This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 6, 2021

US markets moved higher with the S&P and Nasdaq up 0.6% and 0.8% respectively. Energy, financials and utilities were up more than 1%. Healthcare was down 0.4%. European markets hovered around the highs – CAC and DAX were up 0.5% and 0.3% respectively while the FTSE was flat. Saudi’s TASI and UAE’s ADX were down 0.4% and 0.2% respectively. Brazil’s Bovespa fell 0.1%. Asia Pacific stocks opened flat – Nikkei, HSI, Shanghai and Singapore’s STI were trading within a range of -0.5% to 0.5%. US 10Y Treasury yields rose 4bp to 1.24%. Lufthansa missed earning estimates while Uber beat expectations. US IG CDS tightened 0.8bp and HY spreads tightened 7.4bp. EU Main and Crossover spreads also tightened 0.6bp and 2.6bp respectively. Asia ex-Japan CDS spreads were 0.1bp wider.

US initial jobless claims were in-line with estimates, at 385k in the week ending July 31, lower than 399k in the previous week. The layoffs dropped to their lowest level in more than 21 years last month amid a labor shortage. The Bank of England upheld its monetary policy and maintained the quantitative easing program at £895bn ($1.25tn) but raised concerns on near term inflation.

US initial jobless claims were in-line with estimates, at 385k in the week ending July 31, lower than 399k in the previous week. The layoffs dropped to their lowest level in more than 21 years last month amid a labor shortage. The Bank of England upheld its monetary policy and maintained the quantitative easing program at £895bn ($1.25tn) but raised concerns on near term inflation.

%20(1).jpg?width=1400&upscale=true&name=CapbridgeBonds_Newsletter%20(1)%20(1).jpg) With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

- Hassle-free onboarding in 3 simple steps: SingPass MyInfo onboarding available for Singapore residents

- Curated list of fractional bonds

- Yields of up to 7-9%

- Fully transparent fee structure

- Instant settlement

For a limited time, investors get to enjoy up to 50% rebate off annual fees. Now, enjoy an even lower cost of bond ownership.

New Bond Issues

Gemdale Corp raised $480mn via a 3Y green bond at a yield of 5%, a solid 60bp inside initial guidance of 5.6% area. The bonds have expected ratings of Ba3 and received orders over $1.5bn, 3.1x issue size. Asian investors took 96% of the bonds and EMEA 4%. Fund managers and asset managers received 65%, banks and financial institutions 34% and private banks and corporates 1%. The bonds are issued by Gemdale Ever Prosperity Investment, guaranteed by Famous Commercial (rated Ba3/BB–) and have the benefit of a keepwell deed and a deed of equity interest purchase undertaking from Gemdale Corp. Proceeds will be used for offshore debt refinancing.

Hangzhou Shangcheng District Urban Construction & Comprehensive Development raised $200mn via a 3Y bond at a yield of 2.25%, 50bp inside initial guidance of 2.75% area. The bonds have expected ratings of BBB- and received orders of over $2.1bn. The bonds are issued by wholly owned offshore subsidiary Zhejiang Baron (BVI) and guaranteed by the parent company. Proceeds will be used for debt refinancing.

New Bonds Pipeline

- HDFC Bank hires for $ AT1 Bond

- Perusahaan Pengelola Asset hires for $ bond

Rating Changes

- Wyndham Hotels & Resorts Inc. Upgraded To ‘BB+’ On Recovering Lodging Segment And Credit Measures; Outlook Stable

- Moody’s upgrades Olin’s unsecured notes to Ba2; outlook revised to positive

- Evergrande And Subsidiaries Downgraded To ‘CCC’ By S&P On Escalating Nonpayment Risk; Outlook Negative

- Fitch Revises Outlook on China Merchants Bank’s IDR to Positive; Upgrades VR to ‘bb+’

- Fitch Revises Tereos’s Outlook to Stable; Affirms IDR at ‘BB-‘

- Automaker BMW Outlook Revised To Stable By S&P On Stronger Margin And Cash Flow Prospects; Affirmed At ‘A’

- Fitch Removes Raizen from Negative Watch; Affirms IDR at ‘BBB’

- Fitch Revises China South City’s Outlook to Negative, Affirms IDR at ‘B’

- Banco General And Banco Nacional de Panama Outlook Revised To Negative By S&P On Same Action On Sovereign; Ratings Affirmed

- Embarq Corp. Senior Unsecured Debt Rating Put On CreditWatch Negative On By S&P Acquisition By Apollo Global Management Inc.

- Fitch Places MGM’s IDR on Rating Watch Negative Following MGP Sale Announcementto ‘bb-‘

- Fitch Upgrades Industrial Bank’s Long-Term IDR to ‘BBB’; Outlook Stable; Upgrades VR to ‘b+’

- Fitch Affirms CNCB’s Long-Term IDR at ‘BBB’; Outlook Stable; Upgrades VR to ‘bb-‘

- Fitch Affirms China Everbright Bank’s Long-Term IDR at ‘BBB’, Outlook Stable; VR Upgraded to ‘bb-‘

- Fitch Assigns McLaren Holdings Final ‘B-‘ IDR; Stable Outlook

- Europcar ‘CCC+’ Ratings Placed On CreditWatch Positive By S&P On Potential Acquisition By Volkswagen-Led Consortium

Term of the Day

Real Yields

Real yields refer to the yields or returns on a financial instrument after accounting for inflation. It is approximately calculated by deducting the annual inflation rate from the nominal yields. In an inflationary environment, the purchasing power of every dollar invested reduces by the annual inflation rate. This is why investors consider real yields to be an important metric since it indicates a more “real” indication of return compared to nominal yields. For example, US real yields are negative across all the real yield bond curve – the 10Y real yield is currently at -1.1%

Talking Heads

Antoine Bouvet, ING strategist

A sharp drop in yields was “normally a pretty good sign that markets are predicting a dramatic slowdown in growth or even a recession.” “Don’t be fooled. I’m not discounting 100 per cent of the economic worries but by and large, the reason interest rates have dropped so much is because of central bank interventions.”

Mohammed Kazmi, portfolio manager at Union Bancaire Privée

“Investors are saving their bullets because they have been badly burnt in the last quarter.” “We need to wait for new triggers for markets to sell off again, and we aren’t looking to get in the way of this move over the August period.”

“The wider rate differential between China and US bonds and easing monetary expectations drove offshore investors to buy more Chinese government bonds in July.”

On Huarong investors bracing for long-awaited financial results

Thu Ha Chow, portfolio manager at Loomis Sayles Investments Asia

“Our base case is that there would be some weakness in the results from the impact of Covid, but overall there is sufficient capital for the business to continue as a going concern,” Chow said. “Any restructuring plan will only result if operations and asset quality are much worse than it has been in previous years.”

Chang Wei Liang, macro strategist at DBS Bank Ltd

“We also expect transactions with other Chinese state-owned financial enterprises, as part of a restructuring that leaves Huarong focused only on its core business and fortified with capital reserves,” Chang said. “While the debt-to-equity swap for Huarong Trust is a worrying precedent, debtholders are already braced for difficult treatment, resulting in a muted market.” “With this, the authorities could be more confident in estimating the market impact of the planned restructuring for larger business units of Huarong.”

“The opportunity to find distressed-for-control or to buy good companies with bad balance sheets for pennies on the dollar is now more rare.” “This is a new era of investing whereby we believe investors need to be even more hands-on, structurally creative, and proactive in managing their portfolios.”

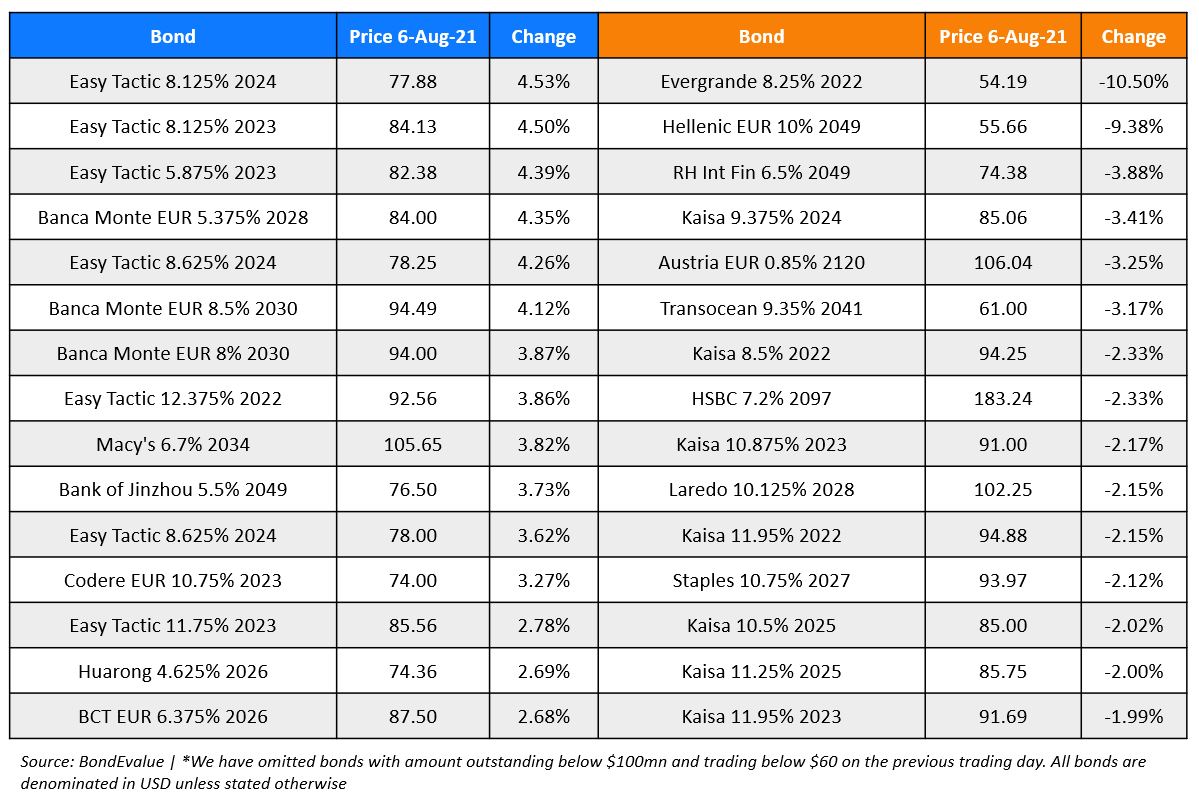

Top Gainers & Losers – 06-Aug-21*

Go back to Latest bond Market News

Related Posts: