This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; New Bond Issues; Rating Changes; Talking Heads; Top Gainers and Losers

January 3, 2022

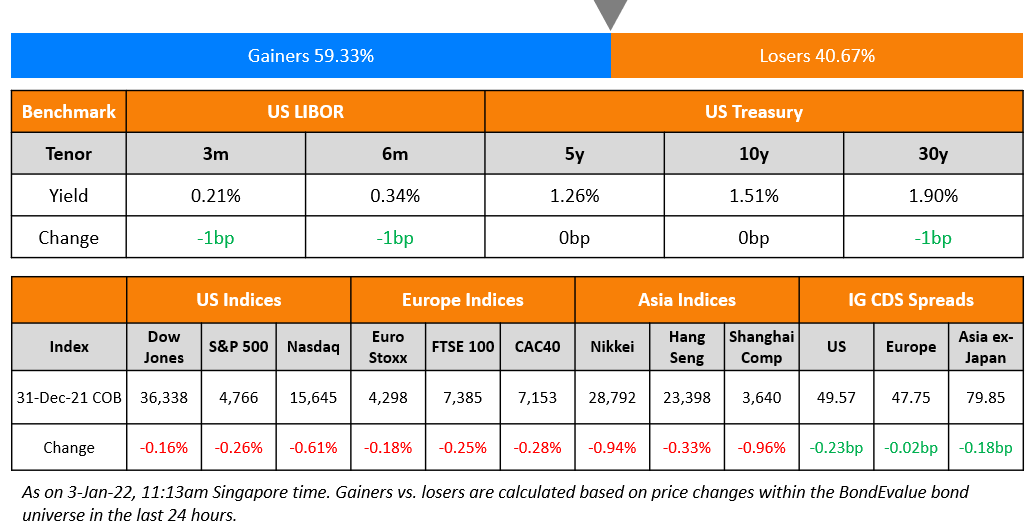

US equity markets ended lower on Friday, with the S&P and Nasdaq down 0.3% and 0.6% respectively. The indices ended 27% and 21% higher during the whole year 2021. US 10Y Treasury yields were flat at 1.51%. European markets were mixed with the DAX up 0.2% while CAC and FTSE were down 0.3% each. Brazil’s Bovespa was up 0.7%. In the Middle East, UAE’s ADX was up 0.5% and Saudi TASI ended 0.4% higher on Sunday. Asian markets have opened mixed – Shanghai and STI were up 0.6% and 0.3% while HSI and Nikkei were down 0.3% and 0.4% respectively. US IG CDS spreads tightened 0.2bp and HY CDS spreads tightened 1.7bp. EU Main CDS spreads were flat and Crossover CDS spreads were 0.2bp wider. Asia ex-Japan CDS spreads tightened 0.2bp.

Singapore recorded a 7.2% growth in GDP in 2021, the fastest pace since 2010. This comes after a 5.4% contraction in 2020 due to the pandemic. The final quarter saw the country grow 2.6% QoQ beating median forecasts of 2.1%.

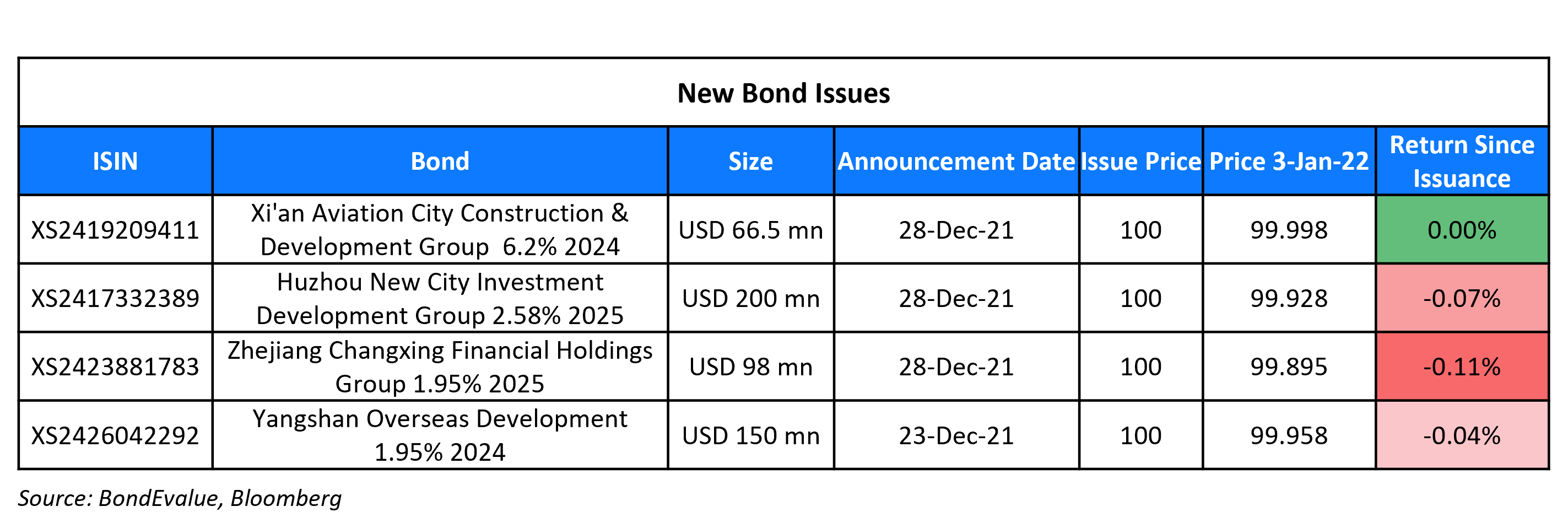

New Bond Issues

Zhejiang Qiantang River Investment Development raised $100mn via a 3Y bond at a yield of 1.95%. The bonds are unrated. Proceeds will be used for project construction and working capital. The bonds are issued by wholly owned subsidiary ZhongChuang (HK) Technology and guaranteed by Zhejiang Qiantang River Investment Development. The bonds are supported by a letter of credit from Bank of Shanghai Hangzhou branch.

Haining Yangshan Industrial Group raised $150mn via a 3Y bond at a yield of 1.95%. The bonds are unrated. The proceeds from the Hong Kong-listed trade will be used to fund the group’s industrial park projects, to upgrade projects and to replenish working capital. The bonds are issued by Yangshan Overseas Development. The bonds are supported by a letter of credit from the Bank of Shanghai Hangzhou branch.

Huzhou New City Investment raised $200mn via a 3Y bond at a yield of 2.58%, 2bp inside initial guidance of 2.6% area. The bonds are unrated. The bonds are supported by a letter of credit from Huishang Bank. The issuer is an investment and financing entity in Wuxing district in Huzhou city in China’s Zhejiang province and is wholly owned by Huzhou Wuxing State-owned Assets Investment Development. It operates in urban construction, property development and property leasing.

New Bonds Pipeline

- Airport Authority HK hires for $ bond

- Reliance Industries hires for $ bond

- China Oilfield Services Limited hires for $ bond

Rating Changes

Term of the Day

Bear Flattening

Bear flattening refers to a change in the yield curve where short-term rates move up faster than long-term rates. The opposite of a bear flattening is a bull flattening where long-end rates move lower faster than short-end rates. Brian Quigley, senior portfolio manager at Vanguard Group says that their base case for 2022 is that growth and risk assets would hold up with the market getting comfortable with the idea of the Fed tightening after Q1. This would be moderately bearish for Treasuries with the yield curve bear flattening once the Fed tightens.

Talking Heads

On BlackRock and Vanguard bracing for more fall in Treasuries in 2022

Jean Boivin, head of the BlackRock Investment Institute

“A repeat of 2021 is a reasonable expectation for Treasury market returns in 2022,” “If inflation eases slowly from where it is at the moment, there is the risk of more downside performance in Treasuries next year.”

Brian Quigley, senior portfolio manager at Vanguard Group

“Our base case for 2022 is that growth and risk assets hold up and the market gets comfortable with the idea that the Fed tightens after the first quarter.” “That is moderately bearish for Treasuries.” “Once the Fed tightens, the curve will bearishly flatten.” “Treasuries and duration proved their worth as a diversifying asset during 2020, and the 10-year is not that far off from its pre-Covid yield.”

George Goncalves, head of U.S. macro strategy at MUFG

“There is a first time for anything, and the chances of a second straight negative year for Treasuries is higher given the limited room for yields falling.” “The Fed may not repeat the last cycle, with only steady rate hikes.” “Shrinking the balance sheet is an option and the Fed has the tools to steepen the curve.”

Lou Crandall, chief economist at Wrightson ICAP

“An important point from recent Fed communications is that the reaction function next year may be more hawkish than expected.” “The Fed has indicated it can’t ignore inflation.”

On US 10 year Treasury ending 2021 above 1.5% level

Kathy Jones, chief fixed-income strategist at Charles Schwab

“It’s certainly been a roller coaster year.” “Covid led to the fiscal and monetary policy responses and all of the volatility we saw in the economic data. That was the big story in the market,” Jones said.

Lawrence Gillum, fixed income strategist for LPL Financial

“We expect interest rates to move modestly higher in 2022 based on near-term inflation expectations above historical trends and improving growth expectations once the impact of COVID-19 variants recede.” “Our year-end 2022 forecast for the 10-year Treasury yield is 1.75–2.00%.”

“The key thing is to conserve the constitutional mandate and the law that the bank has today.” “I think those are the best guarantee that an environment of stability and low inflation can be maintained.” “It’s very clear that central banks can do their jobs better in an autonomous framework and it’s really important to preserve that.” “Sometimes it looks like there are two tracks, the track of 25 [basis point rate rises] and the track of 50 . . . The truth is in the bank we don’t see it that way,” he said. “Going forward all the options are available and none are predefined.”

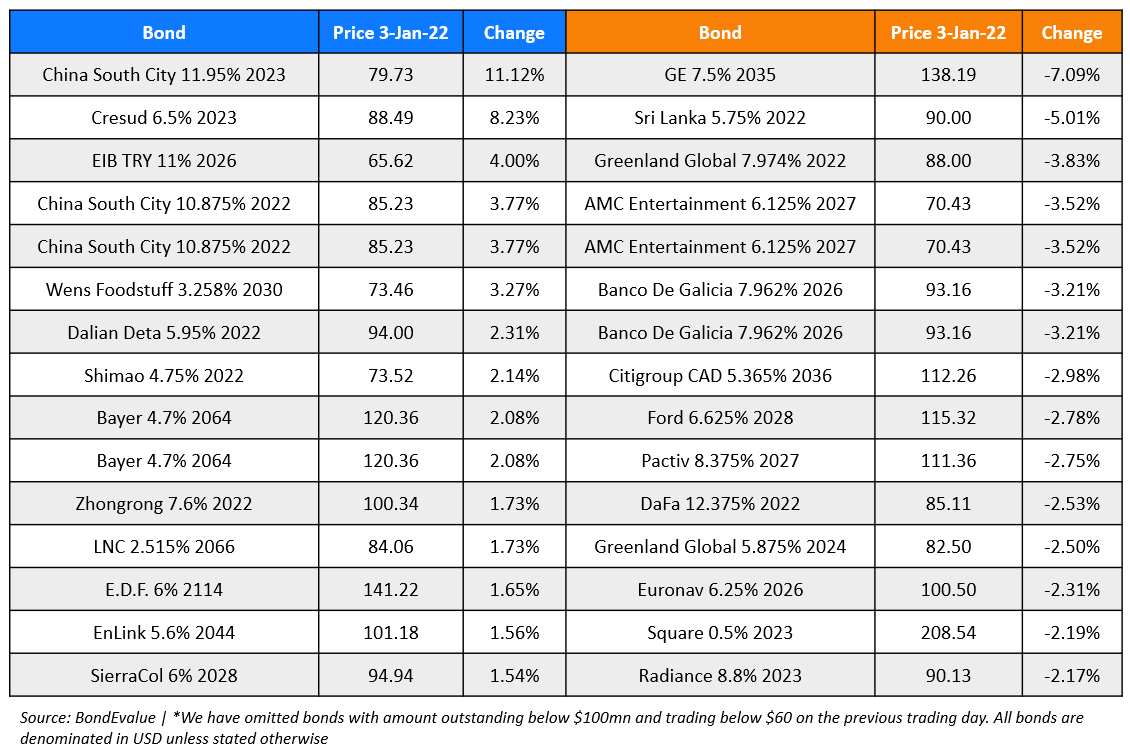

Top Gainers & Losers – 03-Jan-22*

Other Stories

- China to issue record treasury bonds in 2022, guide rates lower

- Credit Suisse may take legal action against SoftBank over Greensill debt -court document

- Tesla Smashes Quarterly Delivery Record With 308,600 Cars

Go back to Latest bond Market News

Related Posts: