This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 10, 2021

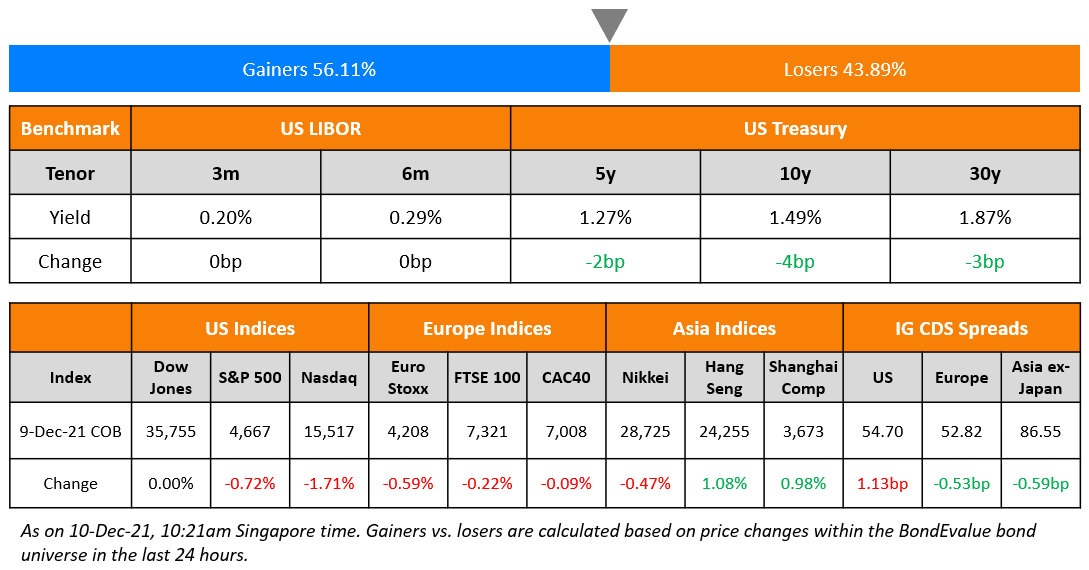

US equity markets dropped with the S&P and Nasdaq closing 0.7% and 1.7% lower. Most sectors were in the red led by Consumer Discretionary, Real Estate and IT, down over 1% each. US 10Y Treasury yields moved 4bp lower to 1.49%. European markets were lower too with the DAX, CAC and FTSE down 0.3%, ).1% and 0.2%. Brazil’s Bovespa was down 1.7%. In the Middle East, UAE’s ADX was down 0.8% while Saudi TASI was down 0.5%. Asian markets have opened lower – Shanghai, HSI, STI and Nikkei were down 0.3%, 0.5%, 0.2% and 0.4% respectively.US IG CDS spreads widened 1.1bp while HY CDS spreads widened 4.7bp. EU Main CDS spreads were 0.5bp tighter and Crossover CDS spreads were 2.1bp tighter. Asia ex-Japan CDS spreads tightened 0.6bp.

US initial jobless claims for the prior week fell to a new 52Y low of 184,000 vs. forecasts of 215k. China increased its forex reserve requirement ratio for banks to 9% from 7% in an effort to contain the rally in its currency.

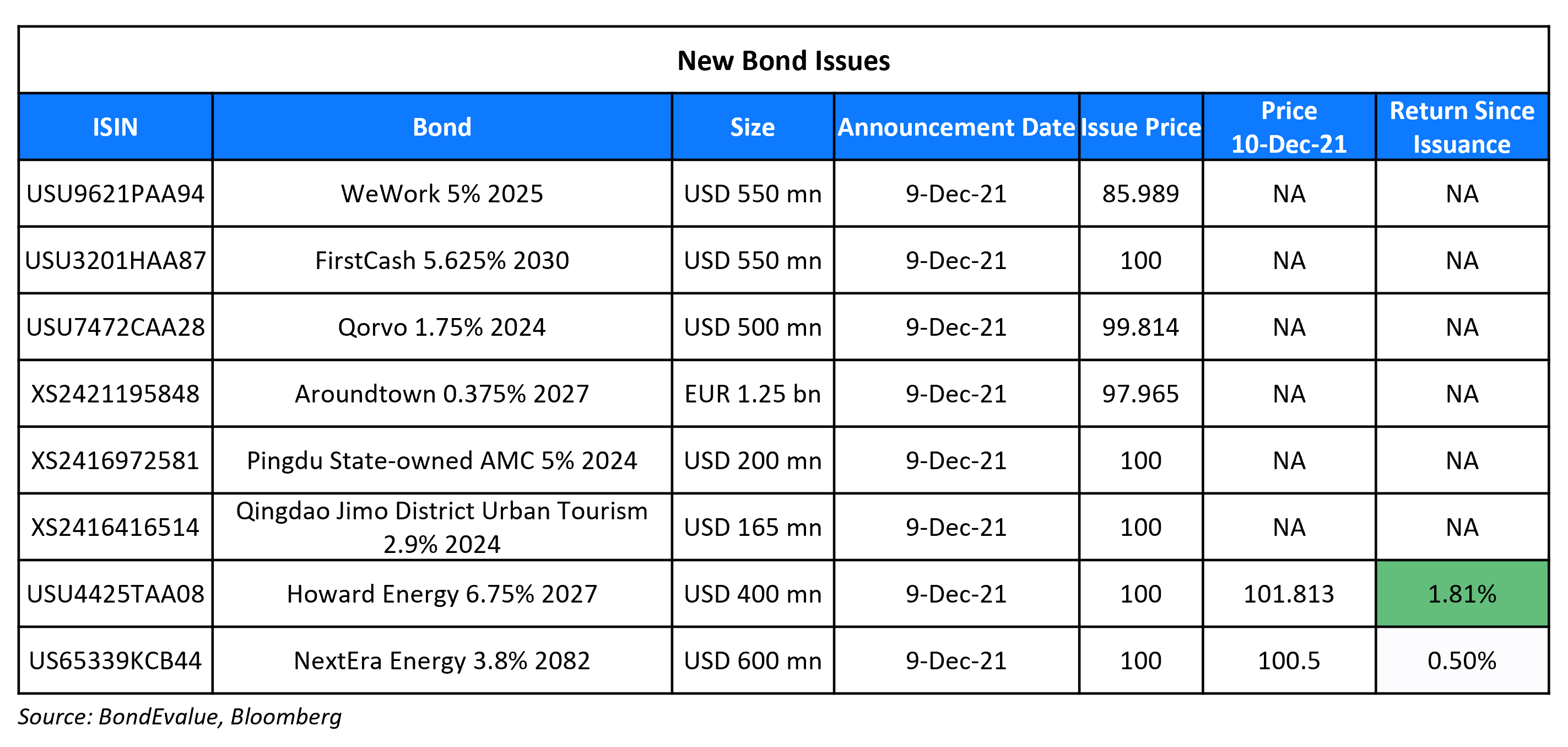

New Bond Issues

- Jingjiang Port capped $98mn 3Y SBLC-backed bond at 2.1% area

SoftBank’s sale of $550mn of WeWork’s bond maturing in 2025 was priced at 85.989 cents on the dollar at a yield of 9.75%, 12.5bp inside initial guidance of 9.875% area. The bonds have expected ratings of CCC+/CCC-. Proceeds will not go to WeWork from this sale. This is a secondary sale by a Softbank affiliate of $550mn bonds issued by WeWork Cos / WW Co-Obligor Inc. SoftBank had purchased $2.2bn worth of these 5% bonds maturing in 2025 from WeWork in July 2020.

Qingdao Jimo District Urban Tourism Development and Investment raised $165mn via a 3Y bond at a yield of 2.9%, 30bp inside initial guidance of 3.2% area. The bonds have expected ratings of BBB-. The proceeds will be used for project development and working capital. The bonds are issued by indirectly wholly-owned subsidiary Jingming Yuantong Development Investment (BVI) and guaranteed by Qingdao Jimo District Urban Tourism Development and Investment.

Pingdu Construction Investment Development raised $200mn via a 3Y bond at a yield of 5%, 30bp inside initial guidance of 5.3% area. The bonds are unrated. Proceeds will be used for project construction and working capital purposes. The bonds are guaranteed by Pingdu Construction. Both the issuer and guarantor are local financing vehicles of Pingdu, a county-level city of Qingdao in Shandong province.

Ningbo Nanbin Group raised $100mn via a 3Y bond at a yield of 3.5%. The bonds are unrated. Proceeds will be used for financing certain projects and working capital. The bonds are issued by Yi Hong International Development and guaranteed by Ningbo Nanbin.

New Bonds Pipeline

- SGSP (Australia) hires for $ green bond

Rating Changes

- Moody’s upgrades United States Steel’s CFR to Ba3; outlook stable

- Fitch Downgrades Evergrande and Subsidiaries, Hengda and Tianji, to Restricted Default

- Fitch Downgrades Kaisa to Restricted Default After Missing Payment

Term of the Day

Value at Risk (VaR)

Value at Risk (VaR) refers to a statistical risk measure which quantifies the maximum dollar loss that can be made over a given time horizon at a pre-defined confidence level. For example, if a portfolio’s 1-Month VaR is $1mn at a 95% confidence-level, then it implies that there is 95% confidence that over the next one month that the portfolio will not lose more than $1 million.

FT noted that Trafigura’s stellar results came with higher risks as measured by its Value at Risk (VaR); its average 1-Day VaR stood at $47.9mn in 2021 from $26.4mn in 2020.

Talking Heads

On AMLO’s $20 Billion of Pemex Aid Leaves Bondholders Wanting More

Alejandro Di Bernardo, a strategist at Jupiter Asset Management

“The capital injection actually doesn’t move the needle that much… For the bonds to compress significantly over sovereign, I think we need to see a concrete action plan from the government.”

Jens Nystedt, a senior portfolio manager at EMSO

“Had AMLO not expressed such support for Pemex, spreads would likely have widened much more”

Luis Maizel, co-founder of LM Capital Management

“They’re kicking the can a little bit further. Investors “need to see that somehow Pemex can find a way to lower its needs for money and start making money.”

Bitcoin Investing Giant Slamming Bond Markets as a ‘Ponzi Scheme’ – Dan Morehead, CEO of Pantera Capital

Bond investors “are going to get absolutely destroyed when the Fed stops manipulating the bond market… Governments should stop obsessing about Bitcoin and look inward. The biggest Ponzi scheme in history is the U.S. government and mortgage bond market – 33 trillion-with-a-T dollars – all being driven by one non-economic actor with a dominant position who is trading based on material, non-public information… The Bitcoin market is way too big to be manipulated”

On Evergrande Crisis to Be Dealt With by Market – PBOC’s Yi

“The rights and interests of creditors and shareholders will be fully respected in aaccordance with their legal seniority

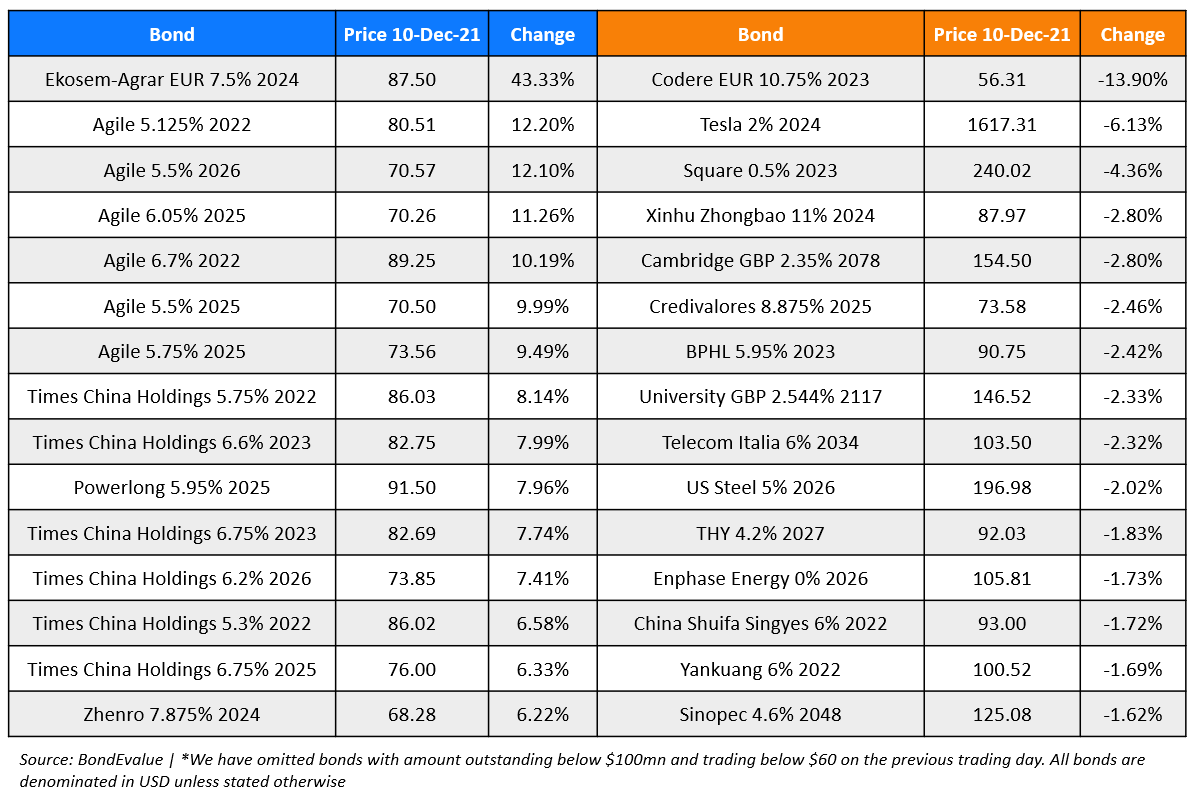

Top Gainers & Losers – 10-Dec-21*

Other Stories

Go back to Latest bond Market News

Related Posts: