This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 29, 2021

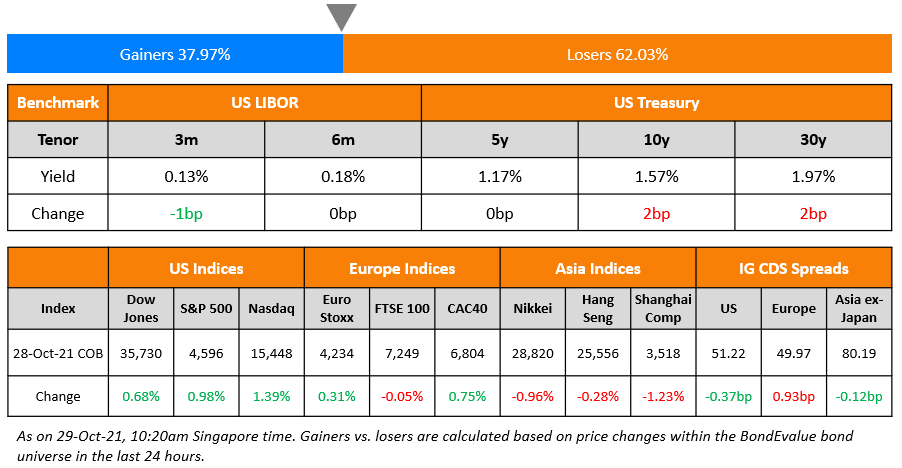

US equities ended higher with the S&P and Nasdaq up 1% and 1.4% respectively. All sectors were in the green with Real Estate, Consumer Discretionary, Industrials and Financials up 1.2-1.5%. US 10Y Treasury yields inched 2bp higher to 1.57%. European stocks were mixed with the DAX and FTSE almost flat while CAC was up 0.8%. Brazil’s Bovespa was down 0.6%. In the Middle East, UAE’s ADX was up 0.2% while Saudi TASI was down 0.4%. Asian markets have opened broadly higher – Shanghai, STI and Nikkei were up 0.2% 0.7% and 0.3% while HSI was down 0.5%. US IG and HY CDS spreads were 0.4bp and 1.9bp tighter. EU Main CDS spreads were 0.9bp wider and Crossover CDS spreads were 3.2bp wider. Asia ex-Japan CDS spreads tightened by 0.1bp.

US Q3 GDP grew at 2% YoY, lower than forecasts of 2.7% and sharply lower from the previous quarter’s 6.7%. The slowing growth was driven by a sharp slowdown in consumer spending (~70% of GDP growth) to 1.6% vs. 12% in Q2. Meanwhile the ECB kept policy unchanged with President Christine Lagarde cooling down rate hike expectations by calling inflation temporary.

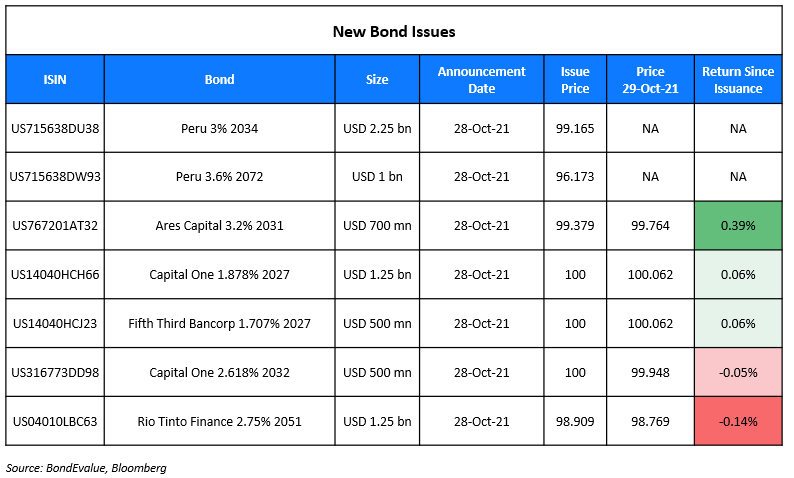

New Bond Issues

Peru raised $4bn via a three-trancher. It raised:

Peru raised $4bn via a three-trancher. It raised:

- $2.25bn via a 12Y sustainability bond at a yield of 3.082%, 30bp inside initial guidance of T+180bp area. The bonds were priced 4bp tighter than its existing 8.75% 2033s that yield 3.12%

- $750mn via a tap of their 3.55% 2051s at a yield of 3.44%, 20bp inside initial guidance of T+170bp area. The tap was priced 15bp wider to its initially issued bonds that yield 3.29%

- $1bn via a 50Y sustainability bond at a yield of 3.77%, 20bp inside initial guidance of T+200bp area

Proceeds will be used to finance general budgetary requirements for fiscal year 2021 and to pre-finance general budgetary requirements for fiscal year 2022. Peru intends to invest proceeds from the sale of the 2034s and 2072s in expenditures that qualify as “eligible green and social categories” under the Sustainable Bond Framework approved by Ministerial Resolution, described under “Recent Developments—Environment—Sustainable Bond Framework”.

Carlyle Group raised $1.01bn via a 5NC2 bond at a yield of 5.375%, 12.5-32.5bp inside the initial guidance of 5.5-5.7%. The bonds have expected ratings of B1/B- (Moody’s/Fitch). Proceeds will be used to fund the purchase of 95.42% stake in Indian IT company Hexaware Technologies. The bonds are issued by special purpose investment holding company CA Magnum Holdings.

Zhoushan City Investment Group raised $100mn via a 3Y bond at a yield of 2.1%, 40bp inside initial guidance of 2.5% area. The bonds have an expected rating of BBB by Fitch. Proceeds will be used for offshore debt refinancing. The company is a Chinese local government financing vehicle in Zhoushan city, Zhejiang province having businesses in infrastructure construction, social-housing development and public utility operations.

Shaanxi Xixian New Area Fengxi New City Development raised $100mn via a 3Y credit-enhanced bond at a yield of 2.55%. The bonds are unrated and have the benefit of an irrevocable standby letter of credit (SBLC) to be issued by Bank of Chengdu. Proceeds will be used for debt refinancing.

New Bonds Pipeline

- State Power Investment Corp hires for $ preference shares bond

- BOCGI hires for $ 5Y green bond issue

Rating Changes

- Anheuser-Busch InBev Outlook Revised To Stable On Steady Deleveraging Trend; ‘BBB+/A-2’ Affirmed

- Moody’s downgrades Sri Lanka’s rating to Caa2; outlook stable

- Mattel Inc. Outlook Revised To Positive From Stable On Good Operating Performance; ‘BB’ Rating Affirmed

- Fitch Affirms Methanex Corporation at ‘BB’; Outlook Revised to Positive

Term of the Day

Social Bonds

These are bonds issued by companies to specifically fund projects with social benefits (new/existing), which should be mentioned in the prospectus. ICMA’s social bond principles set out a standard covering four elements as follows:

- Use of proceeds (range of 6 categories but not limited to them)

- Process of evaluation and selection of social projects

- Management of proceeds

- Reporting

Examples of projects for social bonds include affordable housing, socioeconomic empowerment, essential service access and projects of their like. Citigroup recently priced a 4NC3 social bond.

Talking Heads

On Sri Lanka saying Moody’s latest downgrade to Caa2 untimely

“This untimely rating decision taken prior to the Budget shows that Moody’s has not taken all the relevant information to form its assessment of the country’s performance and the expected path, into account…Even a layman would recognise that the Budget is an important statement for a country as it sets the tone for policy initiatives and structural reforms which could help alleviate the external challenges and improve fiscal settings in the near to medium term.

On a Global bond rout raising worries over the ‘distressed market’

George Saravelos, a strategist at Deutsche Bank

“What is happening now runs beyond macro, it is a plain and simple Value at Risk (VaR) shock driven by positioning and the inability to appropriately calibrate central bank reaction functions in such an uncertain environment”

Stuart Cole, a macro economist at Equiti Capital

“One of the things stopping yields affecting currency markets to the same degree as traditionally is that the outlook for terminal rates still remains low, and hence longer dated instruments are showing less sensitivity to short end moves than usual”

Charles Diebel, head of fixed income, Mediolanum International Funds

“It is a VAR shock but again it’s more a matter of central banks responding to the stimulus they are being given as they all started in the transitory camp but inflation is proving more longer lasting so central banks are responding in a manner that’s true to their DNA and raising rates”

On ECB Seeing Inflation Above 2% Next Year Though Can’t Agree on 2023

Christine Lagarde, ECB President

“While inflation will take longer to decline than previously expected, we expect these factors to ease in the course of next year.”

Bank of France Governor Francois Villeroy de Galhau

Officials won’t consider increases unless projections show inflation at the 2% target within 12 to 18 months

“We will make greater efforts to attract foreign investment, and welcome overseas investors to our bond market on the mainland…We should respond proactively to the concerns of market entities, effectively conduct cross-cyclical adjustments and anchor market expectations to help enterprises survive and thrive.”

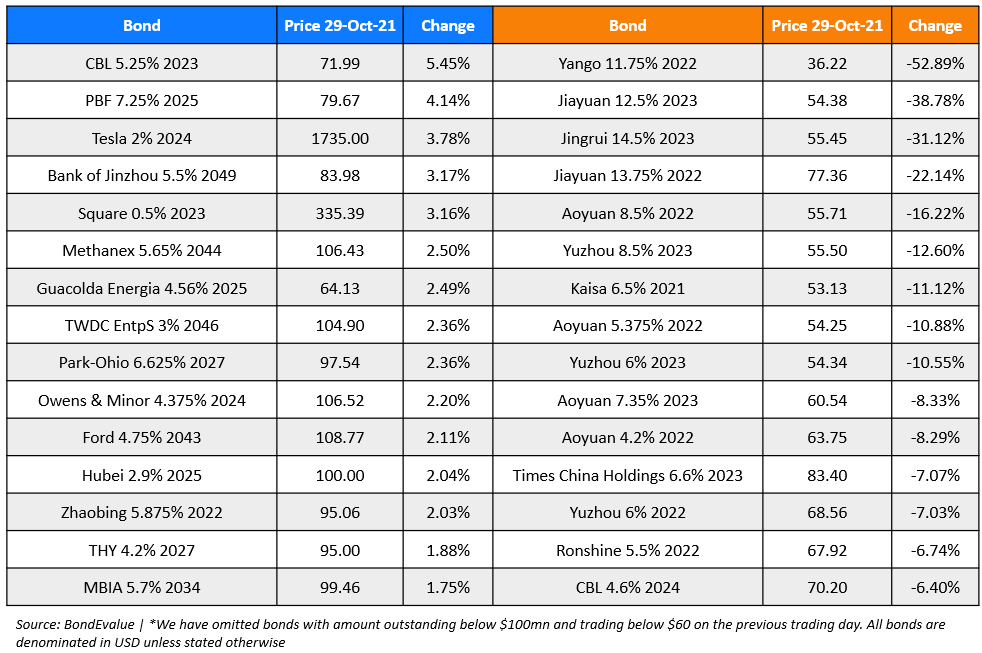

Top Gainers & Losers – 29-Oct-21*

Other Stories

Go back to Latest bond Market News

Related Posts:.png?width=1400&upscale=true&name=IBF_800x400_speakers-%20(1).png)