This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Kaisa Bondholders Reject Offer; R&F Bonds Fall as Repayment Looms

December 3, 2021

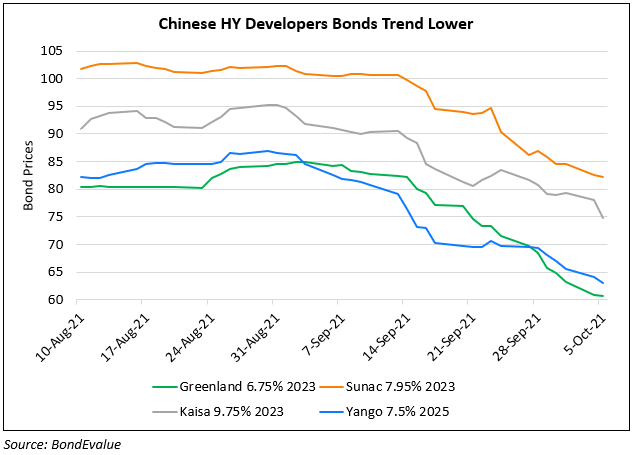

Kaisa Group in an exchange filing said it is exploring alternative solutions after bondholders rejected its debt swap to extend the maturity of its $400mn 6.5% bonds due December 7, 2021. For the debt swap to be accepted, Kaisa required a 95% approval rate. While it has been in discussions with certain bondholders, no legally binding agreement has been reached yet. Whilst not disclosing the amounts, Kaisa said that the valid tenders of the 6.5% 2021s were less than the minimum acceptance amount. It added that if it is unable to repay the maturity or agree for alternative arrangements with its holders, ‘material adverse effect’ would be seen on its financial condition. Kaisa’s dollar bonds were slightly higher with its 10.875% Perps up 0.37 points to 25.57 cents on the dollar.

For the full story, click here

Separately, bondholders of Fujian Yango Group’s RMB 400mn ($62.8mn) bond due December 7 are meeting on Friday to vote on a proposal. Bloomberg states that its statement published on the Shanghai Clearing House website did not give details about the proposals but mentioned that company is facing pressure in paying the bond due to a liquidity squeeze. Fujian Yango is the parent of Yango Group. Meanwhile Fitch withdrew ratings on Yango Group after Yango chose to stop participating in the rating process. Fujian Yango’s dollar bonds continue to trade at distressed levels of 13-14 cents on the dollar.

Guangzhou R&F Properties’ dollar bonds are down 4-5 points ahead of an RMB 263.2mn ($41.3mn) coupon payment scheduled for Saturday. Its 8.125% 2023s issued by Easy Tactic are down 5.04 points to 47.34 cents on the dollar.

Go back to Latest bond Market News

Related Posts: