This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 3, 2021

US equity markets recovered yesterday with the S&P and Nasdaq closing 1.4% and 0.8% higher respectively. All sectors were in the green led by Industrials, Energy, Financials and Real Estate, up over 2.7% each. US 10Y Treasury yields moved 1bp lower to 1.42%. The US Treasury curve continues to flatten with the 2s10s at a 11-month low of 80.7bp. European markets were lower with the DAX, CAC and FTSE down 1.4%, 1.3% and 0.6% respectively. Brazil’s Bovespa saw a sharp 3.7% rally. In the Middle East, UAE’s ADX was closed while Saudi TASI was up 0.3%. Asian markets have opened mixed – Shanghai was up 0.6%, and STI was up 0.3% while HSI and Nikkei were down 0.8% and 0.2% respectively. US IG CDS spreads tightened 1.3bp and HY CDS spreads tightened 9.4bp. EU Main CDS spreads were 1.1bp wider and Crossover CDS spreads were 2.7bp wider. Asia ex-Japan CDS spreads tightened 1.05bp.

US jobless claims for the prior week came at 222k, lower than forecasts of 240k. Bloomberg reports that Brazil’s economy has fallen into recession as extreme weather conditions, high interest rates and inflation cut short its recovery from the pandemic. Its GDP fell 0.1% in July-September after posting a revised decline of 0.4% in Q2, thereby two consecutive quarters of negative GDP growth for South America’s largest economy.

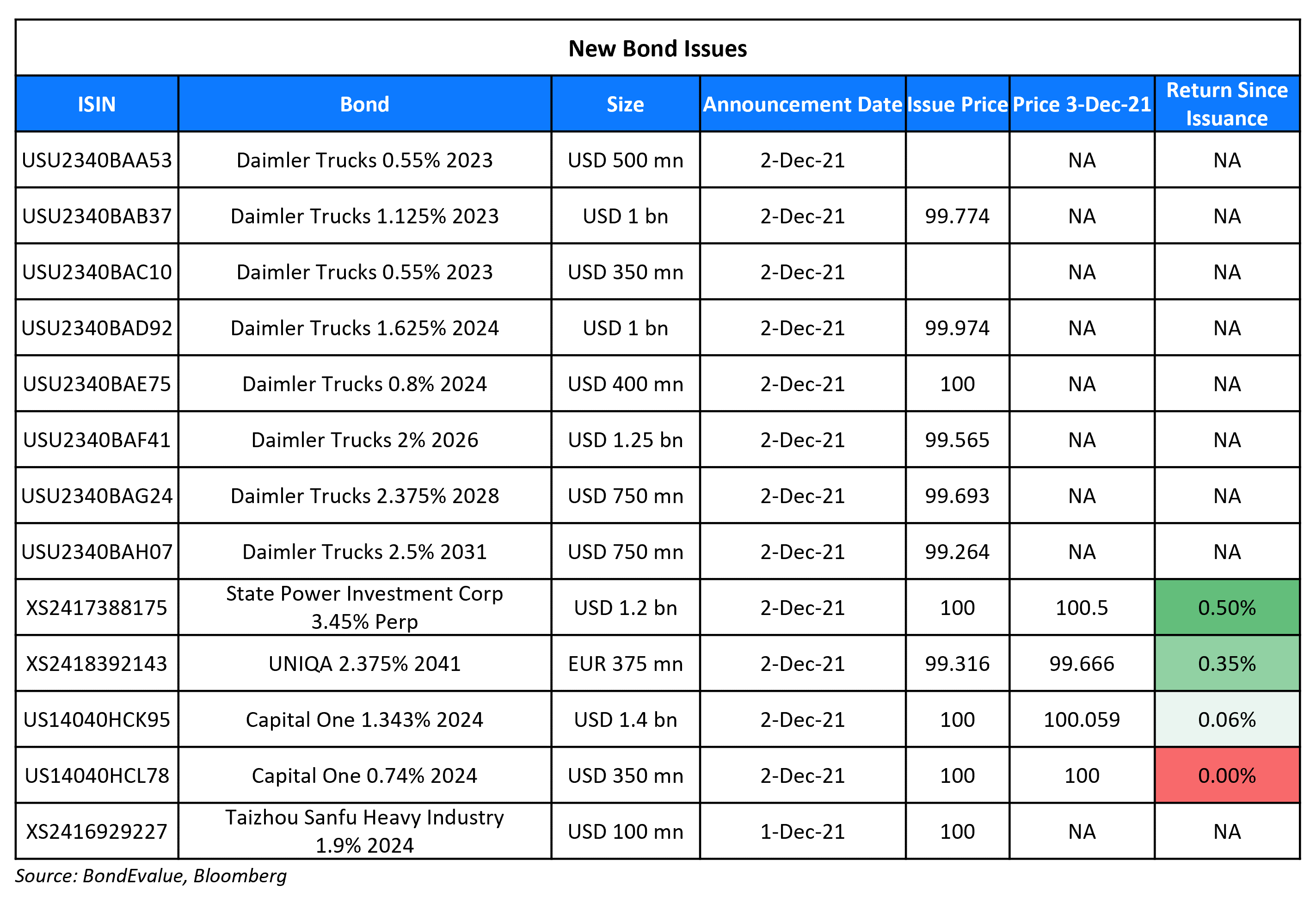

New Bond Issues

State Power Investment Corp (SPIC) raised $1.3bn via PerpNC3.5 preference shares at a yield of 3.45%, 40bp inside initial guidance of 3.85% area. The bonds have expected ratings of Baa1 (Moody’s), and received orders over $1.7bn, 1.3x issue size. If not called on the first call date, the dividend will step-up by 300bp. The preferreds carry both a dividend stopper and pusher, and a change of control put at 101 before the first call date and at par. SPIC is one of the five largest state-owned electricity producers in China. Asia bought 99% while Europe took 1%. Banks and financial institutions bought 35%, asset managers and fund managers 34%, corporates and insurers 18%, and private banks took the remaining 13%. The new bonds are priced 45bp wider to its existing 3.38% Perps callable in October 2024 that currently yield 3%.

Olympus Corp raised $500mn via a 5Y bond at a yield of 2.143%, 17bp inside initial guidance. The bonds have expected ratings of Baa2/BBB+ (Moody’s/S&P). Proceeds will be used for general corporate purposes. Olympus is a global manufacturer of medical devices such as endoscopy and therapeutic equipment, medical products and microscopes.

Taizhou Sanfu Heavy Industry Group raised $100mn via a 3Y bond at a yield of 1.9%. The bonds are unrated. Proceeds will be used for working capital and investment. The bonds are issued by offshore subsidiary Victory Ovation, guaranteed by Taizhou Sanfu Heavy Industry Group, and are supported by a letter of credit from Hua Xia Bank Nanjing branch.

New Bonds Pipeline

- Yantai Guofeng Investment Holdings Group hires for $ bond

-

Greenko hires for $ 7Y bond

- SGSP (Australia) hires for $ green bond

-

Del Monte Pacific hires for $ 3NC2 bond

Rating Changes

- Fitch Downgrades Hongkun to ‘CCC+’ on Refinancing Risk, Removes UCO

- Moody’s revises Honghua’s outlook to negative on slow deleveraging amid business volatility

- Chesapeake, VA Debt Outlook Revised To Stable From Negative On Recovery Of Activity Trends; ‘BBB+’ Rating Affirmed

- Fitch Revises Turkey’s Outlook to Negative; Affirms at ‘BB-‘

- Dominican Republic Outlook Revised To Stable From Negative; ‘BB-‘ Ratings Affirmed

- Fitch Withdraws Yango’s Ratings

Term of the Day

Eurodollar Futures

Eurodollar futures are short-term interest rate contracts for traders to express views on future interest rate moves. The pricing of Eurodollar futures is linear and calculated as 100 minus the expected 3m LIBOR. Hence, if a trader expects interest rates to move higher, he/she will short Eurodollar futures and if a trader expects rates to move lower, he/she will go long Eurodollar futures. Eurodollar futures are among the most liquid contracts in the world with deep liquidity for contracts over five years out and are also used to hedge other positions. Bloomberg notes that short-term interest-rate traders are pricing in a substantially lower peak for the Fed’s policy rate than the central bank expects.

Talking Heads

On Pimco Credit CIO Says Fed Is Behind the Curve Fighting Inflation

“We’ve been very concerned that the Fed has frankly been behind the curve and needed to act more quickly… I don’t think it’s going to be so much of a dramatic event for markets. I think the stock market, the housing market and consumers can handle it… Let’s say labor force participation does not pick up. Then we could have an even bigger issue. Then, instead of the Fed tapping on the breaks, we might see them slam on the breaks. That would cause a lot of volatility. That’s the biggest risk.”

On Bond market flashes warning sign over global economic growth

Mike Riddell, Allianz Global Investors

“Big jumps in energy prices normally cause a growth slowdown six months later. Next year was starting to look grim even before this new variant cropped up.”

Mohammed Kazmi, a portfolio manager at Union Bancaire Privée

“Previously, central banks were using Covid concerns to remain dovish. But this time around we’ve reached the point on the inflation front, at least for the Fed, where they’re not going to do that any more.”

Iain Stealey, CIO fixed income at JPMorgan Asset Management

“Without the Omicron news this would have been bearish for bonds. It’s been a tough few weeks, but our view remains that we will get through this latest concern around Covid a retest those March highs.”

On IMF Warns of Economic Collapse in Poor Nations Without Debt Fix

IMF Managing Director Kristalina Georgieva and Ceyla Pazarbasioglu, head of the fund’s strategy, policy, and review department

About 60% of the world’s poorest countries are at high risk or are already in debt distress, double the share in 2015. “low-income countries will find it increasingly difficult to service their debts… We may see economic collapse in some countries unless G-20 creditors agree to accelerate debt restructurings and suspend debt service while the restructurings are being negotiated.”

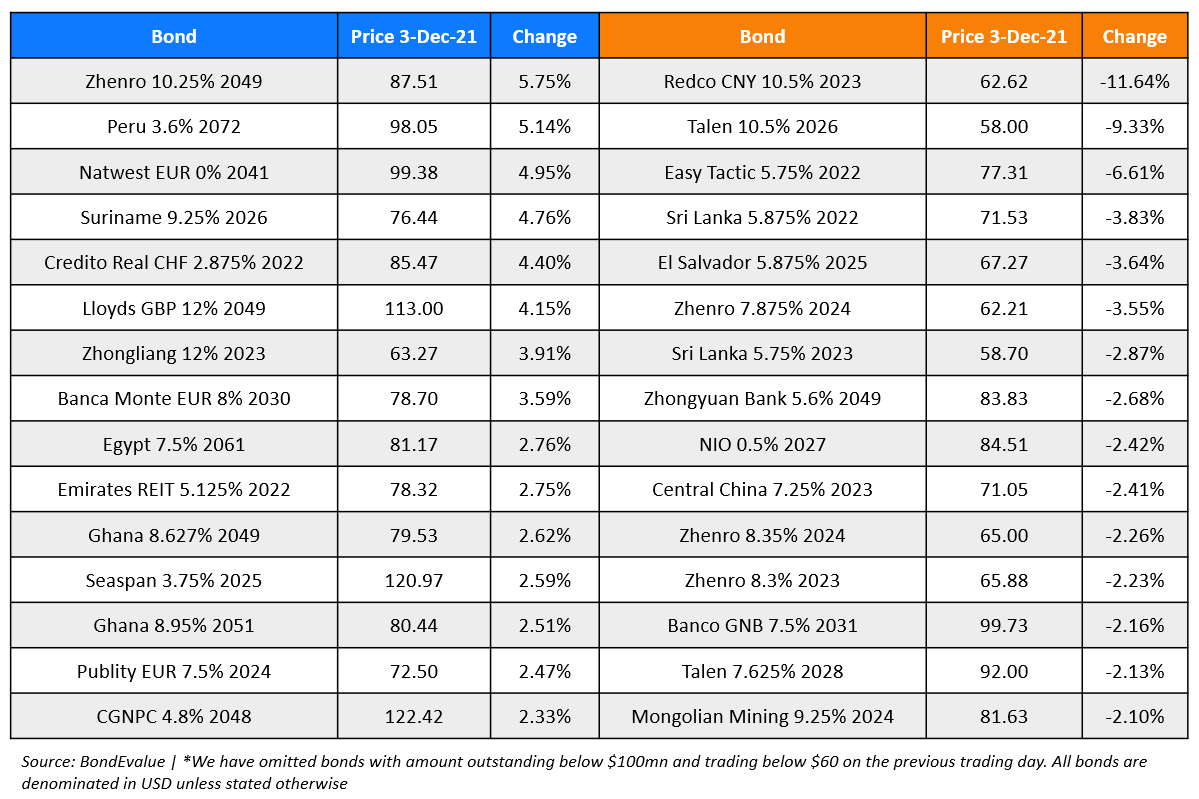

Top Gainers & Losers – 03-Dec-21*

Go back to Latest bond Market News

Related Posts: