This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

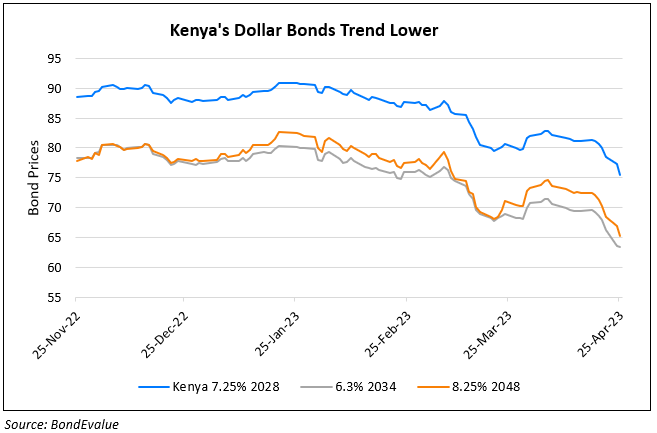

Kenya and African Nations’ Dollar Bonds Come Under Pressure

April 25, 2023

African nations’ dollar bonds have been in focus after the IMF published a report titled “The Big Funding Squeeze” highlighting their concerns about the region. With economic growth slowing down for a second straight year and no sovereign dollar bond issuances from the region over the past year, the IMF expressed concerns about funding troubles. Coupled with the recent monetary policy tightening globally, African nation’s currencies have been hurt and all but cut them out of debt markets. They added that public debt and inflation are at decade highs. IMF Africa Department Director Abebe Selassie said, “in terms of macroeconomic challenges, this is by far the most difficult period I think from the turn of the century”.

Regarding Kenya, Citi strategists expect the Kenyan shilling to “remain on the backfoot in 2023” after having already depreciated 9.7% this year to record lows. StanChart adds that most single-B rated sovereigns including Kenya have lost Eurobond market access since the start of the Fed’s tightening cycle. Kenya has a dollar bond maturity payment of $2bn due in 2024 vs. forex reserves of $6.3bn. The nation has been delaying payment of civil wages amid financing constraints. Bloomberg notes that the sovereign risk premium of Kenya’s dollar bonds over US Treasuries rose to 1,019bp, thus going past the 1,000 level widely considered by bond traders as distressed.

For more details, click here

Go back to Latest bond Market News

Related Posts:

IMF Delays $238mn Kenya Loan for Budget Purposes

June 28, 2022

Kenya Wanting to Renegotiate $5bn Loan with China

October 20, 2022

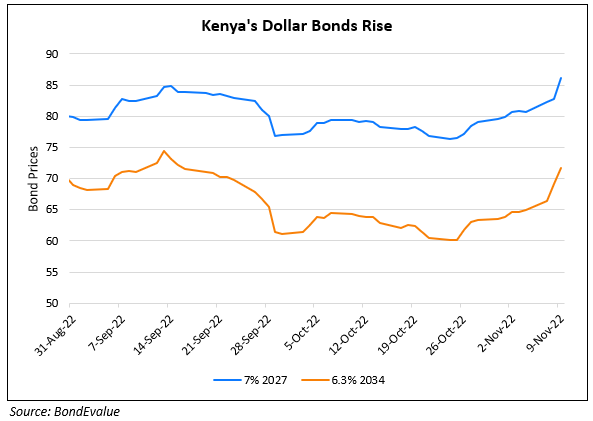

Kenya’s Dollar Bonds Jump Higher on IMF Agreement

November 10, 2022