This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 23, 2021

US equities ended lower with the S&P and Nasdaq down 0.3% and 1.3%. Sectoral gains were led by Energy, up 1.8% and losses by Communication Services and IT, down over 1.1%. US 10Y Treasury yields jumped 7bp to 1.62% after Jay Powell’s nomination for a second term. European markets were trading mixed with the DAX and CAC down 0.3% and 0.1% while FTSE was 0.4%. Brazil’s Bovespa ended 0.9% lower. In the Middle East, UAE’s ADX was up 0.1% and Saudi TASI was down 2.7%. Asian markets have opened mixed – HSI and STI were down 0.8% and 0.1% while Shanghai and Nikkei were up 0.4% and 0.1% respectively. US IG CDS spreads widened 0.9bp and HY CDS spreads were 5.7bp wider. EU Main CDS spreads were 0.9bp wider and Crossover CDS spreads were 2.6bp wider. Asia ex-Japan CDS spreads tightened 1.3bp.

US President Joe Biden said that he will nominate Jerome Powell for another term as Fed chair. Lael Brainard would be the vice chair of the Fed. Market participants consider this to be a slightly more hawkish (Term of the Day, explained below) signal with the Fed Fund Futures now pricing in a 100% chance of a 25bp rate rise by next June, though it was already over 90% before the announcement.

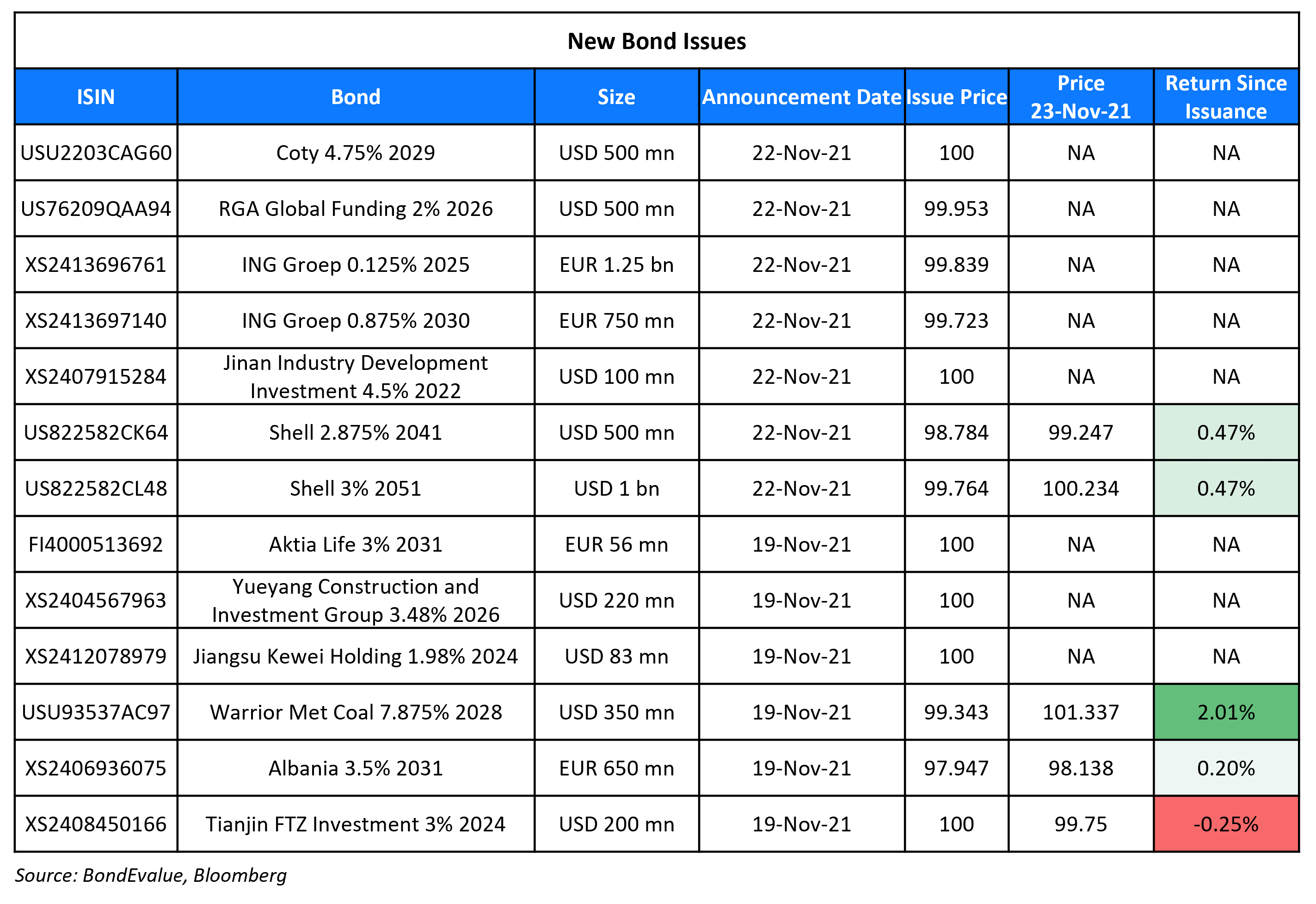

New Bond Issues

- Shandong Energy Group $ 3Y at 3.3% area

- Chengdu Communications Investment Group $ 3Y at 2.7% area

Jinan Industry Development Investment Group raised $100mn via a 364-day bond at a yield of 4.5%, unchanged from initial guidance. The bonds are unrated. Proceeds will be used for project construction, working capital and general corporate purposes. The bonds are issued by wholly owned offshore subsidiary Chanfa International (HK) and guaranteed by Jinan Industry Development Investment Group.

New Bonds Pipeline

- Philippines plans for $ debut green bond

- Del Monte Pacific hires for $ 3NC2 bond

- SGSP (Australia) hires for $ green bond

- East Money Information hires for $ debut bond

- NTT hires for € bond

- Plaza Indonesia hires for $ 5NC3 sustainability-linked bond

Rating Changes

- Moody’s downgrades China Aoyuan’s ratings to Caa2/Caa3; outlook negative

- China Huarong Financial Leasing Downgraded To ‘BB+’ On Declining Strategic Importance To Parent; CreditWatch Developing

- Jingrui Holdings Ltd. Outlook Revised To Negative As Slowing Sales Hinder Deleveraging; ‘B’ Rating Affirmed

- Moody’s changes outlook on Volvo Car’s rating to positive; affirms Ba1 rating

- Ryanair Outlook Revised To Stable From Negative On Air Traffic Recovery; ‘BBB’ Ratings Affirmed

Term of the Day

Hawkish

Hawkish is a term used for a monetary policy stance where policymakers are concerned about inflation or overheating risks and therefore adopt a tightening stance. A hawkish stance could be either in the form of rate increases, asset purchases decreases or even indications on the same relative to market expectations. This is the opposite of a dovish stance which tries to ease financial conditions.

Talking Heads

On T. Rowe Joining Goldman in Betting on China’s Property Debt

Steven Boothe, a portfolio manager for T. Rowe’s global and U.S. investment-grade bonds

“When you have these liquidity issues, you want to be a liquidity provider to the top of the credit quality stack”

Samy Muaddi, portfolio manager of T.Rowe’s emerging markets debt strategy

“We’re starting to finally see the signs that we might get a policy pivot”

On China’s Slowdown Testing the Central Bank Amid Debate Over Easing

Liu Peiqian, China economist at NatWest Group Plc.

“The easing polices will be mild and will be targeted next year… Given the ongoing firm stance on property sector deleveraging, I expect monetary policy easing to be more targeted to support green financing and small and medium-sized enterprises.

David Qu, Bloomberg Economics China economist

[The latest report] indicates the PBOC intends to cushion the impact of potential liquidity tightness stemming from the Fed’s upcoming taper and following tightening… This reflects the current state of China’s economy — sluggish growth means further monetary easing is warranted.”

On Erdogan Defending the Pursuit of Lower Interest Rates as Lira Sinks – Turkish President Erdogan

“We were either going to give up on investments, manufacturing, growth and jobs, or take on a historic challenge to meet our own priorities… We’re pleased to see that the central bank’s policy rate is being kept low…There is a “game” being played against Turkey by those using interest rates, the currency’s exchange rate and inflation…We know quite well what we’re doing with the current policy, why we’re doing it, and the kind of risks it entails and what we’ll achieve at the end”.

On Bond investors being numb to risk – Bond market veteran Dan Fuss

“It scares me when I see what is given up in terms of natural prudence and caution… We’ll have to wait to see how things play out, but the reach for yield has overridden the fear factor… I’m optimistic, but you have to keep your wits about you. The bond market is not as safe and secure as it used to be… Portfolio managers looking at this market are not dumb, they are aware of the risks. But if you run a high-yield fund and retreat to Treasuries then you’re going to underperform”

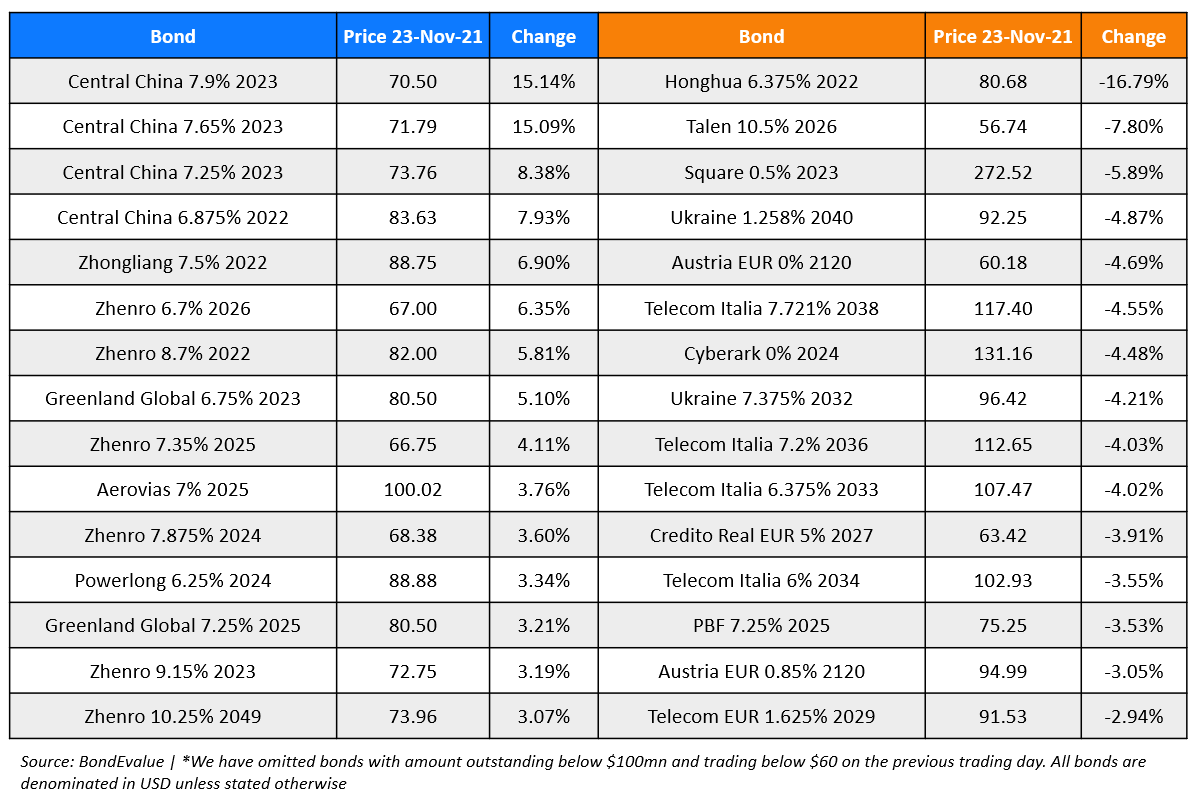

Top Gainers & Losers – 23-Nov-21*

Other Stories

Go back to Latest bond Market News

Related Posts: