This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 21, 2022

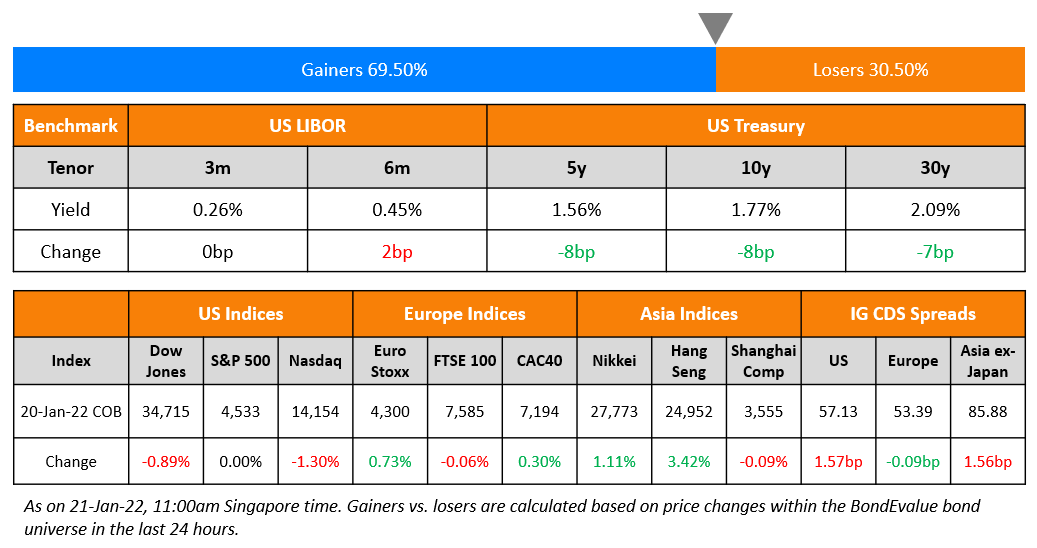

US equity markets dropped yet another day with the S&P and Nasdaq down 1.1% and 1.3% as risk-off sentiment continued to weigh on markets. Most sectors were in the red with Consumer Discretionary, Materials and IT down 1.3-1.9%. US 10Y Treasury yields eased 8bp to 1.77%. European markets closed mostly higher with the DAX and CAC up 0.7% and 0.3% while FTSE was down 0.1%. Brazil’s Bovespa closed 1% higher. In the Middle East, UAE’s ADX and Saudi TASI were up 0.8% and 0.3%. Asian markets have opened in the red – Shanghai, HSI, STI and Nikkei were down 0.8%, 0.6%, 0.1% and 1.4%. US IG CDS spreads were 1.6bp wider and HY CDS spreads were 7bp wider, EU Main CDS spreads were 0.1bp tighter and Crossover CDS spreads were 0.6bp tighter. Asia ex-Japan CDS spreads were 1.6bp wider.

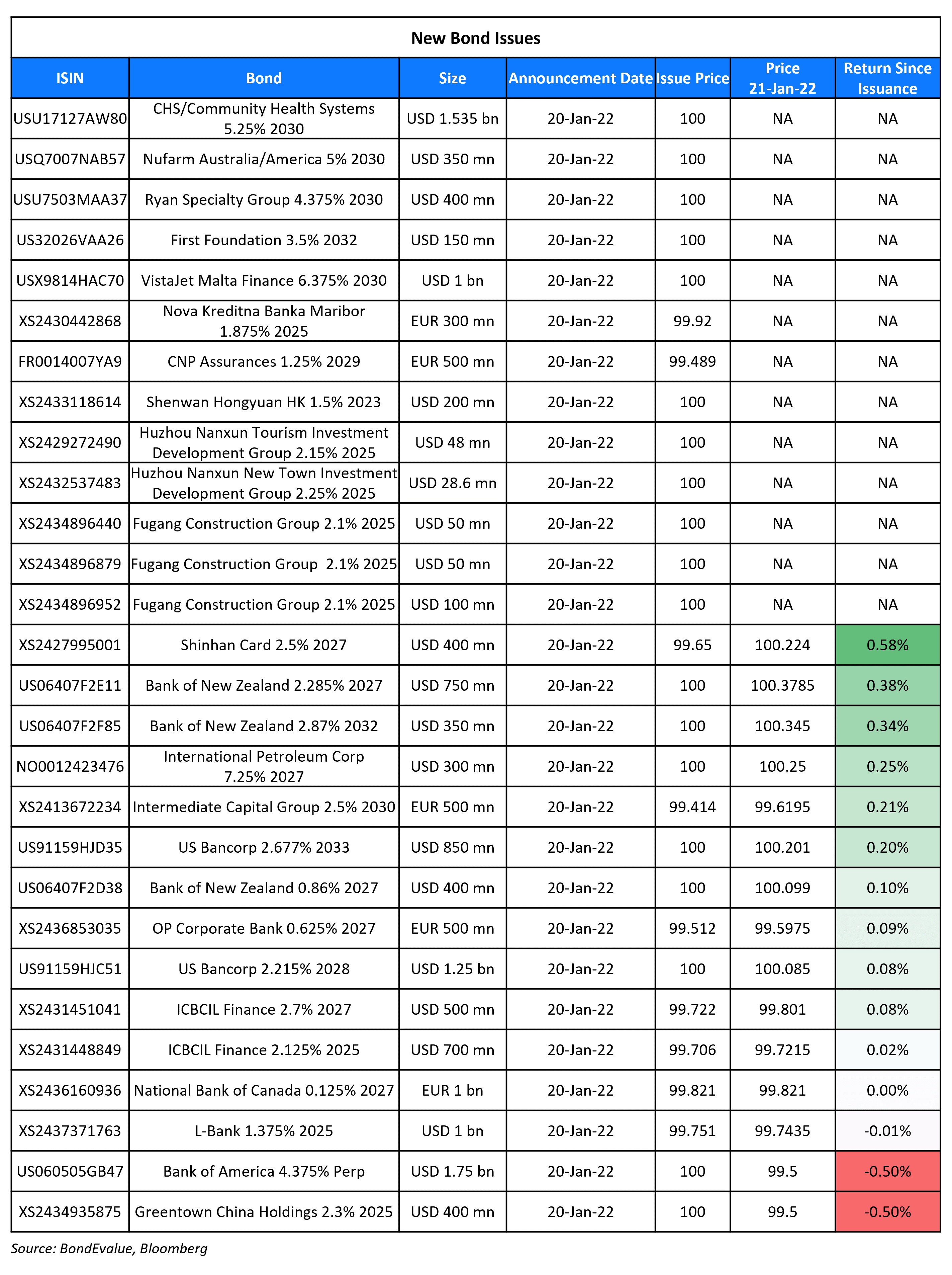

New Bond Issues

- JY Grandmark $ 364-day at 7.5% final

- Taian City Development and Investment $ 364-day at 4.1% area

Bank of America (BofA) raised $1.75bn via a PerpNC5 bond at a yield of 4.375%, 12.5bp inside initial guidance of 4.5% area. The bonds have expected ratings of Baa3/BBB-. Proceeds will be used for general corporate purposes. The bonds are first callable on January 27, 2027, and if not called, the coupons will reset on the day to the prevailing US 5Y Treasury yield + 276bp. The new bonds are priced 26.5bp tighter to its existing 4.25% Perps callable in November 2026 that yield 4.64%.

ICBC Financial Leasing raised $1.2bn via a two-tranche deal. It raised:

- $700mn via a 3Y bond at a yield of 2.227%, 30bp inside initial guidance of T+120bp area. The new 3Y bonds are priced at a new issue premium of 24.7bp over its existing 1.625% bonds due November 2024 that yield 1.98%.

- $500mn via a 5Y bond at a yield of 2.76%, 30bp inside initial guidance of T+145bp area. The new 5Y bonds are priced at a new issue premium of 18bp over its existing 2.25% bonds due November 2026 that yield 2.58%.

Both bonds have expected ratings of A2/A (Moody’s/Fitch). The new 3Y bonds received orders over $1.4bn, 2x issue size, while the new 5Y bond received orders over $1.1bn, 2.2x issue size. The bonds are issued by ICBCIL Finance, while ICBC Financial Leasing has provided a keepwell. Proceeds will be used for funding acquisitions, refinancing and other general corporate purposes. For the new 3Y bonds, banks and financial institutions took 70%, asset managers and fund managers 19%, and central banks, pension funds and private banks 11%. Asia bought 95% of the bonds and EMEA 5%. For the new 5Y bonds, banks and financial institutions received 73%, asset managers and fund managers 17% and insurers, pension funds and private banks 10%. Asian investors bought 99% and EMEA the remaining 1%.

Shinhan Card raised $400mn via a 5Y social bond at a yield of 2.575%, 30bp inside initial guidance of T+125bp area. The bonds have expected ratings of A2 (Moody’s), and received orders over $1.6bn, 4x issue size. Proceeds will be allocated to finance and/or refinance new and/or existing eligible social financing. Asset and fund managers took 65%, insurers 20% and banks and private banks 15%. Asian investors received 96% and EMEA the remaining 4%. The new bonds are priced 32.5bp wider to its existing 1.375% social formosa 2026s that yield 2.25%.

Bank of New Zealand (BNZ) raised $1.5bn via a three-tranche deal. It raised:

- $750mn via a 5Y bond at a yield of 2.285%, 17bp inside initial guidance of T+85bp

- $400mn via a 5Y bond at a yield of 0.86% or SOFR+81bp vs initial guidance of SOFR-equivalent.

- $350mn via a 10Y bond at a yield of 2.87%, 10bp inside initial guidance of T+115bp.

The bonds have expected ratings of A1/AA-/A+.

Greentown China raised $400mn via a 3Y green SBLC (Term of the Day, explained below) backed bond at a yield of 2.3%, 10bp inside initial guidance of 2.4% area. The bonds have expected ratings of BBB– (S&P). Proceeds will be used for debt refinancing in accordance with the issuer’s green financing framework. The bonds are supported by a letter of credit from China Zheshang Bank Hangzhou branch.

Shenwan Hongyuan HK raised $200mn via a 364-day bond at a yield of 1.5%, 40bp inside initial guidance of 1.9% area. The bonds are unrated. Proceeds will primarily be used for general corporate purposes.

Fu Gang Construction Group raised $200mn via a three-tranche deal. It raised:

- $100mn via a 3Y bond at a yield of 2.1%, unchanged from final guidance. The bonds are supported by a letter of credit from Bank of Jiangsu Nantong branch.

- $50mn via a 3Y bond at a yield of 2.1%, unchanged from final guidance. The bonds are supported by a letter of credit from Bank of Hangzhou Nanjing branch.

- $50mn via a 3Y bond at a yield of 2.1%, unchanged from final guidance. The bonds are supported by a letter of credit from China Zheshang Bank Nanjing branch.

The bonds are unrated. The proceeds will be used for project construction and liquidity replenishment.

New Bonds Pipeline

- Pakistan hires for $ 7Y sukuk bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Hanwha Life hires for $ 10NC5 sustainability tier 2 bond

- Dongtai Communication hires for $ 65 mn 180-day bond

- Health and Happiness hires for $ 400 mn bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- Fitch Downgrades Sunac to ‘BB-‘; Outlook Negative

- Fitch Downgrades TalkTalk to ‘B+’; Outlook Negative

Term of the Day

Standby Letter of Credit (SBLC)

Standby Letter of Credit (SBLC) is a note issued by the buyer’s bank to the seller’s bank, where the former guarantees to pay a sum of money to the latter if the buyer defaults on the agreement. Particularly in the shipping of goods, SBLCs are used to reduce risks associated with the transaction on unforeseen events leading to a default. Bonds backed by the above structure are called SBLC-Backed Bonds. Unlike guarantees, which are direct obligations of a bank to cover the timely payment of related bonds, SBLCs require trustees of the bonds to provide demand notices to the banks in the event that issuers fail to make bond payments. Thus as Moody’s says, more analysis is required on whether the language of SBLCs and transaction mechanisms support timely payments.

Talking Heads

“I expect inflation throughout much of the year — 12-month changes — to remain above 2%.”

“But if we’re successful in controlling the pandemic I expect inflation to diminish over the course of the year and hopefully to revert to normal levels by the end of the year, around 2%.” “Households are in good financial shape — in many ways have come out of this even stronger than they were pre-pandemic,” she said. “There’s a buffer stock of savings that accumulated that I think will continue to support the economy in the years ahead, even with less fiscal support.”

On Lagarde’s view that there is no need for a faster than planned response to inflation

Christine Lagarde, European Central Bank president

“The cycle of economic recovery in the US is ahead of that in Europe,” Lagarde said. “So we have every reason not to act as quickly or as ruthlessly as one might imagine with the Fed.”

According to the minutes of the European Central Bank meeting minutes

“Some members retained reservations about some elements of the proposed package such that they could not support the overall package.” ECB should “retain the ability to calibrate and recalibrate the monetary policy stance in a data-driven manner in either direction”.

In an article by German economists Jürgen Stark, Thomas Mayer and Gunther Schnabl

“It is becoming increasingly clear that inflation will gain momentum without monetary policy countermeasures”. “Such tightening would create serious problems for highly indebted eurozone members.”

On global investment grade bond index seeing worst start to the year in over two decades

Viktor Hjort, global head of credit strategy at BNP Paribas SA

“As we reach some of the inflection points in the market cycle, the IG corporate bond market will be hit first.”

Eve Tournier, credit portfolio manager at Pacific Investment Management Co.

“As well as offering diversification, these can improve the convexity of our portfolios through their defensive qualities.”

Winnie Cisar, global head of strategy at CreditSights

“Yields are going to go a little bit higher before things start to stabilize.” “For retail investors right now, it’s hard to see those total return losses and kind of stick with the trades.”

Shanawaz Bhimji, senior fixed-income strategist at ABN Amro NV

“We see turbulence in spreads as higher rates inflict pain in general risk sentiment through the equity market like a repeat of end-2018.”

“Now with the selloff that we have seen and the improvement in the outlook we are coming closer to a fair area with what the market is pricing in terms of hikes by central banks.” “It’s not like a bang the table, right here right now, but certainly coming into a zone where fixed income is becoming more attractive.” “The pendulum has swung from no hike as far as the eye can see to the situation now where the market is probably going over its skis when it comes to thinking that it needs so much hiking and the situation is out of control.”

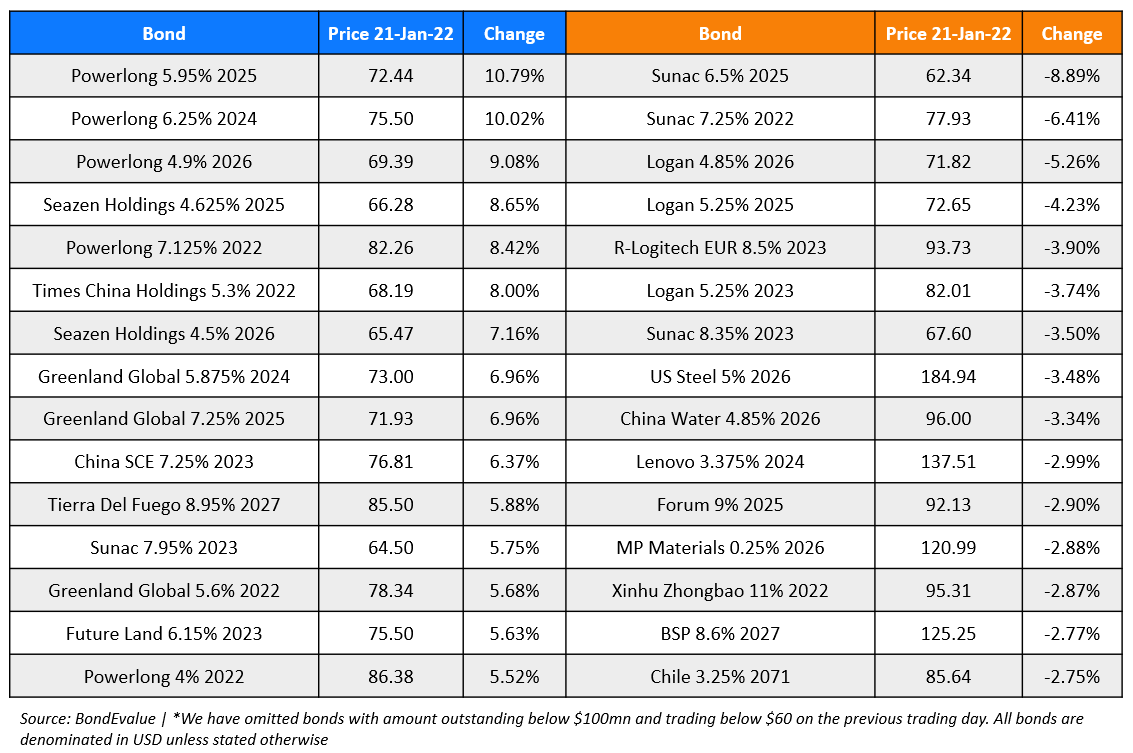

Top Gainers & Losers – 21-Jan-22*

Other Stories

Go back to Latest bond Market News

Related Posts: