This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

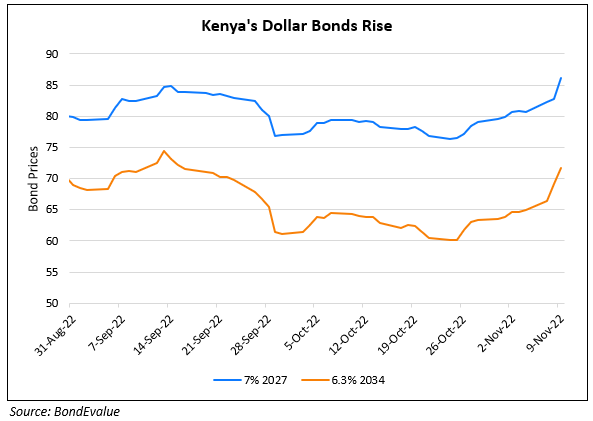

Kenya Dollar Bonds Higher After IMF’s Verbal Support

May 5, 2023

Kenya’s dollar bonds were higher by over 1 point after the IMF gave verbal support for the government’s efforts to shore up its finances, saying “The IMF stands with Kenya”. IMF’s Managing Director Kristalina Georgieva said that they were impressed by the nation’s “vigorous actions to keep the economy vibrant in the face of external headwinds”. The Kenyan shilling is down 10% YTD and the nation has been facing pressures regarding delayed payment of civil wages amid financing constraints. Besides, it has also lost access to offshore bond markets since the start of the Fed’s tightening cycle. Kenya has a dollar bond maturity payment of $2bn due in 2024 vs. forex reserves of $6.3bn.

Its 7.25% 2028s were up 1.1 points to 78.25, yielding 13.55%.

For more details. click here

Go back to Latest bond Market News

Related Posts:

IMF Delays $238mn Kenya Loan for Budget Purposes

June 28, 2022

Kenya Wanting to Renegotiate $5bn Loan with China

October 20, 2022

Kenya’s Dollar Bonds Jump Higher on IMF Agreement

November 10, 2022