This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 1, 2021

US equities ended slightly higher on Friday with the S&P and Nasdaq up 0.2% and 0.3% respectively. Healthcare was up ~1% while Real Estate was down 1.2% as sectoral returns were mixed. US 10Y Treasury yields inched 2bp higher to 1.57%. European stocks were mixed with the DAX ending flat, CAC up 0.4% and the FTSE down 0.2%. Brazil’s Bovespa was down 2.1%. In the Middle East, UAE’s ADX was down 0.1% while Saudi TASI was down 0.5% on Sunday. Asian markets have opened mostly higher – Shanghai was up 0.1%, STI up 0.7% and Nikkei up 2.2% while HSI was down 1.2%. US IG and HY CDS spreads were 1.1bp and 4.8bp wider. EU Main CDS spreads were 0.7bp wider and Crossover CDS spreads were 3.8bp wider. Asia ex-Japan CDS spreads widened 0.7bp.

China’s October manufacturing PMI came at 49.2 vs. September’s 49.6 and its non-manufacturing PMI came at 54.2 vs. September’s 53.2. Reuters notes that high raw material prices and softer domestic demand have seen the index contract for a second month. With the Chinese real estate sector taking a hit last month on defaults and concerns on liquidity, the month of November sees over $2bn in onshore and dollar bond payments due across the HY developers as per Bloomberg. Developers with payments in November 2021 include Evergrande, Zhenro, Central China, Yango, Kaisa, Xinyuan, Agile, R&F Properties, Redsun, Rongxin and Zhongliang.

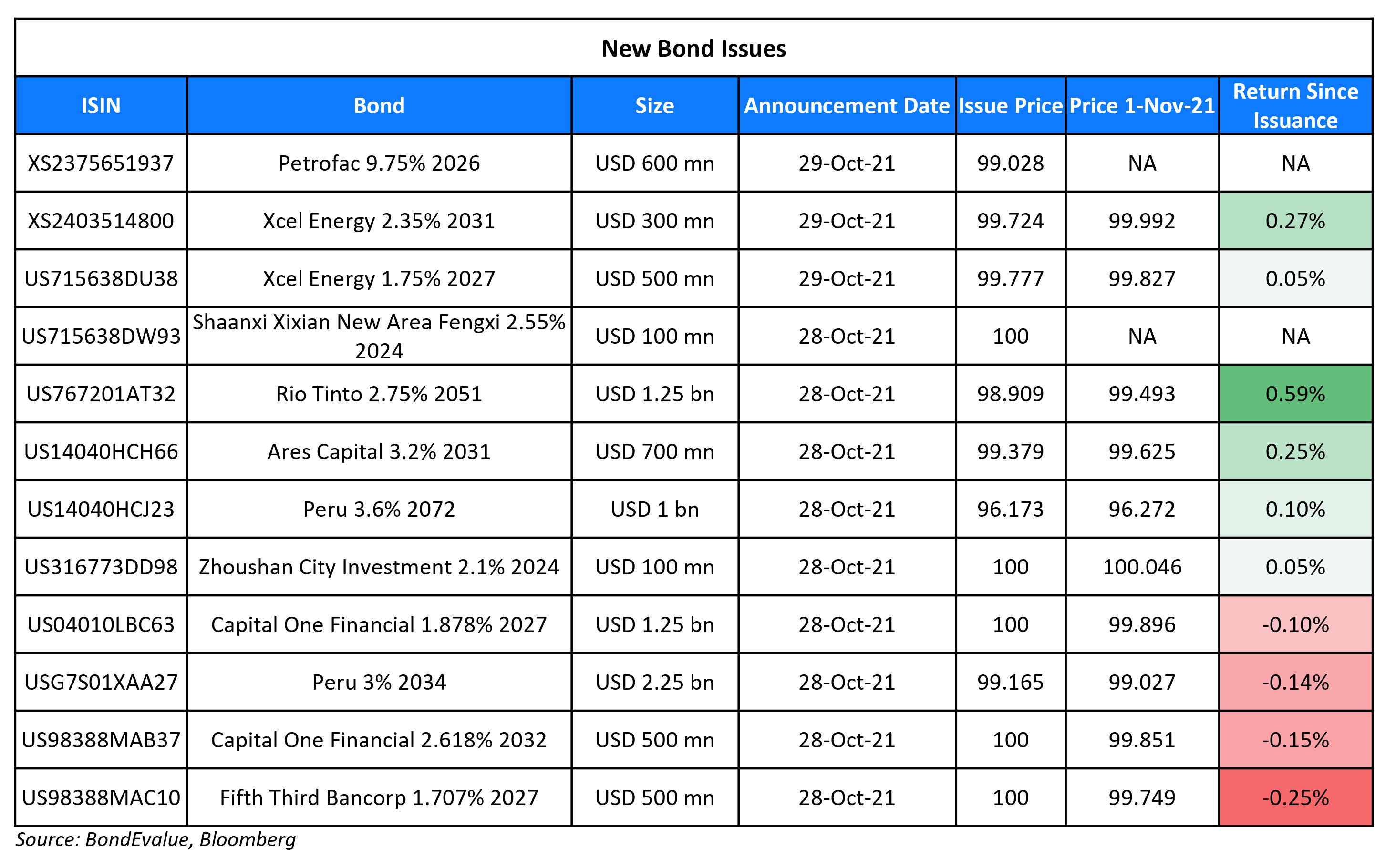

New Bond Issues

-

Yunnan Communications Investment and Construction Group $ 5Y at 3.8% area

New Bonds Pipeline

- China plans for € 3/7/12Y bond

- Plaza Indonesia hires for $ sustainability-linked bond

- State Power Investment Corp hires for $ preference shares bond

- VNET Group hires for $ senior bond

Rating Changes

- Moody’s upgrades INEOS Group to Ba2; stable outlook

- Moody’s upgrades Spirit to Baa2, outlook stable

- Moody’s upgrades Dell’s senior unsecured ratings; outlook positive

- Moody’s downgrades Kaisa to Caa1/Caa2; outlook negative

- Fitch Downgrades Guangzhou R&F and Subsidiary to ‘B-‘; Removes from UCO; on Rating Watch Negative

- Fitch Downgrades Xinjiang Zhongtai to ‘B’; Off RWN; Outlook Stable

- Moody’s downgrades Hidrovias do Brasil’s ratings to B1; stable outlook

- Ineos Group Holdings’ Senior Secured Debt Downgraded To ‘BB’ From ‘BB+’ On Announced Refinancing

- Fitch Revises Slovakia’s Outlook to Stable; Affirms IDR at ‘A’

- Fitch Affirms AerCap at ‘BBB-‘; Rating Watch Negative Removed; Outlook Stable

- Schlumberger Ltd. Outlook Revised To Stable From Negative On Improving Oilfield Services Demand, Ratings Affirmed

Term of the Day

Gearing

Gearing refers to the financial leverage a company takes in the form of debt. While gearing ratio is typically calculated as a company’s debt divided by its equity, it could also be measured as a company’s debt divided by its total assets, since it ultimately shows leverage. In the case of Saudi Aramco, gearing is a measure of the degree to which Aramco’s operations are financed by debt. Aramco defines gearing as the ratio of net debt to net debt plus equity – total borrowings less cash and cash equivalents to total borrowings less cash and cash equivalents plus total equity.

Talking Heads

On corporate credit traders watching for taper announcement in upcoming Fed meeting

Art de Pena, head of loan syndicate and distribution at Mitsubishi UFJ Financial Group Inc

“Smaller LBO financings and more opportunistic trades such as repricings, add-ons, dividend recaps along with the Thanksgiving holiday will likely see issuance drop by 20%-25% from October levels.”

Nicole Hammond, a senior portfolio manager at Angel Oak Capital Advisors

“It’ll probably be a robust month for issuance, but unlikely to be a record breaker after such heavy supply this year and with upcoming holidays.” “But issuers are still going to want to get in front of potential rate increases, and the primary market is open for almost anyone.” “So far, they’ve been pretty good with few disappointments. Companies are talking about supply chain issues, and they’re having to do more to access materials and labor, but it’s not having an impact on margins as demand remains strong,” said Hammond.

On the view that ‘there is no alternative’ to higher-yielding securities amid rising inflation

Charles Diebel, head of fixed income at Mediolanum International Funds

“It’s surprising that stocks have not responded more but with real yields so negative, markets are not too worried.” “If you decompose the forward curve on inflation it’s about the near-term pressure on inflation … so breakevens are moving up but central banks are starting to respond, which means slower activity and meaning inflation will not be a problem in the longer-term.”

Barnaby Martin, head of credit strategy at BofA

“(Low real rates), I think that is having an effect on markets in the sense that it’s creating the ‘TINA’ effect: There Is No Alternative to buy higher-yielding securities.” “The real widening (in stocks and corporate spreads) would come on a recession, not so much rates risk, just because we’ve seen time and time again that if markets begin struggling because of interest rate fears, central banks try to push back dovishly again.”

Chris Iggo at AXA Investment Managers

“It’s typical mid-cycle type of economic conditions, where inflation has gone up a bit, rates have gone up, growth starts to slow, but it’s not a recession yet.”

Matt King, Citi strategist

“Expect tantrums in risk if central banks respond to inflation – and tantrums in bonds if they don’t.”

On Kaisa’s plans to sell property management unit – according to S&P

“In our view, the company will need to rely on asset disposals and successfully improving its capital structure to avoid defaulting on its debt commitments.”

Jessica Chen, co-head of ESG financing for Asia ex-Japan at JPMorgan

“There are a number of factors that will drive growth of ESG bonds from increasing investor demand, greater adoption of ESG strategies by issuers and the need to finance them, to government policy and regulatory requirements.” “We expect to see more harmonisation of local and global standards, greater alignment of ESG financing with issuers’ decarbonisation targets, and more focus on disclosure and transparency from both issuers and investors.”

Sean Kidney, chief executive of the Climate Bonds Initiative

“Capital allocation towards clean energy, resilient infrastructure, green transport, buildings and sustainable agriculture needs to accelerate into the multiple trillions, every year, rippling through both developed and emerging economies.” “US$5 trillion in annual green investment by 2025 is a real economy investment benchmark to judge progress in greening the financial system,” said Kidney.

Gabriel Wilson-Otto, director of sustainable investing at Fidelity International

“There is an enormous gap globally between ambition to mitigate the worst impacts of climate change, and current climate change policies. COP26 could help reduce this gap by driving members to set more ambitious policies for lowering near-term emissions.”

“Argentina is not going to pay the IMF. Argentina is not going to do good macro-micro institutional policies.” “We’re overplaying the IMF program, because at most it’s going to be a temporary Band-Aid to hold the expectations and delay the run on banks for four months. Then everything will play out because you look at these guys … What are you going to expect from this government?” “The best thing with an IMF program [is that] we’ll have four months in which they will pass one review and that’s kind of it.” “We will go back to arrears or quasi-arrears. At the end of the day, it’s not going to be an instrument for good policies and from the flows side it is not going to change anything.”

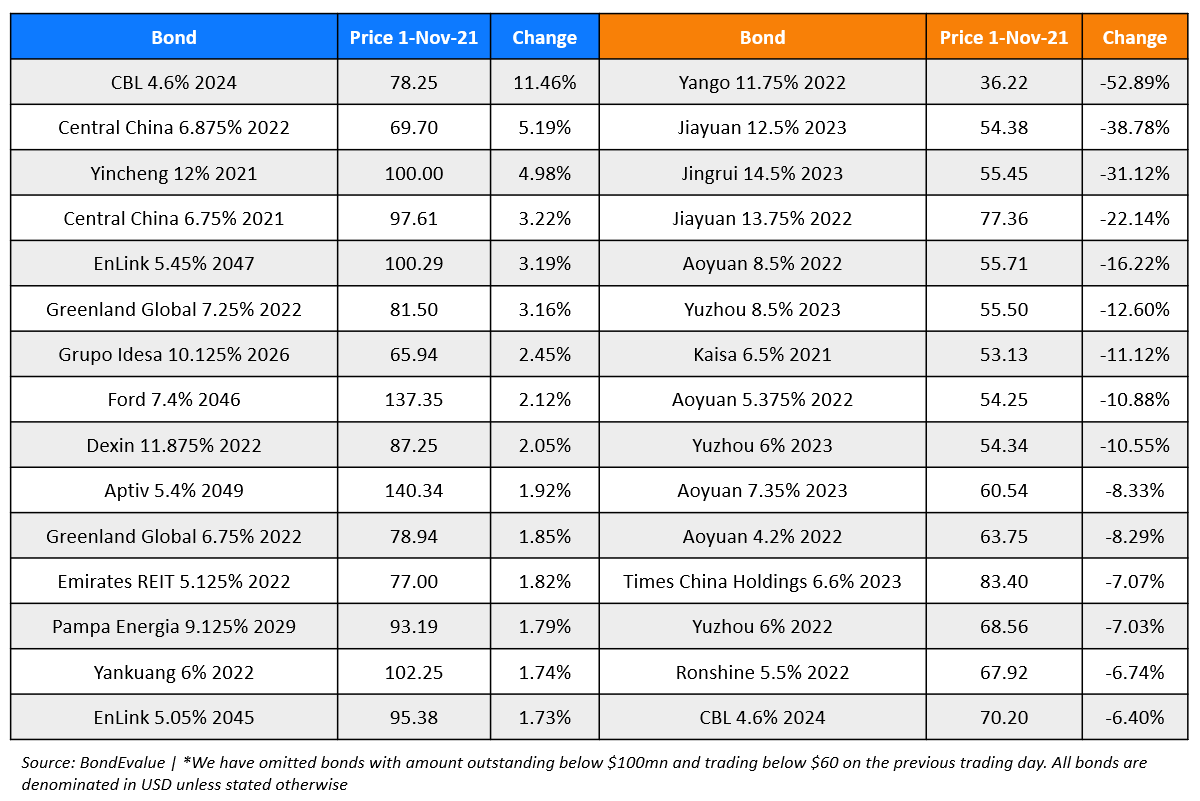

Top Gainers & Losers – 01-Nov-21*

Other Stories

Go back to Latest bond Market News

Related Posts:.png)