This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

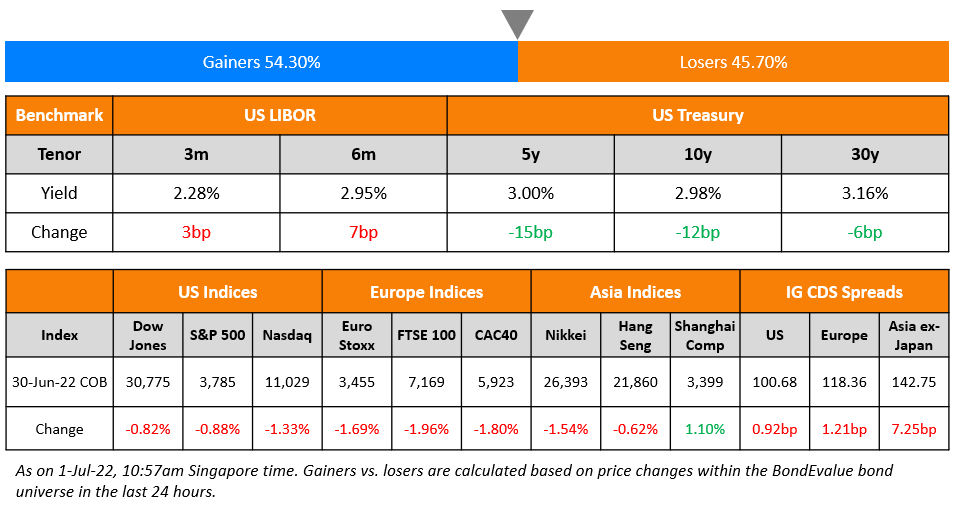

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

May 4, 2023

US Treasury yields dropped sharply across the curve for a second straight day led by the 2Y yield that fell 17bp to 3.80%. The Fed hiked interest rates by 25bp yesterday, to a target range of 5.00-5.25%, in-line with expectations. While they hinted at a possible pause in rate hikes, Fed Chair Jerome Powell said that it would not be appropriate to cut rates, given their view that inflation will take some time to come down. He also said that while there was a need to strengthen supervision, regulation for large banks, the banking system was sound and resilient. The peak Fed Funds Rate was down 2bp and CME probabilities indicate a status quo in the policy rate for the June meeting.

However, concerns over the stability of the financial system continued to weigh on markets as shares of small bank PacWest Bancorp plunged 60% in post-market trading, leading regional banks lower. Sources said that the bank was weighing a range of strategic options, including a sale. US equity indices fell again with the S&P and Nasdaq down 0.5-0.7%. US IG and HY CDS spreads were wider by 1.7bp and 8.3bp respectively.

European equity markets ended slightly higher. European main CDS spreads were tighter by 0.3bp and Crossover spreads tightened 1.7bp. Turkey’s inflation slowed below 50% for the first time in over a year, coming in at 43.7% in April, down from 50.5% in March. Asia ex-Japan CDS spreads widened by 2.6bp. Asian equity markets have opened in the green today.

New Bond Issues

New Bonds Pipeline

- Korea Credit Guarantee Fund hires for $ 3Y Social bond

- Melbourne Airport hires for € 10Y bond

Rating Changes

- First Republic Bank Issuer Credit Rating Lowered To ‘CC’ After Regulatory Closure; Ratings Subsequently Withdrawn

Term of the Day

Technical Recession

A technical recession for economic purposes is defined as one where a country witnessed two consecutive quarters of negative GDP growth/decline in GDP. However in reality, it might not necessarily indicate an actual recession and could be influenced by temporary factors. A actual recession may sustain for a considerable period of time and covers a wide range of declines in economic activity.

Regarding the US economy, Lindsay Rosner, a multi-sector portfolio manager at PGIM said, “Our view is for a technical recession, when is the question mark, but likely Q3/Q4.”

Talking Heads

On Wall Street’s Reaction to the Fed Decision

Scott Ladner, CIO of Horizon Investments

“The fact the stock market is having trouble trying to figure out where to go from here is an indication this was already priced in… going forward, investors want to know how much weight the Fed will put on tightening credit conditions that is emanating from regional bank stresses… For us, this is the end of the hiking cycle”

Eric Winograd, US economist at AllianceBernstein

“Fed still has a tightening bias… still talking in terms of possible rate hikes, which they view as more likely than rate cuts for the time being… tentatively, however, the Fed believes that they may have done enough “

Lindsay Rosner, multi-sector portfolio manager at PGIM

“Our view is for a technical recession, when is the question mark, but likely Q3/Q4… That is why we believe they will have to cut”

On Sovereign Debt Costs to Double by 2025 as Rates Rise – Janus Henderson

“People have become numb to the scale and magnitude of these numbers. We went through almost two decades of heavy borrowing loads not making much of an impact to interest rates.. free lunch is over and the fiscal problem will perhaps be one of the defining problems of the next decade”

On Bank Pain Is Just Getting Started – Ex-Fed President Robert Kaplan

“I’d prefer to do what’s called the hawkish pause, not raise but signal that we are in a tightening stance, because I actually think the banking situation may well be more serious than we currently understand… It is more important to be able to sustain the current rate for an extended period of time, longer than the market thinks, than to get another 25-50 basis points and risk having to cut again”

On Traders Flocking to US Stocks on Earnings – Citigroup

“With the earnings season going into full swing, investors appear encouraged by the recent slew of positive surprises and bullish flows returned to US futures… A stronger-than-expected earnings season for US large caps seemed to overshadow the recent weak macro data releases”

Top Gainers & Losers – 04-May-23*

Go back to Latest bond Market News

Related Posts: