 1bp tighter. Asia ex-Japan CDS spreads tightened by 1.2bp.

China’s new home prices stalled with no change for the first time since the pandemic began in Feb 2020 after seeing a 0.2% MoM rise in August. Reuters notes that some analysts say that prices fell 0.08%, or even 0.1%, based on their respective calculations. Eurozone HICP inflation came at 1.9% YoY, in-line with expectations

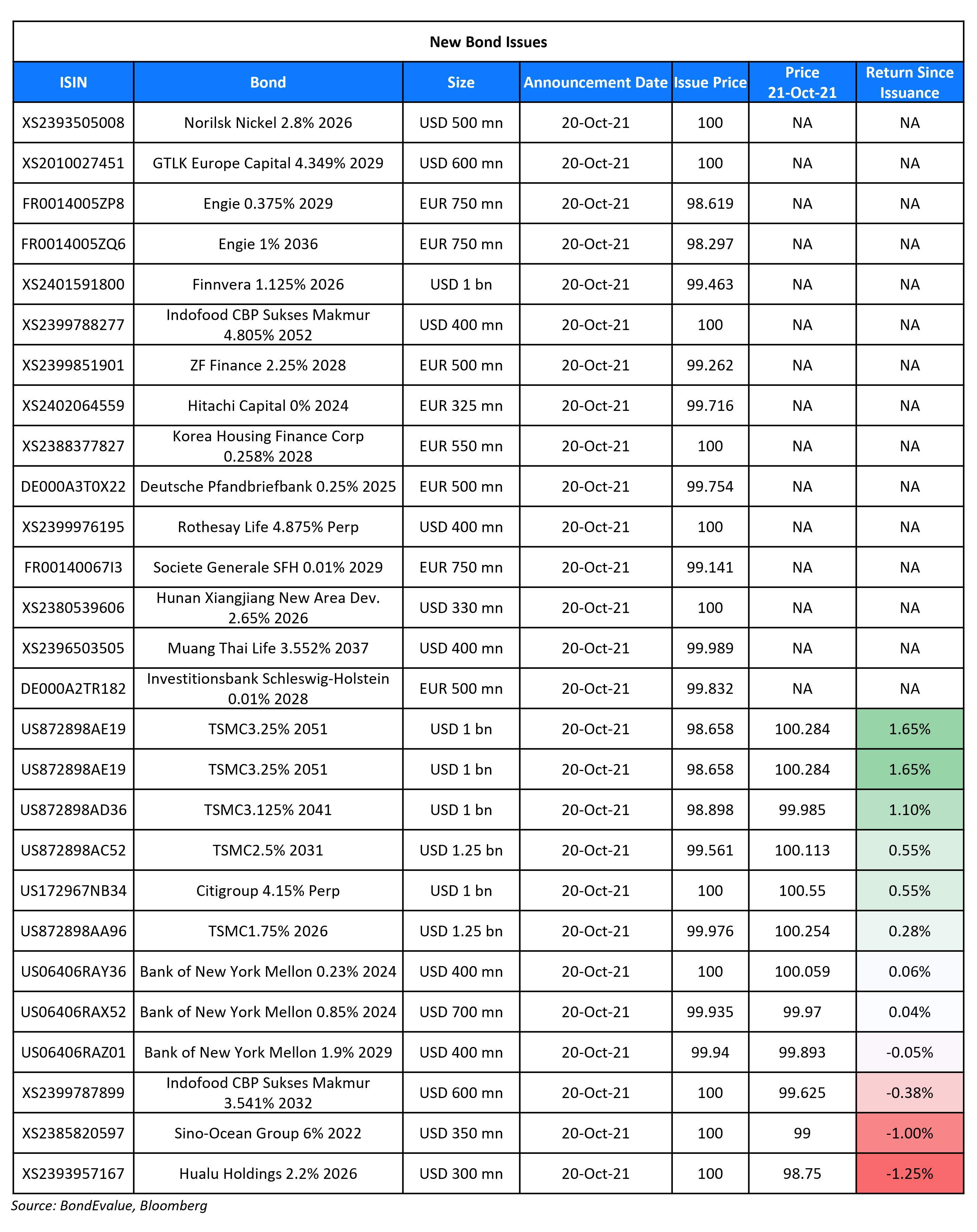

New Bond Issues

- Far East Horizon $ 5Y at T+340bp area

- Huzhou City Investment Development $ 5Y at 3.25%

- ICBC $ 3/5Y green @ T+70/85bp area; € 3Y at MS+70bp area; £ 4Y green at UKT+110bp area

Sino-Ocean Capital Holding raised $350mn via a 364-day bond at a yield of 6%, 37.5bp inside initial guidance of 6.375% area. The bonds are unrated. The bonds will be issued by Mega Wisdom Global and guaranteed by Fortune Joy Ventures and Sino-Ocean Capital Holding. Sino-Ocean Group Holding, which indirectly owns 49% of Sino-Ocean Capital, has provided a keepwell deed.

Indofood CBP Sukses Makmur raised $1bn via a two-tranche deal. It raised $600mn via a 10.5Y bond at a yield of 3.541%, 30bp inside initial guidance of T+220bp area, and $400mn via a 30.5Y bond at a yield of 4.805%, 30bp inside initial guidance of T+300bp area. The bonds have expected ratings of Baa3/BBB– (Moody’s/Fitch). Indofood CBP Sukses Makmur is one of the largest producers of packaged food products in Indonesia. The new 10.5Y bonds are priced 21.1bp wider to its existing 3.398% 2031s that yield 3.33%, while the new 30.5Y bonds are priced 17.5bp wider to its existing 4.745% 2051s that yield 4.63%.

Bank of New York Mellon raised $1.5bn via a three-tranche deal. It raised:

- $700mn via a 3Y bond at a yield of 0.872%, 20.5bp inside the initial guidance of T+37.5bp area

- $400mn via a 3Y FRN bond at a yield of 0.23% or SOFR+20bp vs initial guidance of SOFR-equivalent.

- $400mn via a 7.25Y bond at a yield of 1.909%, 20bp inside the initial guidance of T+65bp area.

The bonds have expected ratings of A1/A/AA-.

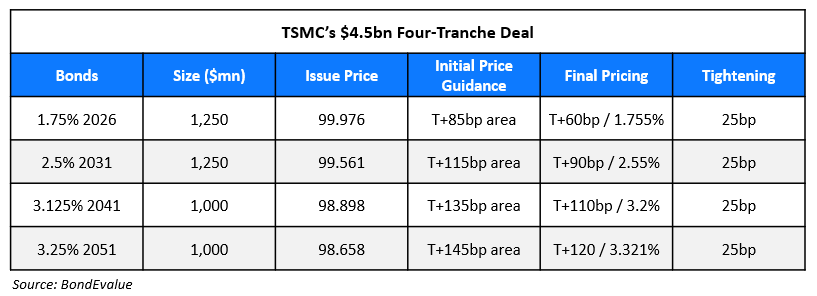

TSMC raised $4.5bn via a four-tranche deal. Details are given in the table below:

The bonds have expected ratings of Aa3/AA– (Moody’s/S&P). The bonds will be issued by wholly owned subsidiary TSMC Arizona Corporation and guaranteed by TSMC. The new 5Y bonds are priced 12.5bp wider to its existing 1.25% 2026s that yield 1.63%, while the new 10Y bonds are priced 6bp wider to its existing 2.25% 2031s that yield 2.49%.

The bonds have expected ratings of Aa3/AA– (Moody’s/S&P). The bonds will be issued by wholly owned subsidiary TSMC Arizona Corporation and guaranteed by TSMC. The new 5Y bonds are priced 12.5bp wider to its existing 1.25% 2026s that yield 1.63%, while the new 10Y bonds are priced 6bp wider to its existing 2.25% 2031s that yield 2.49%.

Muang Thai Life raised $400mn via a 15.25NC5 Tier 2 bond at a yield of 3.552%, 35bp inside initial guidance of T+275bp area. The bonds have expected ratings of BBB (Fitch). The coupon resets once on 27 January 2027 to the prevailing US 10Y Treasury + 240bp. The notes have a dividend stopper, and there will be a write-down in full or in part if the Thai insurer is unable to continue its business without material financial assistance from the country’s insurance industry regulator.

Hunan Xiangjiang New Area Development Group raised $330mn via a 5Y bond at a yield of 2.65%, 35bp inside initial guidance of 3% area. The bonds have expected ratings of Baa2 (Moody’s), and received orders over $1.5bn, 4.5x issue size. Proceeds will be used for general working capital, investment activities and debt refinancing. The issuer is a local government financing vehicle of the Changsha municipal government. Its main mandate is to promote the development of the Xiangjiang New Area in Changsha city, Hunan province in China.

Hualu Holdings raised $300mn via a debut 5Y bond at a yield of 2.2%, 60bp inside the initial guidance of 2.8% area. The bonds have expected ratings of A3/A– (Moody’s/Fitch), and received orders over $2bn, 6.7x issue size. The bonds will be issued by wholly owned subsidiary Hualu International Finance (BVI) and guaranteed by Hualu Holdings. Hualu Holdings is a state-owned capital investment company majority owned by Shandong SASAC in China, with businesses in coal chemicals, pharmaceuticals, environmental protection, leasing and trading.

New Bonds Pipeline

- Chongqing Southern New City hires for $ bond

- Zhaoqing Guolian Investment Holding hires for $ 3Y green bond

- IOI Corp hires for $ bond alongside tender offer

- KB Securities hires for $ bond

- Hibiscus Petroleum hires for $ 5NC2 bond

Rating Changes

- Moody’s downgrades Central China Real Estate to B1/B2; outlook negative

- Moody’s upgrades Tullow Oil’s Corporate Family Rating to B3; stable outlook

- Fitch Downgrades Xinyuan to ‘RD’; Upgrades to ‘CC’

- Moody’s downgrades Ethiopia’s rating to Caa2; outlook negative

- Moody’s affirms the long-term deposit and debt ratings of ICICI Bank UK PLC, outlook changed to stable

- Fitch Revises Tupras’s Outlook to Stable; Affirms at ‘B+’

Term of the Day

Cost of Risk

Cost of Risk refers to the losses that arise out of ‘expected losses’ and the ‘cost of losses over and above the average loss’. Expected losses are those that arise on average due to defaults and depend on the credit risk of the borrower. The cost of losses over and above the average loss are measured by either Basel related regulatory capital or risk based capital.

Talking Heads

On China home prices fall for the first time since the pandemic

Zhang Dawei, chief analyst with property agency Centaline

“Real estate credit tightening – with home loans down by 510 billion yuan ($79.8 billion) year-on-year in the third quarter – was the biggest reason for the overall market freeze… Many developers have recently been exposed to a liquidity crunch, leading buyers to worry about buying buildings that are forever unfinished… It is expected that in the fourth quarter of 2021, the markets in most cities will enter an obvious adjustment cycle… If there is no significant easing of mortgage loans from October onwards, price wars will be the main buzzword in the real estate market in the fourth quarter”

On A Flatter Yield Curve Being Bad News for Corporate Bonds – BofA

A flatter yield curve gives investors relatively less compensation for buying longer-term bonds like high-grade company debt instead of shorter or intermediate-term notes. A less steep curve also tends to increase hedging costs for foreign investors, reducing their demand for U.S. corporate debt.

On Fed’s Quarles Urging November Taper and Warning of Inflation Risks

“I would support a decision at our November meeting to start reducing these purchases. There is evidence in the past couple of months that a broader range of prices are beginning to increase at moderate rates, and I am closely watching those developments. If we are still seeing 4% inflation or in that area next spring, then I think we might have to reassess the speed with which we would be thinking about raising interest rates”

On Fed’s Mester Saying There Will Be No Rate Hike ‘Any Time Soon

“The thought about raising interest rates is not a near-term consideration at all… We’re going to think about the decision coming up, which is about the asset purchases, and then as those wind down we’ll have time to assess where the economy is.”

On Traders Bracing for Turkey Rate Cut Bet on More Lira Weakness

Paul Greer, a London-based money manager at Fidelity International

“We think the lira will continue to weaken. There is limited anchor for the Turkish currency in this backdrop.”

Phoenix Kalen, a strategist at Societe Generale

Forecasts with a “high degree of uncertainty” that the central bank will cut rates by 100 basis points on Thursday. She sees the lira weakening to 9.80 per dollar by year-end and 11.60 by the third quarter of 2022, given that the bank will refuse to raise rates thereafter

Julius Baer’s emerging-market equity strategist Leonardo Pellandini

“We do not consider it to be a buying opportunity (referring to the Lira) unless we have a change in macroeconomic policy setting”

On Traders Worrying Over Ghana Debt Trajectory Ahead of Budget

Neville Mandimika, an economist and fixed income strategist at FirstRand Bank Ltd.

“Do they still have access to the Eurobond market at these levels? Could they issue one at a reasonable price?…The answer seems to be no… At this point they need to present a credible plan B on how they fund the budget in the absence of Eurobond issuance… In a worst-case scenario where debt is growing amid a global risk-off mood, Ghana may have to head back to the IMF.”

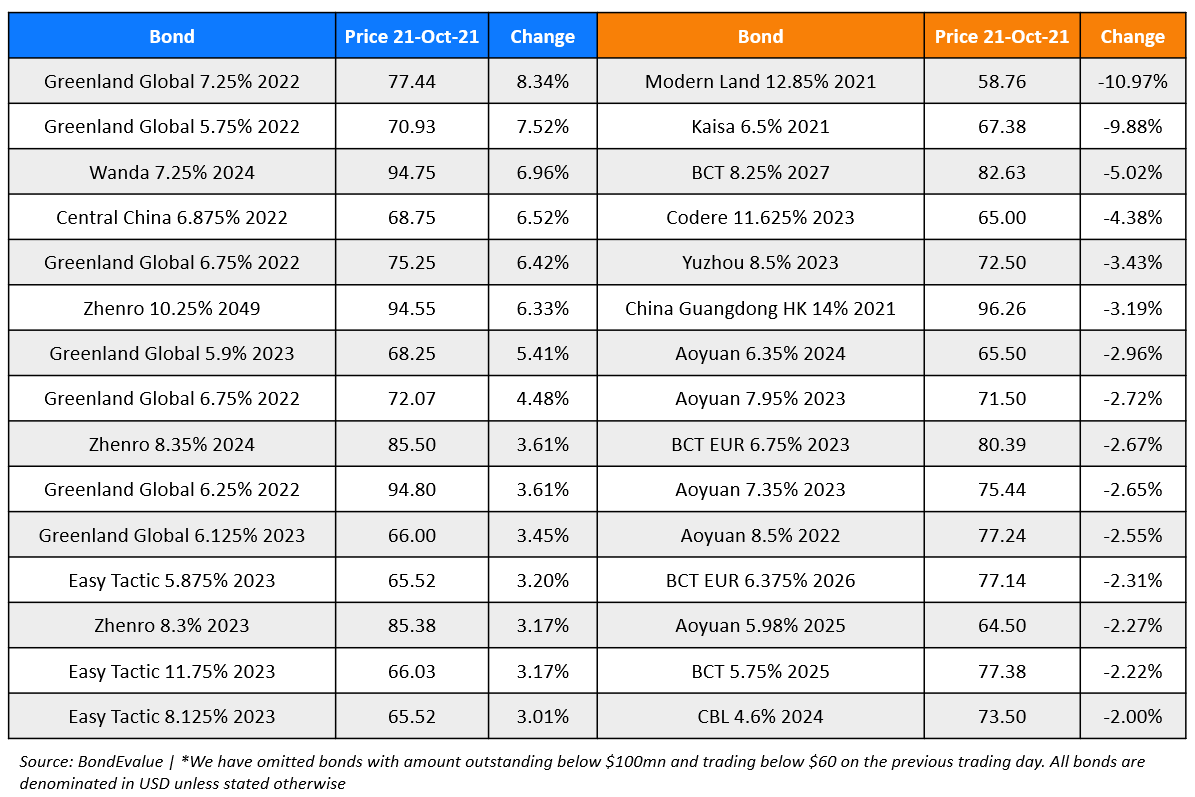

Top Gainers & Losers – 21-Oct-21*

Go back to Latest bond Market News

Related Posts: