This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 19, 2021

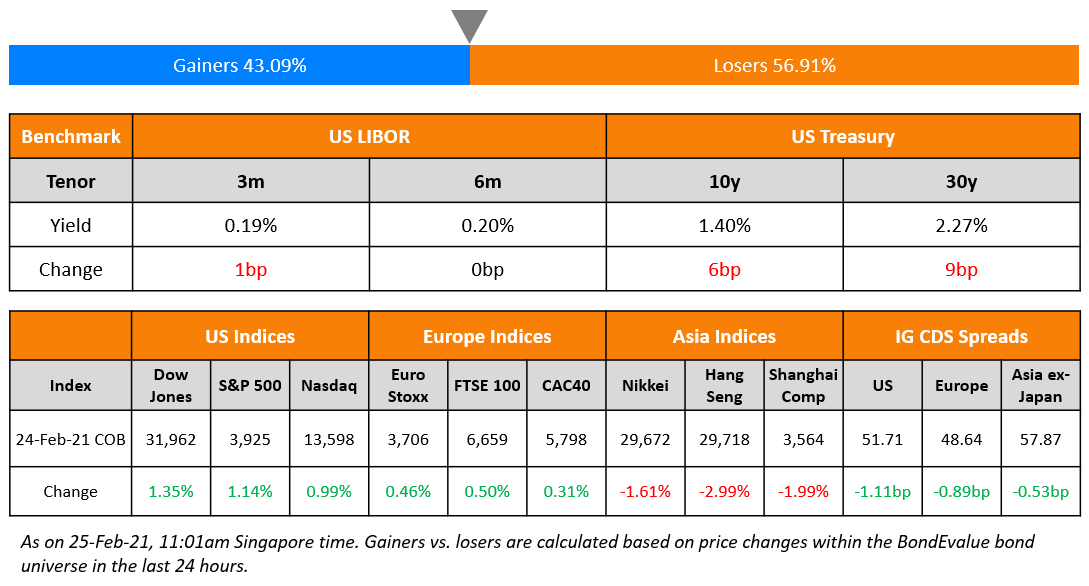

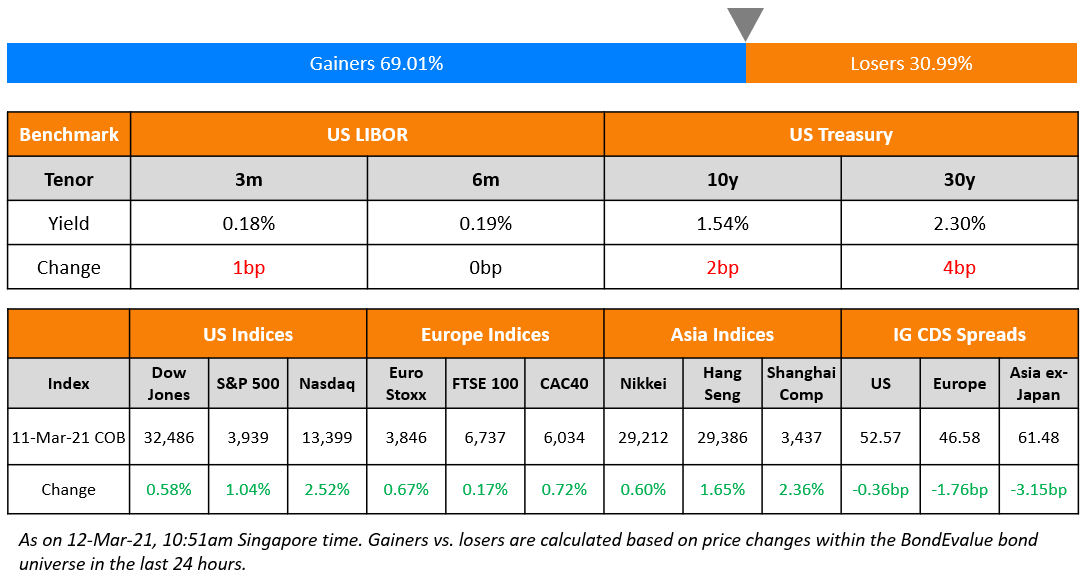

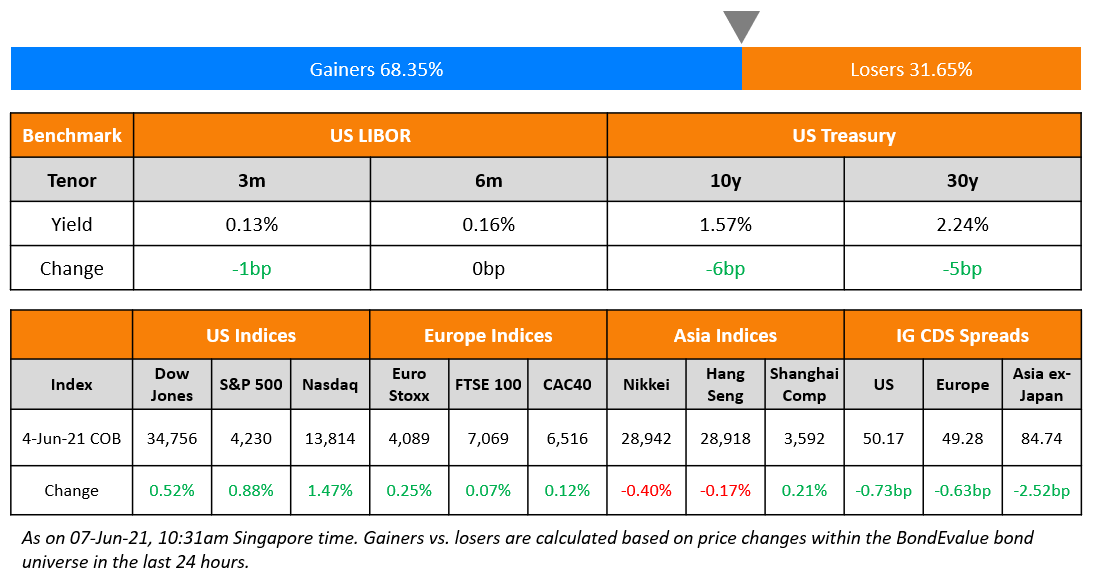

US markets ended on a weaker note on Wednesday after the FOMC minutes indicated that most Fed officials believed that the stimulus program withdrawal would be appropriate to commence later this year – S&P was down 1.1% and Nasdaq was down 0.9%. The fall was led by Energy down 2.4% followed by Healthcare, IT, Consumer Staples, Financials, Materials, Industrials and Real Estate, all down between 1-2%. Consumer Discretionary, up 0.2% was the only sector in green. European markets looked for direction – DAX ended 0.3% higher while CAC and FTSE ended 0.7% and 0.2% lower. Saudi’s TASI and UAE’s ADX closed lower by 0.4% and 0.5% respectively reversing yesterday’s gains. Brazil’s Bovespa, down 1.1% continued its downward rally. APAC stocks started in the red – Singapore’s STI and HSI were down ~1%, and Nikkei and Shanghai were down ~0.6%. US 10Y Treasury yields were flat at 1.26%. US IG and HY CDS spreads widened 0.8bp and 3.3bp. EU Main and Crossover CDS spreads tightened 0.2bp and 1.3bp respectively. Asia ex-Japan CDS spreads were 2.8bp tighter.

The minutes of FOMC’s July meeting were released yesterday. They mentioned that consumer price inflation through May had picked up notably, largely reflecting transitory factors. The minutes stated, “Looking ahead, most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year.” FOMC members broadly agreed that employment has not met their “substantial further progress” benchmark that they would have to see before considering raising rates. At the same time, most participants remarked that this standard had been achieved with respect to the price-stability goal. A few participants noted, however, that the transitory nature of this year’s rise in inflation, as well as the recent declines in longer-term yields and in market-based measures of inflation compensation, cast doubt on the degree of progress that had been made toward the price-stability goal since December.

Advanced Two-Day Course on Bonds | 26-27 Aug

If you are a finance professional or investor who would like to learn about bonds from senior bankers, sign up for our upcoming course with Singapore Management University on 26-27 August.

The course is designed for private bankers, relationship managers and advisors, and covers both theoretic concepts as well as real-world examples. SkillsFuture Singapore Funding is available for Singaporeans and PRs. Click on the link below to sign up.

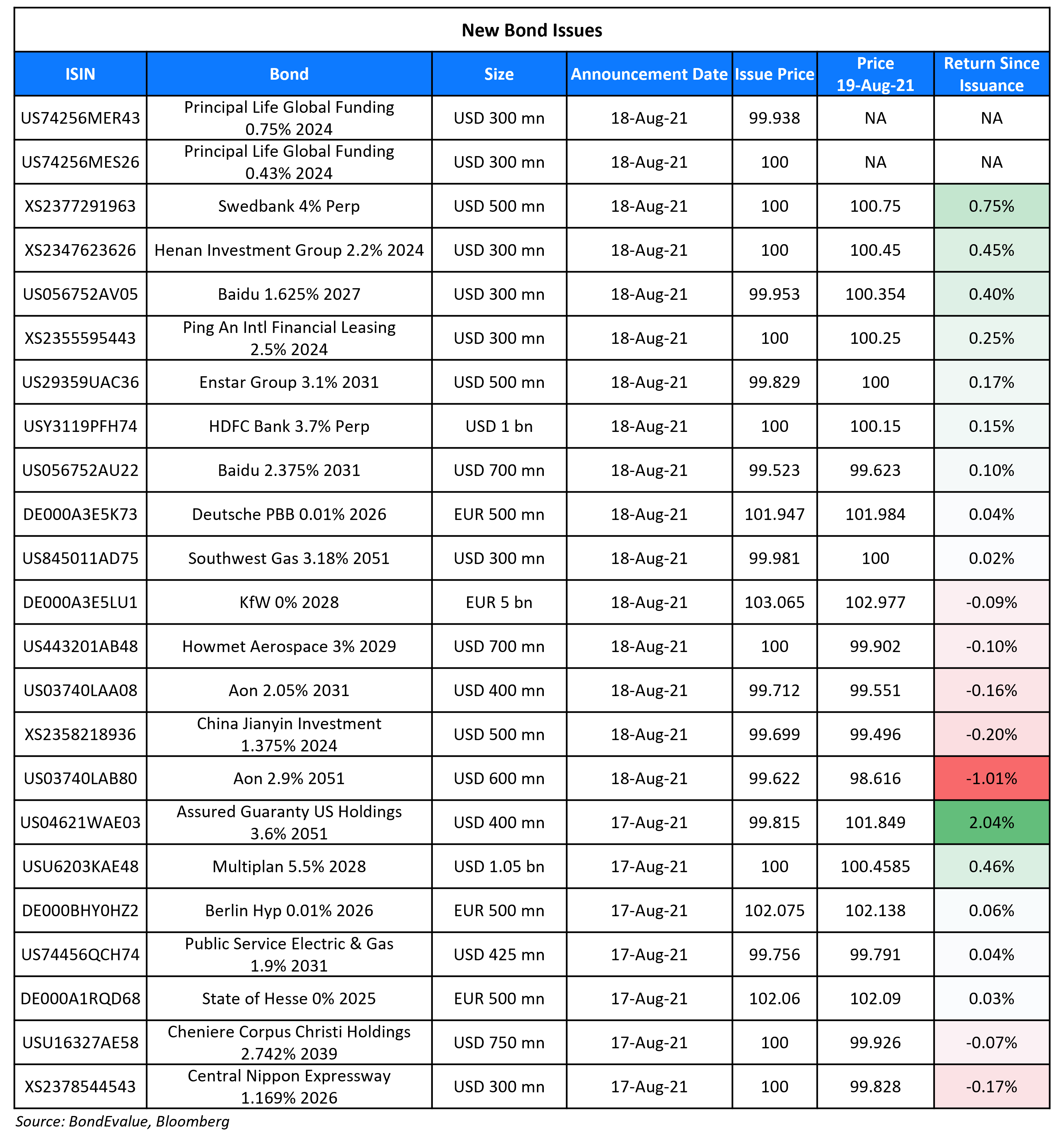

New Bond Issues

- Anhui Transportation Holding Group $ 5Y bond at T+145bp area

- Shandong Gold Group $ 3Y/5Y bond at 3.2%/3.5% areas

HDFC Bank raised $1bn via a debut dollar bond, a PerpNC5 AT1 at a yield of 3.7%, a solid 42.5bp inside the initial guidance of 4.125% area. The bonds have expected ratings of Ba3 and received orders over $4.4bn at final guidance, 4.4x issue size. Final orders are yet to be released. Coupons are fixed at 3.7% until the first reset date of February 25, 2027 and if not called, resets to the 5Y US Treasury + 292.5bp. The bonds will be written down temporarily if the Reserve Bank of India (RBI) deems the bank would fail without a write-down or an injection of public funds, or if the bank’s CET1 ratio drops to 5.5%. The CET1 trigger ratio applies until the end of September, after which it will rise to 6.125% from October 1, when the RBI will implement an additional capital conservation buffer. The AT1s carry a dividend stopper.

HDFC Bank is the largest private sector bank in India with a CET1 ratio of 17.2% as of June 30. Nomura’s Nicholas Yap says that the temporary write-down feature for Indian AT1s is more investor-friendly compared to AT1s in other Asian jurisdictions such as Thailand, which generally have permanent write-downs at CET1 or point of non-viability trigger events (Term of the Day, explained below). IFR reports that HDFC Bank’s new AT1s priced tighter than offshore AT1 issues from some other Asian banks like Thailand’s Kasikornbank’s PerpNC5.5 issued earlier this month at 4%, and Bangkok Bank’s outstanding AT1s, callable in September 2025, that currently yield 3.8%.

Ping An International Financial Leasing raised $300 via a 3Y bond at a yield of 2.5%, a strong 50bp inside the initial guidance of 3% area. The bonds are unrated and received orders over $1.35bn, 4.5x issue size. APAC investors bought all the bonds – banks and financial institutions received 57%, fund/asset managers/hedge funds 26%, corporates 16% and private banks 1%. Proceeds will be used for business development. Ping An International Financial Leasing is a wholly owned subsidiary of Ping An Insurance (Group) Co of China. There is a change-of-control put at 101 if Ping An Insurance (Group) Co of China ceases to own or control at least 75% of the company. The company provides leasing services to various business segments, including corporate finance, urban development, engineering and construction, energy and automobile finance, healthcare and manufacturing.

Baidu raised $1bn via a debut sustainability bond dual-trancher. It raised $300mn via a 5.5Y bond at a yield of 1.634%, 32bp inside the initial guidance of T+115bp area. It also raised $700mn via a 10Y bond at a yield of 2.429%, 37bp inside the initial guidance of T+150bp area. The bonds have expected ratings of A3/A. Proceeds will be used to for general corporate purposes, including repaying debt. An equivalent amount of the net proceeds may be used to fund projects related to green buildings, energy efficiency, clean transportation, renewable energy, pollution prevention and control, or access to healthcare. Baidu is the leader in the Chinese online search market.

Henan Investment Group raised $300mn via a 3Y bond at a yield of 2.2%, 70bp inside the initial guidance of 2.9% area. The bonds have expected ratings of A- and received strong orders of over $5.7bn, 19x issue size. Proceeds will be used for debt refinancing, project construction and fund investment. The bonds will be issued by indirect wholly owned subsidiary Central International Development (BVI) and guaranteed by Henan Investment Group which is the primary investment and financing arm of the Henan provincial government and has businesses in power generation, paper making, cement production, infrastructure construction and financial services.

China Jianyin Investment raised $500mn via a 3Y bond at a yield of 1.478%, 45bp inside the initial guidance of T+150bp area. The bonds have expected ratings of A+ and received orders over $1.85bn, 3.7x issue size. Asian investors took 98% and EMEA 2%. Banks and financial institutions were allocated 88%, fund/asset managers 10%, and central banks/insurers and others 2%.Proceeds will be used for offshore debt refinancing. Subsidiary Xingsheng (BVI) will issue the proposed bonds with a guarantee from JIC Leasing. China Jianyin, which owns an ~81% stake in JIC Leasing, which in turn owns Xingsheng (BVI) will provide a keepwell deed for the bonds. Central Huijin owns China Jianyin, which is managed and controlled by China Investment Corp, China’s sovereign wealth fund. China Jianyin is an investment vehicle used to support and reform China’s financial sector.

New Bonds Pipeline

- Perusahaan Pengelola Asset hires for $ bond

Rating Changes

- Argentine Conglomerate CLISA Upgraded To ‘CCC’ From ‘SD’ By S&P On Exchange Offer Completion; Outlook Positive

- Empresas CMPC S.A. Outlook Revised To Positive By S&P On Stronger Forecasts And Track Record Of Consistent Financial Policy

- KazMunayGas International N.V. Rating Withdrawn By S&P At The Company’s Request

- Fitch Affirms Lebanon’s Long-Term Foreign-Currency IDR at ‘RD’

Term of the Day

Non-Viability Trigger Event

This is an event when the regulators/relevant authorities determine that the company under consideration may be non-viable or may not remain a going concern unless measures are taken to revive its operations given financial difficulties. Once the regulators determine that the company would be non-viable, it would trigger an action where for example, the company would have a right to irrevocably write-off (partly or fully) the outstanding principal of the bonds and make this portion non-payable henceforth. It could also include accrued and unpaid interest/dividends being unpayable. Thus, in this case, the regulator determines that without a write-off, the issuer would become non-viable and without a public sector injection of capital or other equivalent support, the issuer would become non-viable.

Talking Heads

“The only thing that is now clearer than it was prior to the release of the Minutes is that the hawkish crowd that has publicly been calling for an ‘early and fast’ tapering does not represent the majority view.”

Gregg Lemos-Stein, chief analytical officer for corporate ratings at S&P

“It might not come home to roost in the next year or even longer.” “But there are clear signs of risk-taking and a lot of lower-rated issuance. We think this will lead to elevated levels of defaults down the road.” “It averted a much worse downturn for corporates but the trade-off is that it leads to an increase in risk and the possible creation of asset bubbles,” said Lemos-Stein.

Christina Padgett, head of leveraged finance research and analytics at Moody’s

“If you take a forward view, there are many more companies that are fragile,” she said. “They have layered on a lot of debt. What if growth slows beyond what was anticipated when that balance sheet was structured? What if real rates rise or inflation remains higher for longer than we think?” “What may be manageable given today’s outlook could be unsustainable in a higher-cost or lower-growth environment,” Padgett said.

“If you take a forward view, there are many more companies that are fragile,” she said. “They have layered on a lot of debt. What if growth slows beyond what was anticipated when that balance sheet was structured? What if real rates rise or inflation remains higher for longer than we think?” “What may be manageable given today’s outlook could be unsustainable in a higher-cost or lower-growth environment,” Padgett said.

“We are very long-term investors, and we’re so big it is kind of difficult to move around,” he said. “We are in a way also too big for counterparties.” “We are at a situation now where bond yields are extremely low and the stock market is extremely high and so therefore any major change in inflation will hit both parts of the portfolio,” he said. “In the past, it’s been one and not the other. But this time, both can move in the same direction.”

Sonal Desai, chief investment officer for fixed income at Franklin Templeton

“It has been a very solid position for us.” “I would consider it reckless to assume we will magically come back down to very low month-on-month prints,” she said.

Steve Rodosky, a managing director and portfolio manager at Pimco

“As we head into the end of the year, the challenge is, how much of that . . . pent-up demand persists? What goes beyond just transitory, and how does the market perceive what policymakers’ reaction to that will be?”

“As we head into the end of the year, the challenge is, how much of that . . . pent-up demand persists? What goes beyond just transitory, and how does the market perceive what policymakers’ reaction to that will be?”

Robin Xing, chief China economist at Morgan Stanley

It “should make a positive contribution to the economy,” he said.

Zhang Yiqun, a member of the Society of Public Finance of China

“The government is keeping a low profile but is determined, and local authorities are quietly making efforts [to deal with it],” he said.

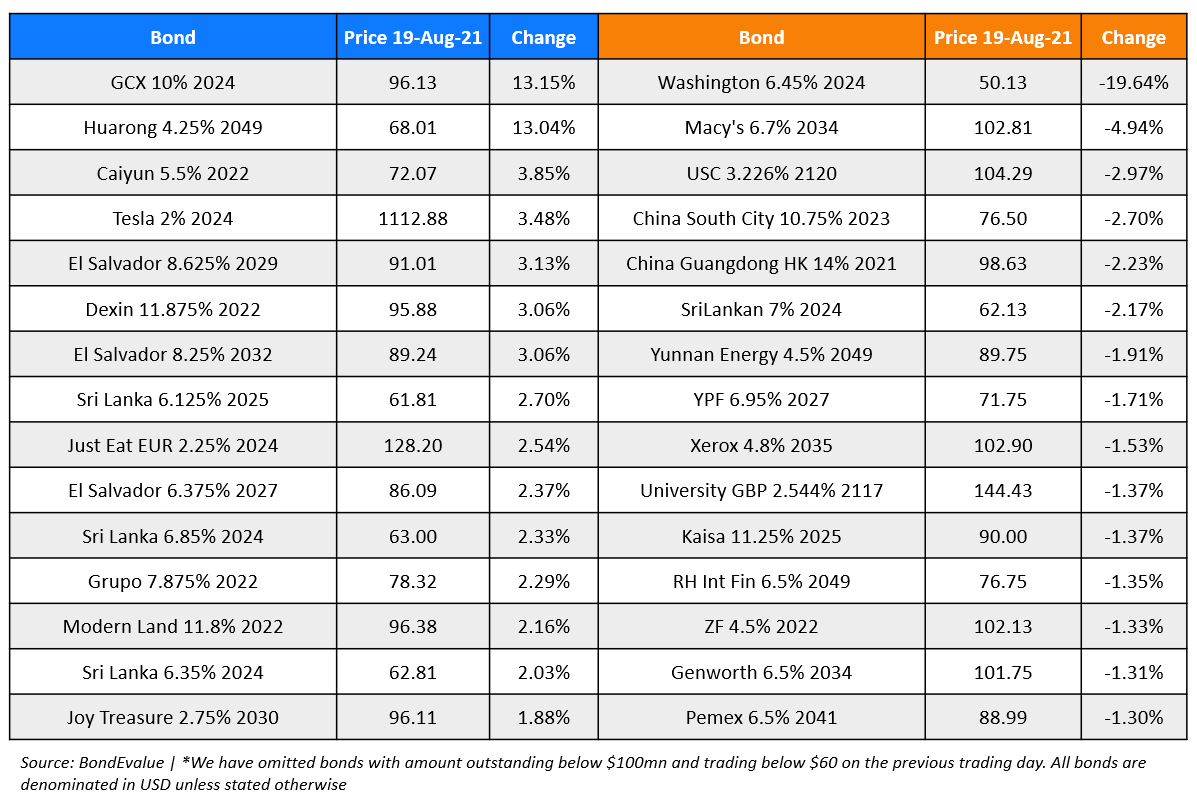

Top Gainers & Losers – 19-Aug-21*

Go back to Latest bond Market News

Related Posts: