This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 11, 2021

US equities ended lower with the S&P and Nasdaq down 0.8% and 1.7% respectively with US inflation shooting higher. Sectoral losses were led by Energy, down 3% as Brent fell over 2.4% and IT down 1.7% respectively. US 10Y Treasury yields shot up 9bp to 1.55%. Europe’s DAX was up 0.2%, CAC ended flat and FTSE was up 0.9%. Brazil’s Bovespa ended 0.4% higher. In the Middle East, UAE’s ADX was up 0.4% and Saudi TASI was up 0.9%. Asian markets have opened broadly mixed – Shanghai was up 0.6%, HSI was down 0.2% each, STI was flat and Nikkei was up 0.8%. US IG and HY CDS spreads were 1.2bp and 5.8bp wider. EU Main CDS spreads were 0.4bp wider and Crossover CDS spreads were 2.8bp wider. Asia ex-Japan CDS spreads tightened 3.9bp.

US CPI jumped to 6.2% YoY in October, well above forecasts of 5.8% and Core CPI was also higher than forecasts of 4.3%, coming at 4.6% YoY. This is the highest inflation print by the US since 1990. US jobless claims for the prior week came at 267k, just shy of expectations for a 265k increase.

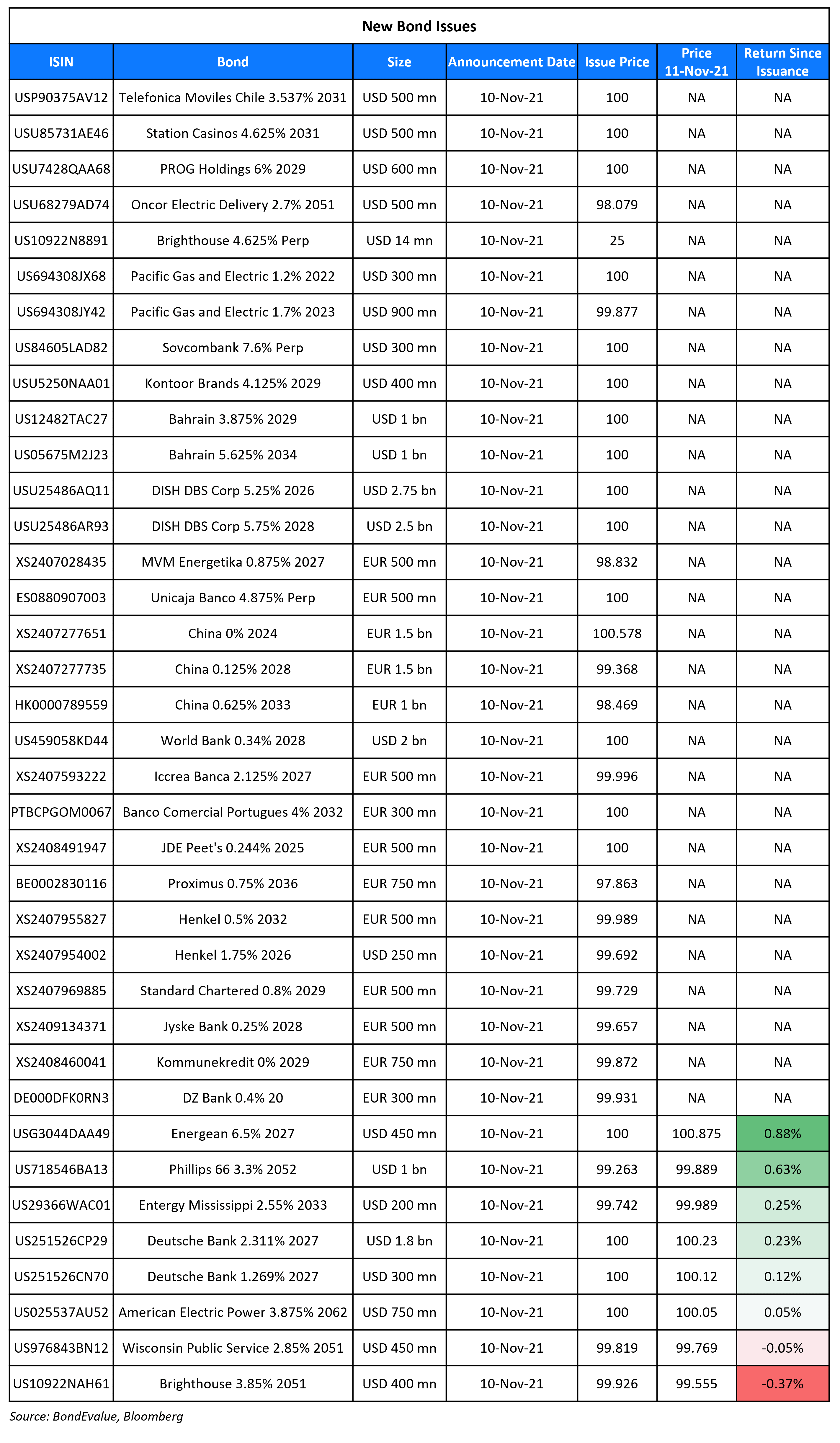

New Bond Issues

- Tai’an Municipality Taishan Finance and Investment Group $ 3Y at 4% area

Standard Chartered raised €500mn via an 8NC7 sustainability bond at a yield of 0.84%, 15bp inside initial guidance of MS+100bp area. The bonds received orders over €1.1bn, 2.2x issue size. Proceeds will be used to finance and/or refinance eligible businesses and projects in accordance with StanChart’s Sustainability Bond Framework dated 7 January 2021.

Bahrain raised $2bn via a two-tranche deal. It raised $1bn via a 7.5Y sukuk at a yield of 3.875%, 37.5-50bp inside initial guidance of 4.25-4.375%, and $1bn via a 12.5Y bond at a yield of 5.625%, 37.5-50bp inside initial guidance of 6-6.125%. The notes have expected ratings of B+ by both S&P and Fitch. Bahrain received combined orders over $4.7bn, 2.35x deal size. The new 7.5Y sukuk was priced well inside the curve, 35.5bp tighter to its 4.25% bonds due January 2028 that yield 4.23% in secondary markets. The bond was also priced 131.5bp tighter to its 6.75% 2029s that yield 5.19%.

Deutsche Bank New York raised $2.1bn via a two-tranche deal. It raised $1.8bn via a 6NC5 bond at a yield of 2.311%, 25bp inside the initial guidance of T+135bp area, and $300mn via a 6NC5 FRN bond at a yield of 1.269% or SOFR+121.9bp vs initial guidance of SOFR-equivalent. The bonds have expected ratings of Baa2/BBB-/BBB+. Proceeds will be used for general corporate purposes.

China raised €4bn via a three-tranche deal.

The 3Y tranche was priced at the lowest credit spreads ever for China as an international issuer. Proceeds will be used for general governmental purposes.

Weihai Wendeng District Bluesea Investment & Development raised $85mn via a 364-day bond at a yield of 6.5%, unchanged from initial guidance. The bonds are unrated. The bonds are issued by subsidiary Rowen International and guaranteed by Weihai Wendeng District Bluesea Investment & Development, which is wholly owned by the Wendeng SASAC in China’s Shandong province and mainly engages in infrastructure construction and affordable housing.

VNET Group has pulled its offer for a 3Y dollar bond due to souring market sentiments caused by negative news on Chinese real estate companies. The issuer initially marketed the deal at initial price guidance of 8.75% area, and had expected ratings of B2/B (Moody’s/S&P). Proceeds were planned to be used to fund capital needs and general corporate purposes. VNET Group is an internet data centre services provider in China, providing hosting and cloud services as well as business VPN services.

New Bonds Pipeline

- Port of Newcastle hires for $ 10Y bond

- Impact Investment Exchange hires for $ 31.5 mn 4Y women’s livelihood bond

- Plaza Indonesia hires for $ 5NC3 sustainability-linked bond

Rating Changes

- Moody’s upgrades Cikarang’s ratings to Ba1; outlook stable

- Moody’s upgrades Yes Bank’s rating to B2 from B3; changes outlook to positive

- Swiss Agrichemical Company Syngenta Upgraded To ‘BBB/A-2’ On Stronger Parential Support; Outlook Stable

- Agile Group Downgraded To ‘BB-‘ On Weaker Sales And Funding Access; Outlook Negative

- Moody’s downgrades Kaisa’s ratings to Ca/C; outlook negative

- Kaisa Group Downgraded To ‘CCC-‘ On Depleted Liquidity; Outlook Negative; Rating Withdrawn At Issuer’s Request

- Chilean Coal-Fired Generator Guacolda Energia Downgraded To ‘B’ From ‘B+’ On Rising Refinancing Risks, Outlook Negative

- Fitch Revises Outlook on Sunac to Stable; Affirms at ‘BB’

- Fitch Revises Outlook on Times China to Negative; Affirms at ‘BB-‘; Removes from UCO

- Moody’s upgrades Jefferies (senior debt to Baa2 from Baa3) and its subsidiaries, outlook stable

- Moody’s changes the rating outlook of four Saudi corporates to stable from negative; affirms ratings following sovereign action

- AusNet Services Ltd. Outlook Revised To Negative On Potential Ownership Change; ‘A-‘ Rating Affirmed

Term of the Day

Japanization

Japanization, also sometimes known as Japanification refers to the combination of low growth, low inflation and low interest rates. This is an issue that has been inherent in Japan since the collapse of its real estate bubble in the early 1990s with some saying that this was due to structural stagnation in economic growth potential caused by an ageing working age population and demographic dividend. “What markets are seeming to price is a return to secular stagnation, or Japanization,”Former U.S. Treasury Secretary Larry Summers said.

Talking Heads

“So the elimination of the condition and therefore the end of the program could — depending on the inflation development — happen in September [next year] or at the end of the year.” “The data analyses we have show that additional lending effects were very low,” he said. “I see no reason for this to keep on running — the economic effect is low.” “Inflation being below 2% at the end of 2022 — I wouldn’t bet a lot of money on that happening.”

“I don’t see how the Fed can afford to wait.” “The pressure is getting awfully high for some sort of response.”

“This is the perfect time to gravitate toward defensive plays, to take profit and to be in the sectors that are strategically positioned toward this volatile market that presents a lot of challenges.”

“China appears to be stress-testing its financial system.” “Only under stress do you know how much off-balance sheet debt there is and how much pressure the system is able to handle. But the danger is that China decides to ease off too late.”

Top Gainers & Losers – 10-Nov-21*

Other Stories

Go back to Latest bond Market News

Related Posts: